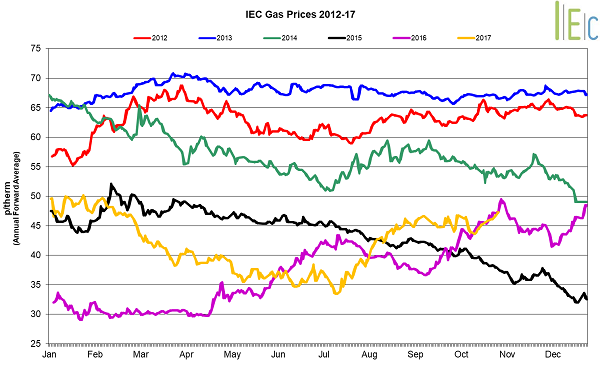

Gas market trends

What’s been happening?

- Most seasonal gas contracts experienced gains in October, with contracts from summer 2018 out to summer 2020 lifting 1.2% on average Summer 18 gas experienced an uptick of 1.2% to average 42.3p/th, up from 41.8p/th the previous month. Though, the contract was 1.7% lower than its value in October 2016 (43.0p/th). Winter 18 gas rose 0.9% to 49.7p/th

- During the month, summer 18 and winter 18 gas both experienced near one-month highs of 43.1p/th and 50.3p/th respectively

- On 30 October summer 20 gas grew to 41.3p/th, the highest price on our record for the contract going back to April this year

- Day-ahead gas prices across the month subsided 1.4% to average 45.5p/th. However, on 9 October day-ahead prices reached an eight-month high of 49.2p/th, strengthened by lower Norwegian supplies due to the Kollsnes gas processing plant and the Vesterled pipeline being offline for maintenance

- The month-ahead (November) gas contract gained 1.1% to 49.2p/th

Key market drivers

- Towards the end of the month, periods of higher exports to Europe and periods of tighter supplies pushed gas prices upwards. In contrast, concerns over tight winter supplies have generally eased following National Grid’s Winter Outlook report, capping bullish price movements

- An unplanned outage at Bacton Seal gas terminal and higher oil prices, which are often linked to the price of gas, also supported prices

* £ per p/therm (Annual Forward Average)

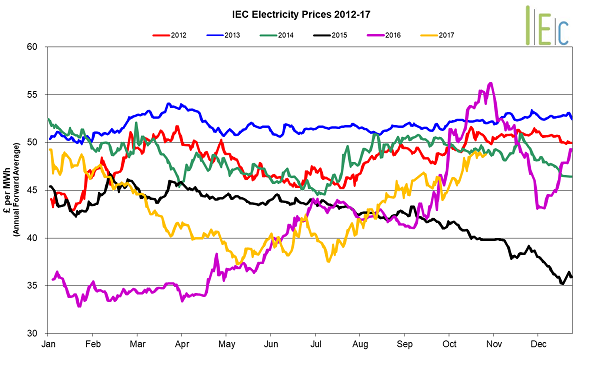

Electricity market trends

What’s been happening?

- The annual April 18 power contract lifted 1.0% to £45.3/MWh

- The majority of seasonal baseload power contracts increased, with contracts from summer 18 to summer 2020 averaging a rise of 0.8%

- Summer 18 power rose 1.3% to £42.8/MWh throughout the month, its highest monthly average since June 2015.

- Winter 18 power reached £47.9/MWh, a 0.8% increase, its highest price on our records.

- An exception was winter 19 power which fell 2.6% to £45.4/MWh, down from £46.6/MWh the previous monthDay-ahead power prices dipped 0.1% to average £46.8/MWh.

- On 17 October, the contract reached a one-month high of £49.40/MWh, amid steep declines in wind generation forecasts

- The month-ahead (November) power contract rose 3.2% to £52.9/MWh

Key market drivers

- In the first half of the month prices were bullish amid the news of the forced shutdown of 29 French nuclear reactors due to safety concerns

- Throughout the second half of the month prices became bearish as French nuclear availability concerns eased as reactors started to come back online.

- In addition, National Grid’s Winter Outlook report expects more comfortable supply margins than previously forecast, which also pressured prices

- The completion of maintenance to the IFA and BritNed interconnectors increased interconnector capacity and helped lower day-ahead prices.

* £ per MWh (Annual Forward Average)

* £ per MWh (Annual Forward Average)

European gas

- The majority of tracked European gas markets moved upwards in October, following several outages at European gas facilities and colder weather increasing demand

- GB prices ended the month 1.3% above Belgian prices, 4.5% higher than German prices and gained 6.1% over Dutch prices

- At the start of the month Norwegian gas operator Gassco announced natural gas production and exports from the Norwegian Continental Shelf were to be reduced for a short period with two unplanned outages and maintenance at the Kollsnes gas processing plant. This proved bullish for European prices

- The French natural gas transmission operator GRTgaz announced on 12 October that strike action will impact flows at the Taisnieres H, Taisnieres B and Obergailbach interconnectors. Capacity at the three sites has been reduced by more than 50%, impacting flows into Belgium and Germany. The duration of the event is currently uncertain and has also supported prices

- The new Dutch coalition government plans to reduce the production quota from the Groningen gas field beyond its current 21.6 bcm quota. They seek a further 1.5 bcm reduction to output by 2021. This is the latest in a series of output reductions from the major European gas field

- On 29 October, an unplanned outage reduced flows from Norway’s Gullfaks gas field, lowering output by 6mcm per day. No reason was given for the outage. European Power

- European power prices experienced growth in October, with notable gains seen in France and Germany GB prices ended the month 20.0% below French prices, 42.2% higher than German prices and 35.7% above Dutch prices

- On 5 October, EDF announced that maintenance to its Belleville-2 reactor was extended. Reducing nuclear availability in France throughout the month supported prices in the country and put power exports to Italy, Spain, Belgium and Switzerland at risk

- Throughout the month French nuclear output has been averaging 37GW, with forecasts for November and December displaying stronger output growth, lifting to 50GW and 59GW respectively. French nuclear output hit 40GW on 26 October, the first time in 24 days. A further three reactors came back online on 20 October However, on 30 October, EDF delayed the restart of five of its reactors planned to return at the start of November, cutting approximately 4TWh of nuclear production this winter

- Higher French power prices due to nuclear outages can often prove bullish for GB prices, particularly over peak periods when GB is a net importer of power

- Above average wind generation and high solar PV output throughout the week starting 23 October forced German power prices into negative

- German wind generation is projected to more than double year-on-year to exceed 12TWh by the end of October, according to the German grid operators. This trend has suppressed German spot power prices

World oil

- Brent crude oil prices rose 3.4% to average $57.3/bl across October. On 30 October prices reached a two-year high of $60.8/bl. Prices started the month at $56.1/bl, but moved upwards amid concerns of cuts to oil exports from the Iraqi Kirkuk region due to potential unrest between Kurdish and Iraqi forces.

- On 18 October, reports surfaced that oil flows from the Kirkuk-Ceyhan pipeline had fallen by approximately 375,000 barrels per day. Prices were also strengthened by news that OPEC will meet in November to debate extending its production cut agreement through 2018.

Coal

- API 2 coal prices grew 1.2% to average $82.4/t in October. On 30 October prices reached $85.8/t, a fresh three-year high. Prices started at $77.5/t and increased steadily across the month. The news of French nuclear outages, increasing coal demand for power generation, and periods of low Chinese stockpiles leading to robust demand from the nation, strengthened prices.

Carbon (EU ETS)

- EU ETS carbon prices leapt 6.9% to average €7.3/t. On 19 October EU ETS carbon reached €7.7/t, its highest price since January 2016. Growth in prices was influenced by numerous events, with mid-month bullish prices likely owed to rising coal demand across Europe due to French nuclear outages, along with the conclusion of carbon price reforms for trading phase four (2021-2030).