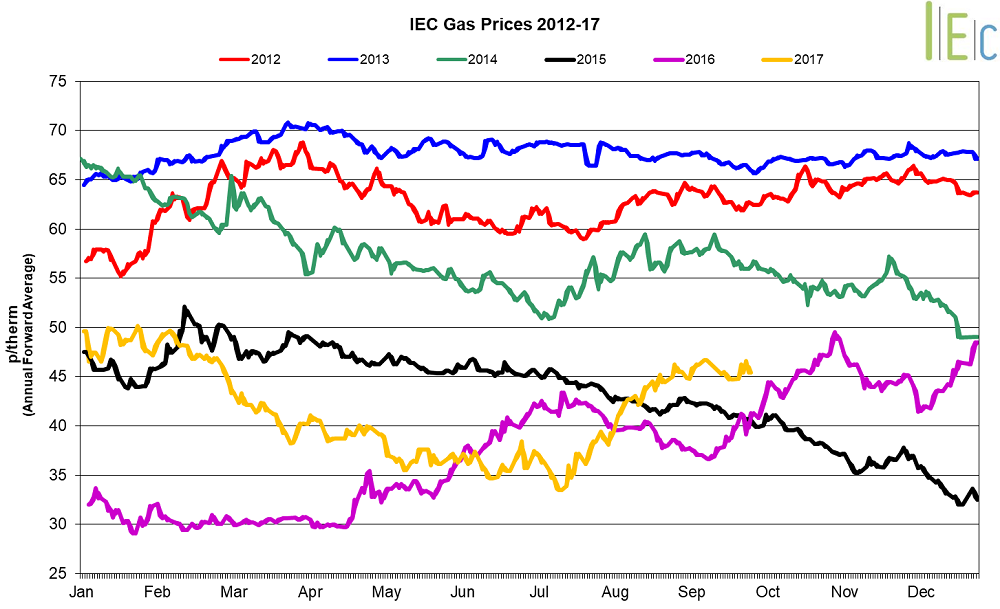

Gas market trends

What’s been happening?

- Most seasonal gas contracts experienced gains in September, rising 1.6% on average, with many reaching multi-month highs

- Winter 17 gas jumped 4.8% to 49.9p/th, 17.7% above its value of 42.4p/th in September 2016. Summer 18 gas gained 2.5% to 41.8p/th

- On 14 September, the winter 17 and summer 18 contracts reached seven-months high of 51.5p/th and 43.3p/th, respectively

- In September, day-ahead gas gained 8.1% to average 46.2p/th, its highest monthly average in seven months. On 14 September, day-ahead gas reached a seven-month high of 48.0p/th, with a planned outage at the St. Fergus terminal and increased demand contributing to an undersupplied system

- The month-ahead contract climbed 5.5% to 45.5p/th

Key market drivers

- Annual maintenance at a number of gas terminals and processing facilities restricted gas supplies throughout the month

- Concerns over winter gas supplies, following the closure of the Rough gas storage site and low gas storage levels across Europe, supported prices

* £ per p/therm (Annual Forward Average)

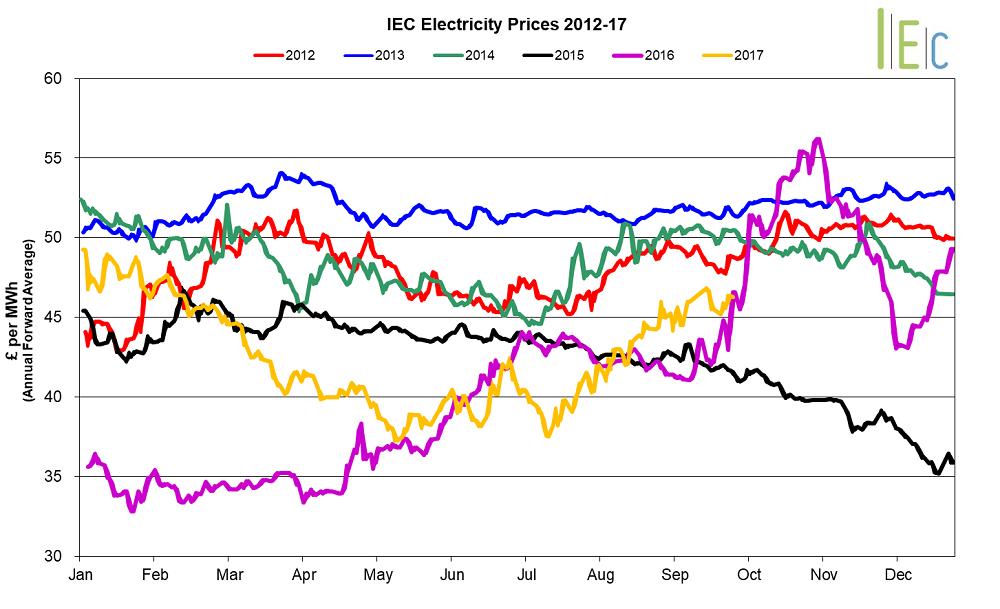

Electricity market trends

What’s been happening?

- The annual October 17 baseload power contract rose 3.3% to average £46.4/MWh

- Most seasonal baseload power contracts moved higher, with an average increase of 1.5%

- Winter 17 baseload power jumped 4.3% to £50.6/MWh. On 14 September, the contract reached £52.3/MWh, its highest price since December 2014

- Summer 18 power increased 2.1% to £42.2/MWh. On 14 September, the contract hit £43.7/MWh, its highest price since June 2015

- Day-ahead baseload power lifted 8.8% to average £47.2/MWh, its highest monthly average in seven months. On 15 September, the contract hit a two-month high of £55.0/MWh, amid forecasts of low wind generation and reduced capacity on the French Interconnector due to a maintenance outage

- The month-ahead contract rose 3.2% to average £46.5/MWh

Key Market Drivers

- Reduced interconnector capacity on the IFA and BritNed interconnectors pushed prices higher in the second half of the month

* £ per MWh (Annual Forward Average)

European gas

- All tracked European gas markets experienced upward movements in September

- GB prices ended the month 1.3% below Belgian prices, 1.8% higher than German prices and 2.0% above Dutch prices

- Gas production at the Netherland’s Groningen gas field rose to a four-month high of 1.8bcm in August. Despite the increase, output was still 16% lower than the 2.2bcm in August 2016

- Norwegian gas exports to the Netherlands hit a record high of 2.2bcm in August, amid falling domestic production from the Groningen gas field. Flows from Norway were up 82% year-on-year and were more than double the level from 2014

- Netherlands has received 16.932bcm of gas from Norway so far in 2017, more than the 16.887bcm it received in the whole of 2016. The total is already a new record high for a calendar year

- Ukraine’s six-month heating season may be required to start earlier than planned due to falling temperatures. The government is required to start heating homes if temperatures fall to an average of 8°C for at least three days

European power

- European power prices experienced mixed movements in September

- GB prices ended the month 23.6% above French prices, 32.9% higher than German prices and 24.6% above Dutch prices

- On 21 September, the French and Spanish transmission system operators started the public consultation process on the proposed 2GW Bay of Biscay interconnector

- Nemo Link, the joint venture between Belgium’s system operator Elia and National Grid, started laying the first 37 miles of double subsea cable between the UK and its French offshore section. The 1GW interconnector is set to enter use in early 2019

- German power generation from wind reached a new hourly record of 37.8GW between 11am and 12pm local time on 13 September, according to EEX transparency data. Aggregated TSO data also showed that German wind power output for the first eight months of the year was nearly 65TWh, a 30% rise year-on-year

- On 6 September, RWE announced it would temporarily de-mothball its 410MW gas-fired Gersteinwerk-G power plant in Germany for flexible operation from 1 November until the end of March 2018

- On 23 September, Spain’s 1.1GW Cofrentes nuclear reactor was taken offline for refuelling which is expected to last 35 days

- EDF was requested to temporarily shut down its 3.7GW Tricastin nuclear power plant by French nuclear regulator ASN due to safety concerns

World Oil

- Brent crude oil prices climbed 6.6% to average $55.3/bl in September. On 28 September, Brent crude oil reached $58.5/bl, its highest price since July 2015.

- Prices started the month at $52.3/bl and climbed steadily throughout the month. Prices were supported by the ongoing restart of US crude oil refineries following forced shutdowns caused by Hurricane Harvey, forecasts of strong European and US crude demand, and news that Saudi Arabia will cut allocations to its customers by 350,000bl/d in October.

Coal

- On average, API 2 coal prices gained 6.3% to $81.5/t during the month. On 20 September, prices reached $84.0/t, its highest level since January 2014. Coal prices were supported by continued high demand from Asia, stronger demand from Europe amid low levels of hydro and gas stocks, and supply disruptions caused by miner strikes in South Africa and China.

Carbon (EU ETS)

- EU ETS carbon prices jumped 19.7% to average €6.8/t. On 14 September

- EU ETS carbon reached €7.6/t, its highest price since January 2016, following a breakthrough in talks intended to overhaul the carbon market post-2020.