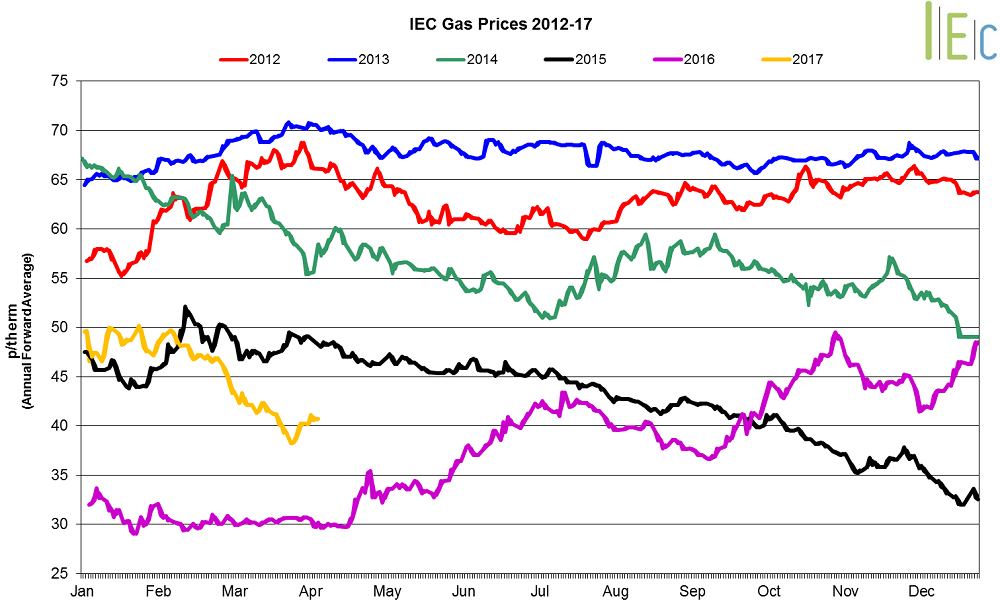

Gas market trends

What’s been happening?

- All seasonal gas prices lost during March, falling 5.5% on average

- Seasonal gas prices remained higher than their levels last year

- Summer 17 gas dropped 9.7% to average 40.4p/th, which was higher than the contract price at the same time last year (30.1p/th)

- Winter 17 gas went down 6.8% to average 46.8p/th, also higher than at the same time last year (34.9p/th)

- In March, day-ahead gas plummeted 20.5% to average 41.1p/th

- On 28 March, day-ahead gas decreased to a new five-month low of 38.0p/th, amid lower than seasonal normal demand owing to warmer temperatures

- The month-ahead contract moved 13.9% lower to average 41.2p/th

Key Market Drivers

- Last month it was announced that GB’s largest gas storage facility, Rough, will be unable to inject with gas until July this year. This will lower injection demand during this period and has weighed on gas contracts out to summer 17.

- Lower spot gas prices can be expected as we move into spring, with lower demand amid higher temperatures and increased solar output reducing the need for gas-fired power generation

* £ per p/therm (Annual Forward Average)

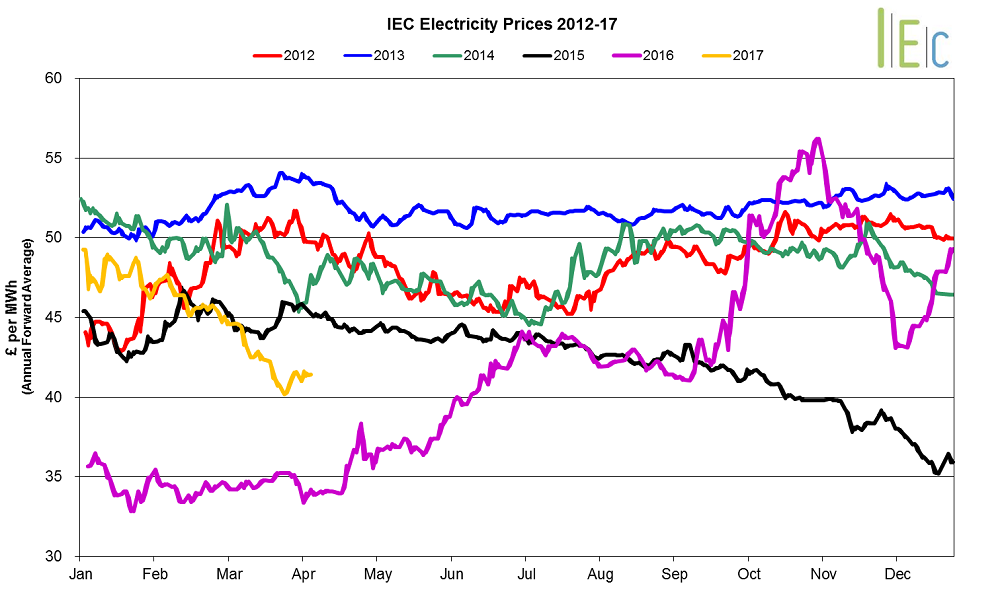

Electricity market trends

What’s been happening?

- In March, the annual April 17 baseload power contract decreased 5.3% to average £43.6/MWh

- Most seasonal baseload power contracts moved lower, with an average decrease of 3.2%

- Summer 17 power was down 6.5% to £41.2/MWh

- Winter 17 power slipped 4.1% to £46.0/MWh

- Day-ahead baseload power decreased by 15.1% to average £42.0/MWh in March, extending losses experienced in February

- On 29 March, the day-ahead contract dropped to £38.8/MWh, a five-month low, with weakening power demand amid milder than normal temperatures and higher wind generation forecast for the following day

- The month-ahead contract went down 10.3% to £42.5/MWh

Key market drivers

- Decreased gas prices pushed power prices lower in March

- Lower spot power prices can be expected as we move into spring, with lower demand amid higher temperatures and increased solar output

* £ per MWh (Annual Forward Average)

European gas

- European gas prices all decreased in March

- GB prices ended the month 1.3% below Belgian prices, 3.9% lower than German prices and 1.6% below Dutch prices

- For the aggregate April-June period, The Weather Company is forecasting above-normal temperatures across most European locations, with the warmth especially notable across the eastern half of Europe. Temperatures in western Europe are expected to be near, but slightly above, normal. The report said the UK can expect warmer-than-usual temperatures in April and June, but will be slightly cooler during May. Warmer temperatures decrease gas and power demand, leading to lower prices

- European gas and power prices followed oil prices downwards. It remains uncertain as to whether countries will be willing to comply with the proposed extended duration of oil production cuts, which has pushed oil prices down

European power

- European power prices experienced mixed movements in March

- GB prices ended the month 29.0% above French prices, 29.9% higher than German prices and 36.5% above Dutch prices

- Germany’s 1.4GW Brokdorf nuclear reactor outage has been extended further, E.ON announced last week. The reactor was taken offline for a refuelling stop on 4 February and was originally expected to return before the end of February. However, it is now expected to come back online mid-April. German reactor availability this winter is at its lowest level since the early 1980s due to unprecedented refuelling stops following the expiry of the nuclear fuel tax at the end of 2016. Limited nuclear capacity in the country may push power prices upwards

- For the aggregate April-June period, The Weather Company is forecasting above-normal temperatures across most European locations, with the warmth especially notable across the eastern half of Europe. Temperatures in western Europe are expected to be near, but slightly above, normal. The report said the UK can expect warmer-than-usual temperatures in April and June, but will be slightly cooler during May

- The Moyle Interconnector between Northern Ireland and Scotland is to operate at a reduced capacity of 250MW following a “serious operational problem”. The issue with the 500MW electrical link arose on Saturday 18 February and depending on the availability of resources, such a repair could typically take an estimated six months

World oil

- Brent crude oil prices declined 6.1% to average $52.7/bl in March, the lowest monthly average in four months, since prior to the OPEC output cut agreement. Prices continued to remain above the $50.0/bl mark for the entire month. Reports showed that OPEC-led crude oil output cuts will have to be extended beyond June to successfully support the market. It remains uncertain as to whether countries will be willing to comply with the proposed extended duration of production cuts, which has pushed prices downwards.

Coal

- API 2 coal prices fluctuated throughout the month, but on average went down 3.2% to $64.9/t.

- Prices remain well above levels last year when the price averaged $40.8/t in March 2016.

Carbon (EU ETS)

- EU ETS carbon prices varied between €4.7/t and €5.7/t, and on average slipped by 1.2% to €5.1/t. On 28 March, prices fell to a new fifteen-week low of €4.7/t. The market is well supplied at present, with the Polish government selling allowances for the first time since last summer. This is holding prices down.