Gas market update

What’s been happening?

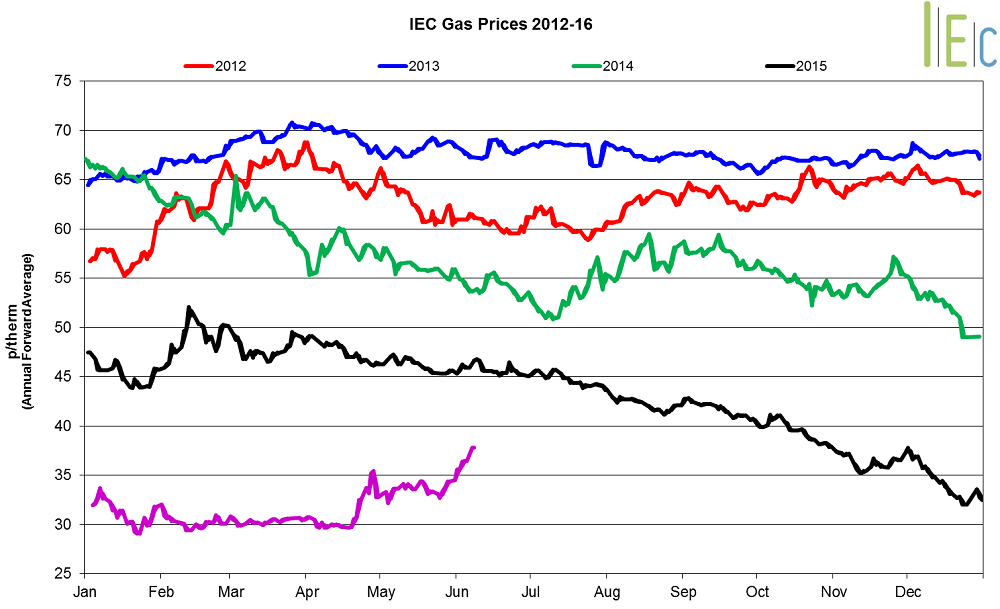

- The annual October 16 gas contract gained 7.7% to average a five-month high of 34.7p/th. Winter 16 gas rose 6.9% to average 36.1p/th, while summer 17 gas was up 8.5% to 33.4p/th.

- Spot gas prices also rose in May, with day-ahead gas lifting 3.6% to average 30.3p/th. The month-ahead gained 9.6% to average 29.6p/th.

Key market drivers

- Rises in oil prices have fed directly into the GB gas market, supporting seasonal contracts.

- Gas-for-power demand was at a four-year high during May, compared to the same month in previous years. Gas-fired generation provided 47% of GB’s electricity mix during the month, while coal only produced 4%. Higher demand for gas has helped to support prices.

* £ per p/therm (Annual Forward Average)

Power market update

What’s been happening?

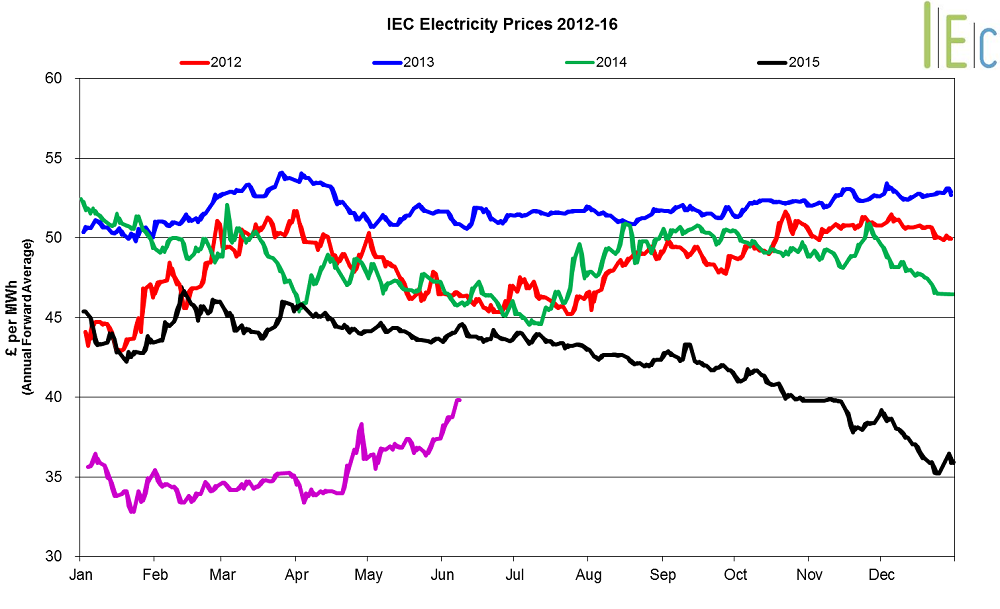

- The annual October 16 baseload power contract rose 6.1% to average £37.4/MWh. Winter 16 power gained 5.4% to average £40.2/MWh, while summer 17 lifted 7.0% to £34.6/MWh.

- Spot power prices also rose, with day-ahead power climbing 1.0% to average £34.2/MWh. The month-ahead contract grew 2.3% to average £32.6/MWh during May.

Key market drivers

- A recent surge in oil, coal and gas prices have helped to support seasonal power contracts. In addition, the recent closure of multiple coal-fired power stations may cause prices to rise.

- In the shorter term, spot contracts also followed gas prices higher, while a reduction in wind generation compared to the previous month also supported power prices.

*£ per MWh (Annual forward average)

European markets

All European gas prices increased in May, following a rise in commodity prices, higher gas-for-power demand, and restricted deliveries from the Norwegian continental shelf at the month’s end. GB prices ended the month 1.2% below Belgian prices, and 4.1% above German and Dutch prices.

- European power prices showed mixed movements in May.

- German prices experienced the largest overall gain, up £0.5/MWh to £22.6/MWh.

- GB prices ended the month 51.3% above the European average of £22.5/MWh.

World markets

- Brent crude oil surged 10.4% to average $47.5/bl in May, and hit a seven-month high of $50.1/bl on 26 May.

- A number of supply disruptions supported prices, including wildfires in Canada and economic issues in Venezuela.

Coal

- API 2 coal grew 7.3% to average $46.9/t, and reached an eight-month high of $49.6/t at the month’s end.

- A number of production cuts and a rise in Asian import demand helped push prices higher during the month.

EU ETS

- EU ETS carbon jumped 5.4% to average €6.0/t in May.

- However, prices remained 20.1% lower than last year’s level (€7.5/t).