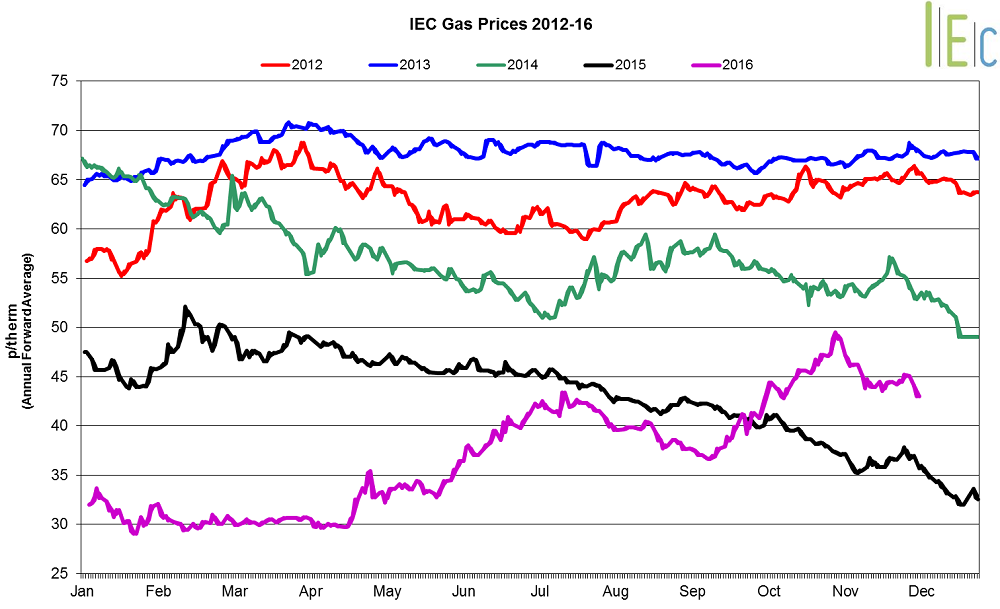

Gas market trends

What’s been happening?

- Seasonal gas prices decreased 1.6% on average, with a fall in oil prices. Seasonal gas prices were higher than their levels last year.

- In November, day-ahead gas gained 12.4%, after experiencing the largest monthly gain since at least 2012 last month.

- On Thursday 3 November, the contract climbed to 53.8p/th, the highest price since February 2015, as colder temperatures and a bleak LNG outlook supported prices.

- The month-ahead contract moved 5.0% to higher average 50.0p/th.

Key market drivers

At the end of the month, Centrica announced that withdrawal capacity at Rough, the UK’s largest gas storage facility, will restart no later than 9 December. This sent the gas forward curve lower, with the prospect of increased supplies for the coming winter.

* £ per p/therm (Annual Forward Average)

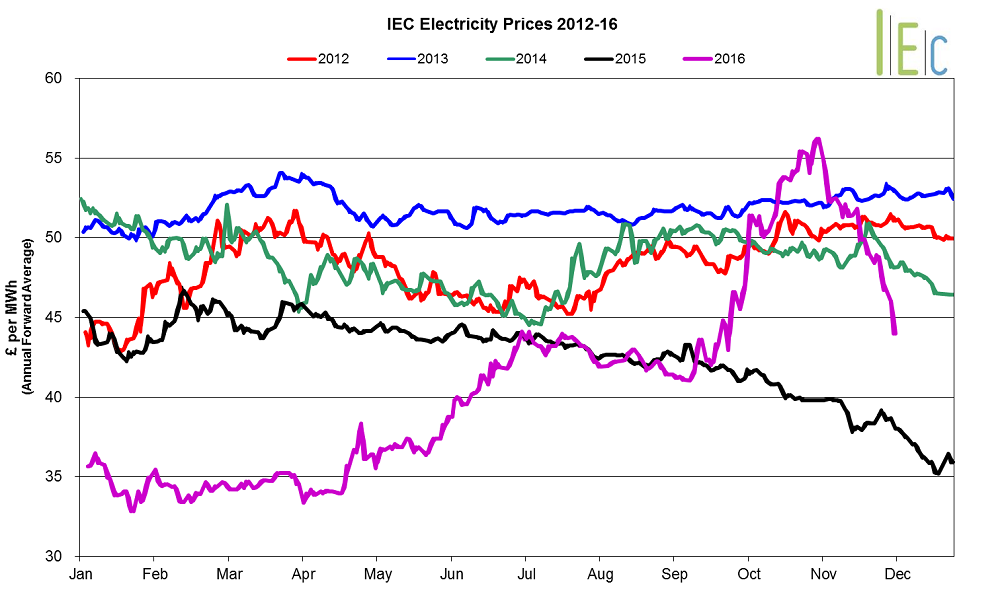

Electricity market trends

What’s been happening?

- The annual April 17 baseload power contract lost 1.1% to average £46.0/MWh.

- Seasonal baseload power contracts on average fell 2.6% in November, following their gas counterparts downwards.

- Summer 17 power slipped 0.6% to £43.9/MWh.

- Winter 17 power declined 1.6% to £48.1/MWh.

- Day-ahead power jumped 16.7% to average £66.4/MWh.

Key market drivers

Fears over French production and a tight UK supply margin continued to influence the market in November. Many French nuclear reactors in the country remain shut for testing. This has sparked concerns over power supply tightness as lower temperatures lift demand. Towards the end of the month, EDF announced it had delayed the return of two French nuclear reactors until the end of December. French grid operator, RTE, has said it may have to use “exceptional measures” to guarantee power supplies to domestic users in the first three weeks of December.

*£ per MWh (Annual forward average)

European gas

- European gas prices experienced mixed movements in November.

- GB prices ended the month 1.3% lower than Belgian prices, 7.9% above German prices and 9.0% higher than Dutch prices.

- Prices have been influenced as outages at Norway’s Nyhamna gas processing plant and at the St. Fergus terminal ended, which boosted flows.

- Prices were also impacted as the UK-Belgium interconnector swung strongly into import mode, helping to offset the effect of delays in the restart of gas withdrawals from Rough, the UK’s largest storage site.

- In addition, there were stronger imports through the UK-Holland interconnector.

- According to the IEA, global gas demand is set to grow by 50% by 2040, outstripping oil and coal demand growth, with much of this coming from increased use in the transport and industrial sectors, and not from the power generation sector.

European power

- European power prices experienced mixed movements in November.

- French prices jumped £36.3/MWh to £102.0/MWh, with continued fears over French production. Many French nuclear reactors in the country remain shut for testing. This has sparked concerns over power supply tightness as lower temperatures lift demand. Towards the end of the month, EDF announced it had delayed the return of two French nuclear reactors until the end of December. French grid operator, RTE, has said it may have to use “exceptional measures” to guarantee power supplies to domestic users in the first three weeks of December

- GB prices ended the month 41.2% below French prices, 162.5% above German prices and 58.0% higher than Dutch prices.

World oil

- Brent crude oil prices lost 8.4% to average $47.2/bl in November, with prices moving back below the $50.0/bl mark for nearly the entire month.

- Prices were influenced heavily by speculation leading up to the predicted outcome of the latest OPEC meeting, held on 30 November. At the meeting OPEC agreed on its first oil output reduction since 2008. The deal also included the group’s first coordinated action with non-OPEC member Russia in 15 years. This saw prices hit a one-month high of $50.1/bl on the day of the meeting.

Coal

- API 2 coal went up 5.2% to average $70.3/t. On Thursday 17 November, the price fell to a one-month low of $64.0/t. This month China announced a relaxation of restrictions on domestic coal production, ahead of peak winter demand for heating fuels, allowing mines 54 more working days a year. This has started to limit import demand there and is set to slacken global supply.