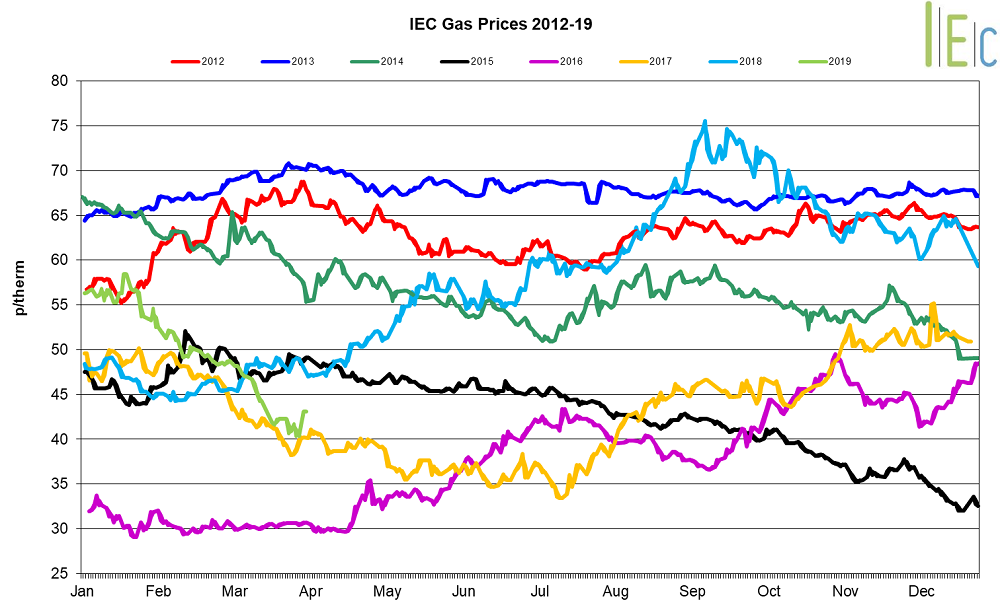

Gas market trends

What’s been happening?

- In March, day-ahead gas fell for the sixth consecutive month, down 16.5% to average 39.6p/th

- The month-ahead (April) gas contract dropped 15.3% to average 39.2p/th

- All seasonal gas contracts fell in March, decreasing 7.8% on average

- Summer 19 gas saw the biggest change, falling 13.2% to average 39.9p/th. The contract went down to 35.5p/th on 29 March, its lowest price since June 2016

- Winter 19 gas was 8.7% lower, averaging 53.5p/th, and dropping to an 11-month low of 50.3p/th on 26 March

- The annual April 19 gas contract dropped 10.7% to average 46.7p/th but was 5.8% higher than in March 2018 when it averaged 44.1p/th

Key market drivers

- A total of 14 LNG tankers arrived at UK terminals last month, continuing to ensure gas supplies remained comfortable as above seasonal normal temperatures dampened gas demand. Comfortable gas storage levels across Europe also helped to prevent any price rises during the month

- Average demand on the National system fell month-on-month, down from 283.5mcm/d in February to 253.5mcm/d. Regional gas demand also dropped month-on-month, falling from 197.7mcm/d in February to 176.9mcm/d in March. Both were well below the six-year averages for the month, at 269.5mcm/d for National demand and 186.8mcm/d for Regional gas demand

* £ per p/therm (Annual Forward Average)

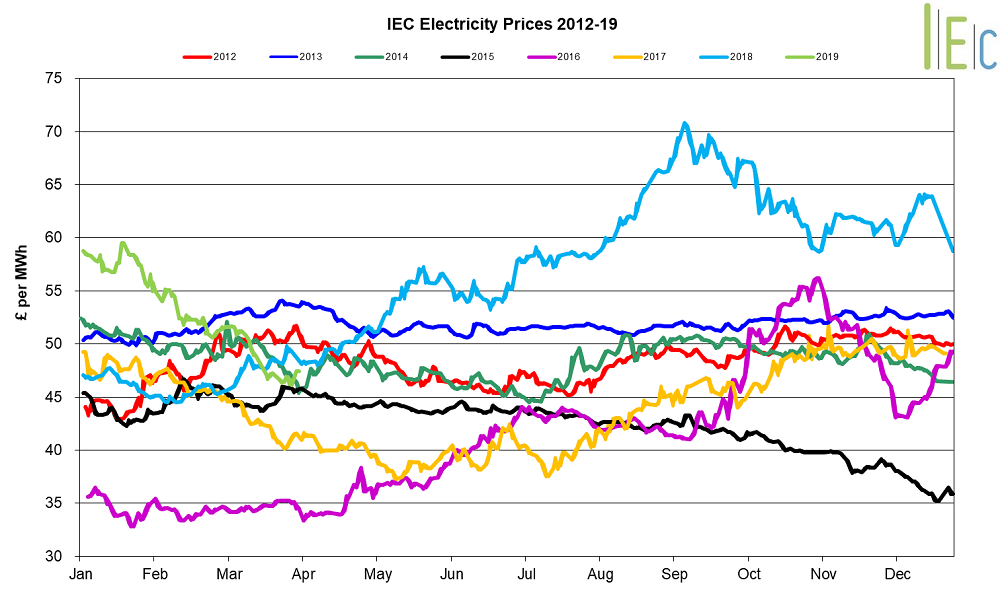

Electricity market trends

What’s been happening?

- Day-ahead power fell 10.4% to average £45.0/MWh in March, its third consecutive monthly decline. The contract ended the month at an 18-month low of £42.0/MWh

- Month-ahead power fell 10.0% to average £45.3/MWh

- All seasonal baseload power contracts decreased in March, down 4.4% on average

- Summer 19 power averaged £45.7/MWh, down 8.1% from February, with the contract dropping to a one-year low of £42.8/MWh on 29 March. As gas-fired power generation continues to dominate our electricity mix, seasonal baseload power contracts have been pressured by falling gas prices

- The annual April 19 power contract declined 6.7% to average £50.6/MWh, but was 14.2% above its price in March 2018 when the contract was at £44.3/MWh

Key market drivers

- Day-ahead power prices continued to follow their gas counterparts lower, as CCGT generation remained dominant in the supply mix, providing 39.2% of the generation mix in March, down from 42.1% in February. Prices were also pressured from high levels of wind generation, which accounted for 20.6% of the generation mix, up from 17.0% in February

- Average daily demand continued to decrease month-on-month, falling from 820GWh/d in February to 765GWh/d in March. Average peak demand also fell month-on-month, down from 42.8GW in February to 40.2GW in March. Average daily demand and peak demand were 9% and 8% below their respective six-year average for March, which were 839GWh/d and 43.4GW respectively

* £ per MWh (Annual Forward Average)

* £ per MWh (Annual Forward Average)

European gas

- All tracked gas markets fell further in March. The largest decline was observed in the day-ahead Belgian Zeebrugge contract, which dropped 8.7p/th to end the month at 35.8p/th

- Belgian Zeebrugge prices were weighed on by comfortable gas supplies, with 11 LNG tankers arriving in the country in March, up from four in FebruaryAs Belgian Zeebrugge prices have fallen, the market signal is providing less incentive for other countries to export gas to the country. Data from S&P Global Platts shows that pipeline imports from Norway, Germany and the Netherlands fell to 2.87bcm in February, a 37% decrease year-on-year

- Dutch TTF prices fell 7.7p/th in March, ending the month at 37.7p/th. The TTF was pressured in March as mild temperatures dampened gas demand amid comfortable gas storage levels and the expected arrival of further LNG tankers throughout the month

- Gas prices were also pressured by high European gas stocks, which according to Gas Infrastructure Europe, started the month at ~42.6% capacity, up 11% from the same time last year

- German gas prices were 7.5p/th lower at the end of March, ending the month at 36.1p/th

- Looking ahead, European gas hubs have started Q219 with gas stocks up 17bcm year-on-year, at around 25bcm. The outlook for gas prices is therefore relatively bearish as LNG is expected to continue to flood into the market, and encourage further coal-to-gas switching.

European power

- European power contracts experienced mixed movements in March, as GB and French power prices fell, whilst German and Dutch prices rose month-on-month

- German power prices experienced the largest movement, increasing £16.1/MWh to end the month at £38.3/MWh. German power prices started the month at £22.2/MWh amid forecasts of high wind generation, with expectations of peaks around 40GW. According to transmission system data, wind generation of 5.8TWh between 11-17 March set a new weekly record as it accounted for 50% of total generation, driving the average weekly price to the lowest since Q116. However, German prices recovered towards the end of the month as renewables generation was forecast lower

- French power prices were pressured in the middle of the month by warm temperatures and weaker power demand, easing pressure on power supplies with EDF’s Chooz-2 (1.5GW) nuclear reactor shut down for maintenance between 15 March and 29 July. French power prices ended the month at £39.2/MWh, down £3.2/MWh from February

- Across the month, Dutch power prices underwent the smallest change, rising £2.1/MWh to end the month at £41.6/MWh

World oil

- Brent crude oil prices rose for the third consecutive month, up 4.1% to average $66.9/bl in March, peaking above $68.2/bl in the middle of the month.

- Production cuts from OPEC+ have provided support to prices this year, with Brent crude oil experiencing its biggest quarterly rise in Q119 since 2009, up ~27% from the start of the year. Sanctions on Venezuela and Iran have also acted to reduce global oil supplies, offsetting pressure from rising US crude production levels and calls from US

- President Donald Trump for OPEC to raise output to stop prices rising. Concerns that the ongoing US-China trade war will dampen global economic growth has continued to create an uncertain outlook for demand this year.

Coal

- API 2 coal prices experienced a third consecutive monthly decline, down 3.7% to average $75.7/t in March.

- Coal prices have fallen amid weak demand in the Northern Hemisphere, as both Europe and Asia faced temperatures well above seasonal normal levels. Cheaper gas prices throughout Europe have resulted in more favourable gas-fired generation margins and has pushed coal-fired generation further out of the generation mix.

Carbon (EU ETS)

- EU ETS carbon prices reversed the previous month’s decline, rising 4.5% to average €22.0/t.

- Prices rose above €23.0/t on 8 March; however, traders suggested the recovery was unsustainable as temperatures remained above seasonal normal levels across Europe and low gas prices were pushing coal-fired power plant out of the generation mix.

- Brexit negotiations continue to add uncertainty to the EU ETS market, but the news that a ‘hard-Brexit’ has been ruled out for 29 March, and an unconditional extension has been set for 12 April with the potential for a further delay until 22 May, has provided some respite for falling carbon prices.