Gas market trends

What’s Been Happening?

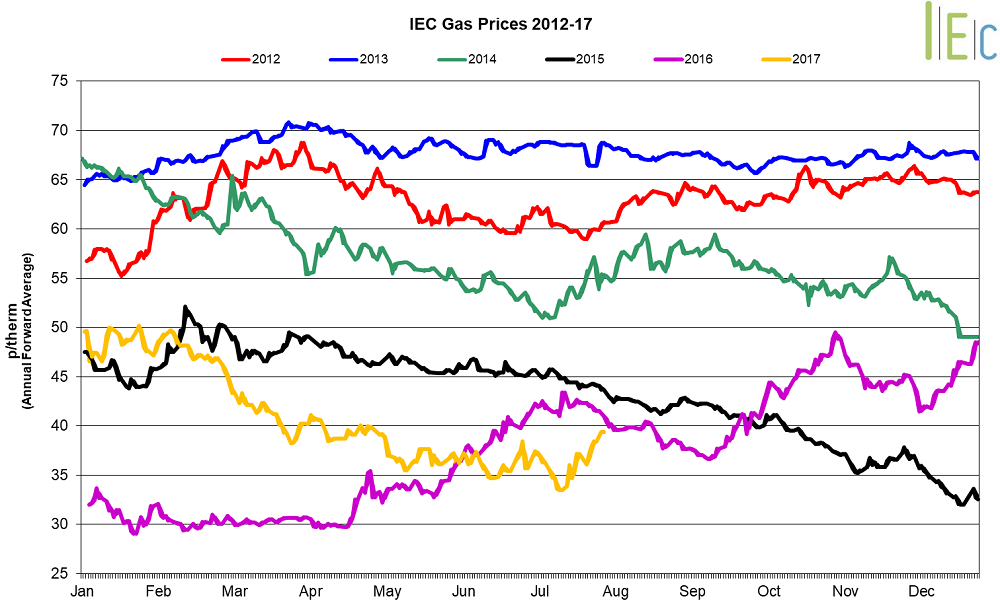

- Seasonal gas prices experienced mixed movements in July, rising 0.4% on average

- Winter 17 gas slipped 1.0% to 44.9p/th, slightly lower than its value of 46.0p/th in July 2016, and summer 18 gas trimmed 1.0% to 38.9p/th

- All gas contracts beyond summer 18 rose, with winter 19 seeing the largest rise of 2.2% to 39.4p/th

- In July, day-ahead gas rose 3.4% to average 36.2p/th, halting a five-month downward trend. On 31 July, day-ahead gas reached a two-month high of 40.0p/th

- The month-ahead contract moved 2.2% lower to average 36.3p/th

Key market drivers

- Ongoing maintenance at the Kollsnes gas processing plant in Norway and in the North Sea limited gas supplies, lifting the day-ahead contract

- Lower spot gas prices can be expected during spring and summer, with reduced demand amid higher temperatures and increased solar output reducing the need for gas-fired power generation

Electricity market trends

What’s Been Happening?

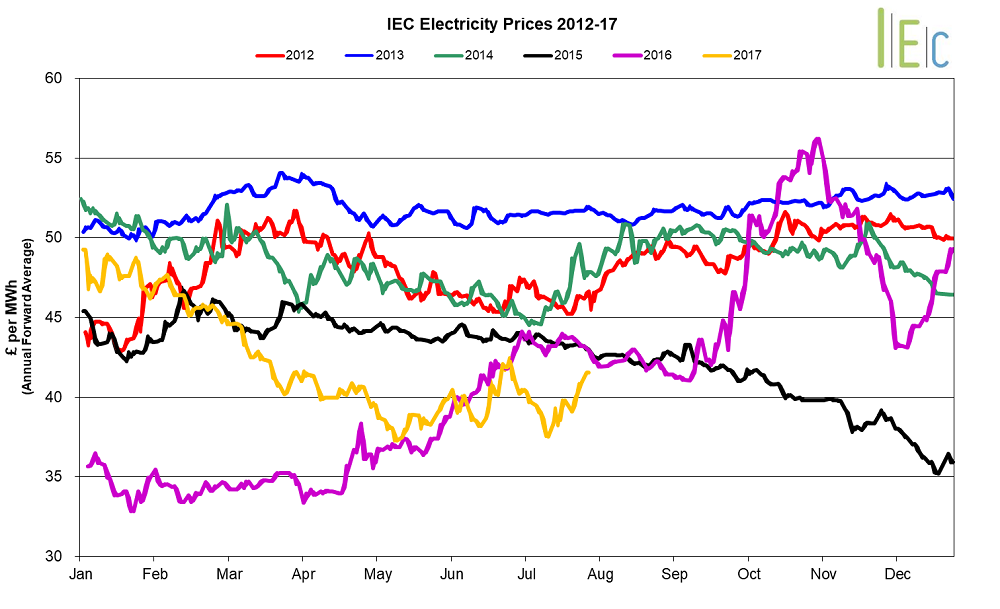

- The annual October 17 baseload power contract gained 0.2% to average £43.0/MWh

- Most seasonal baseload power contracts moved higher, with an average increase of 0.9%

- Summer 18 power was up 0.5% to £39.7/MWh. In contrast, the winter 17 contract was unchanged at £46.2/MWh

- Day-ahead baseload power gained 8.1% to average £42.9/MWh, its highest monthly average in five months

- The month-ahead contract rose 0.7% to average £39.3/MWh

- Outages at a number of nuclear plants, including Hartlepool 2 and Hinkley Point B, and higher gas prices pushed the day-ahead contract higher

- Despite a rise last month, lower spot power prices can be expected during spring and summer, with lower demand amid higher temperatures and increased solar output

European Gas

- Most tracked European gas markets experienced upward movements in July

- GB prices ended the month 1.5% below Belgian prices, 2.5% lower than German prices and 0.8% lower than Dutch prices

- Ireland’s offshore gas field, Corrib, produced at 98% of its capacity in the first half of 2017, a rate of approximately 10mcm/d, according to Vermilion Energy, which holds an 18.5% stake in the project

- Spanish gas demand for August is expected to rise 9% year-on-year to 23.2TWh, according to grid operator Enagas. The company expects gas-for-power demand to increase 34% compared to August 2016 to 6.4TWh

- NextDecade, a US LNG project developer, is planning to install a floating storage and regasification unit in Cork, Ireland. The unit will be designed to receive up to 3mn metric tonnes of LNG per year from NextDecade’s planned Rio Grande LNG project in Texas

European Power

- All European power prices experienced losses in July

- GB prices ended the month 33.8% above French prices, 33.3% higher than German prices and 33.8% above Dutch prices

- Spain’s second wind and solar PV auction resulted in 5.0GW of new capacity awarded, with 3.9GW awarded to solar installations and 1.1GW to wind farms. All winning projects must commission by the end of 2019. The winning installations will not receive an uplift on wholesale prices, but will be shielded against weaker wholesale prices by being guaranteed a reasonable rate of return

- On 28 July, the French energy ministry announced it had awarded subsidised contracts for 507.6MW of solar capacity to 77 ground-based projects. The tender was the second of six rounds to take place under a scheme aiming to reach a target of over 10GW of solar capacity by the end of 2018.

- Germany added 0.9GW of solar capacity in the first half of 2017, the highest rate of additions in three years, bringing total solar capacity to 42GW. In the same period, the country also added 2.5GW of onshore wind capacity, with capacity from onshore windfarms now totalling 48GW

World Oil

- Brent crude oil prices climbed 2.4% to average $48.9/bl in July, and ended the month at a two-month high of $52.5/bl. Prices were supported by falling US crude inventories, which decreased every week last month, and high demand forecasts for China and the US. Furthermore, Saudi Arabia pledged to cap crude exports at 6.6mn bl/d during August and Nigeria said it would cap oil production once it stabilises at 1.8mn bl/d. However, OPEC crude production hit at 2017 high in July, as Libyan output continued to recover. Production from Iraq, UAE, Gabon and Ecuador also increased.

Coal

- On average, API 2 coal prices jumped 5.8% to $72.5/t during the month. On 31 July, prices reached an eight-month high of $75.8/t. Coal prices were supported by high demand from China and supply disruptions in Australia, Indonesia, South Africa and Colombia.

Carbon (EU ETS)

EU ETS carbon prices gained 5.2% to average €5.2/t, following a series of strong auctions. On 10 July prices hit a four-month high of €5.5/t.