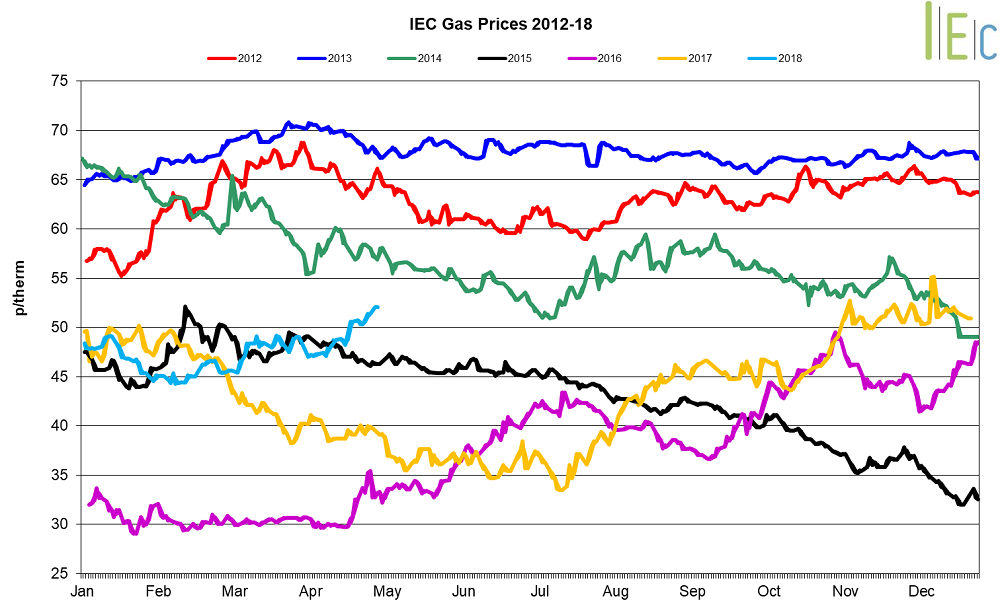

Gas market trends

What’s been happening?

- In contrast to all other contracts, day-ahead gas prices fell 17.8% to average 51.0p/th

- The month-ahead (May) gas contract climbed 7.7% to average 49.7p/th. May 18 gas reached its highest price since February 2017 in the middle of April, hitting 52.2p/th

- Bullish growth was observed across all seasonal gas contracts, which rose 4.7% on average

- The largest gains were on the near-curve as winter 18 and summer 19 gas contracts increased 5.8% and 5.7% to average 55.5p/th and 42.3p/th respectively

- Winter 19 gas lifted 4.8% to 50.5p/th, while summer 20 and winter 20 contracts climbed to 39.6p/th (up 3.7%) and 48.0p/th (up 3.4%)

- The annual October 18 gas contract lifted 5.7% to 48.9p/th

Key market drivers

- Early month spot prices were bearish, with prices influenced by falling demand coupled with comfortable supplies from LNG deliveries – April saw nine LNG tanker deliveries, the highest in a year

- However, April saw the lowest wind in-feed since September 2017, dropping to 3.1TWh, resulting in more gas being utilised for power generation

- Cooler temperatures tied with unexpected supply outages in Norway towards the end of the month saw prices rise despite three LNG arrivals over three consecutive days.

* £ per p/therm (Annual Forward Average)

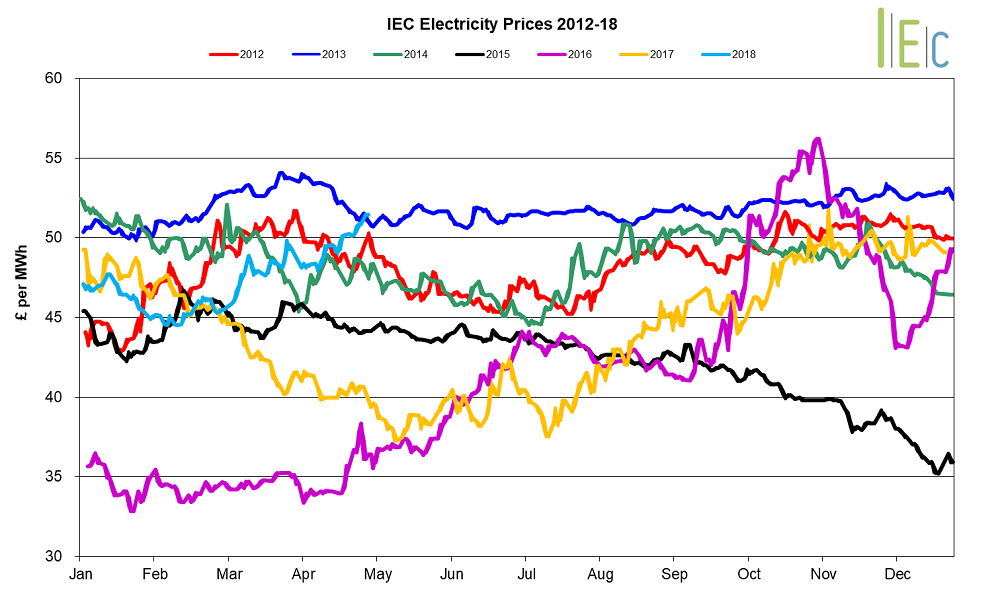

Electricity market trends

What’s been happening?

- Last month day-ahead power dropped 12.4% to average £50.7/MWh

- The month-ahead (May) power contract climbed 7.3% to average £49.5/MWh

- On average seasonal power contracts grew 6.3% across April

- Winter 18 and summer 18 lifted 6.0% and 6.5% to average £54.3/MWh and £44.0/MWh respectively

- Winter 19 and summer 20 also grew, up 5.6% and 7.0% to £49.9/MWh and £41.1/MWh. Winter 20 boosted 10.5% to £47.3/MWh

- The annual October 18 power contract increased 6.2% to average £49.2/MWh

Key market drivers

- Prices were predominantly driven up in the first half of the month by weaker wind generation

- The second half of the month saw prices slip as increased wind and solar generation, combined with lower demand, saw the UK break its no-coal record twice, with 55 hours and 76 hours

- National Grid’s Summer Outlook forecasts UK power demand to decline compared to last year, driven by lower underlying power demand and the increased levels of embedded renewables output.

* £ per MWh (Annual Forward Average)

European gas

- All tracked European gas markets underwent growth throughout April when compared to the previous month

- GB prices ended the month 1.5% below Belgian prices, 1.3% higher than German prices and 3.1% greater than Dutch prices

- From mid-to-late April demand across the track regions began to grow as temperatures throughout Europe descended after a period of warmer weather. Concerns of low European gas reserves also became a prevalent motivator behind bullish growth, while rising coal prices added to the bullish fundamentals

- German and Dutch gas prices were supported by reduced Norwegian flows into the Emden-Dornum terminal on the German-Dutch boarder during large periods of the month

- Towards the end of the month gas prices were strengthened by further Norwegian outages at Kollsnes, Skarv gas fields and Karsto processing plant

- The TTF market experienced a reduced incentive to inject gas into storage despite record low stock levels, owing to lower spreads between summer and winter prices. A similar lack of incentive was also noted in the German market. Low levels of gas in storage have been a driver behind higher gas prices compared to this time last year

- LNG deliveries were also limited during this period, further supporting prices. Looking ahead, summer forecasts project a tight market, with LNG tankers not expected to hit European shores as the Asian market remains a more attractive destination.

European power

- European power prices experienced mixed movement across the month, with notable losses observed in France and Germany

- GB prices ended the month 86.4% above French prices, 66.4% higher than German prices and 36.9% above Dutch prices

- French prices started the month with bullish momentum, with the announced threat of three months of strikes from France’s largest energy union. However, by the end of the month robust renewables output across Germany drew prices downwards and French power prices subsided in response. However, prices across all tracked regions were pegged back by rising commodity prices

- Dutch gas-for-power demand was impeded by Norwegian outages which reduced gas flows into the country

- Looking ahead French prices may be given support on the near-curve due to historically low hydro stocks. Alpine stocks (France and Switzerland) have recently only reached 16% and 10% of nominal capacity, respectively. This is a new historical low for France, with Switzerland close to the bottom of the historical range, despite extremely high snow cover on the Alps

- The Labor Day holiday across the continent, coupled with forecasts of strong new renewables output is expected to ease demand throughout France, Germany and the Netherlands at the start of May. With prices depressed we can expect this to act as a price signal to export power via the IFA to the UK market.

World oil

- Brent crude oil prices grew 7.7% to average $71.6/bl during April, up from $66.5/bl the previous month. Brent crude oil hit a three-and-a-half year high on 23 April at $75.4/t.

- Oil prices have been driven by political tensions throughout April, with rising tensions between the US and Middle Eastern countries including Syria and Iran. However, a strengthening US dollar towards the end of the month and rising US output capped price gains and reduced the impact of OPEC’s continued supply cuts.

Coal

- API 2 coal prices rose 5.7% to average $80.8/t, up from $76.4/t the previous month. This is the highest monthly average since January this year.

- Coal grew at the start of the month with falling Australian supplies caused by cyclone iris. April’s growth comes despite falling UK and European coal demand, but as thermal coal demand increases across Asia ahead of the Southern Hemisphere winter. Overall, coal demand is reported to be falling as the drive for renewable energy continues to be an international goal.

Carbon (EU ETS)

- EU ETS carbon prices continued with bullish momentum, increasing 15.9% to average €13.4/t (up from €11.5/t). On 19 April prices reached a fresh seven-year high at €14.2/t. Carbon prices have been impacted by market speculators purchasing allowances and chasing profits, causing prices to become inflated and not represent EUA market fundamentals. Analysts suggest that for prices to have been pushed up to recent highs, 140 million EUAs would have had to have been bought in addition to the normal compliance demand.