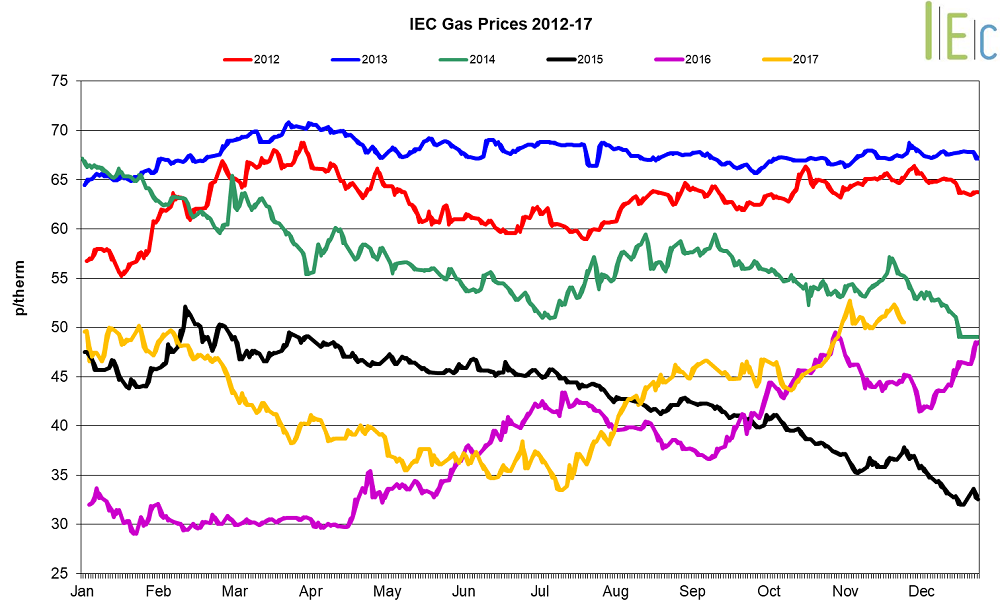

Gas market trends

What’s been happening?

- All seasonal gas contracts experienced gains in November, with the front season contracts undergoing the greatest growth. Contracts from summer 2018 out to winter 2020 lifted 3.9% on average

- The largest growth was observed in the summer 18 gas contract, which increased 5.2% to average 44.5p/th, up from 42.3p/th the previous month. On 27 November the summer 18 gas contract rose to 45.70p/th, exceeding a two-year high. Winter 18 gas rose 4.6% to 51.8p/th

- Throughout the month, winter 18 gas reached 52.9p/th on 27 November, its highest price since February 2015. Summer 19 gas extended to a two-year high of 50.6p/th on 14 November

- The annual April 18 gas contract lifted 4.8% to 48.2p/th

- Day-ahead gas prices across the month boosted 14.8% to average 52.2p/th, up from 45.5p/th throughout October

- The month-ahead (December) gas contract grew 4.5% to average 53.9p/th

Key market drivers

- Colder temperatures increasing demand for gas and robust exports to Europe, predominantly during the start of the month, coupled with tighter supplies, forced near-term prices upwards

- Unplanned outages across three UK gas facilities and at the Oseberg gas field in Norway helped to support prices towards the end of the month

* £ per p/therm (Annual Forward Average)

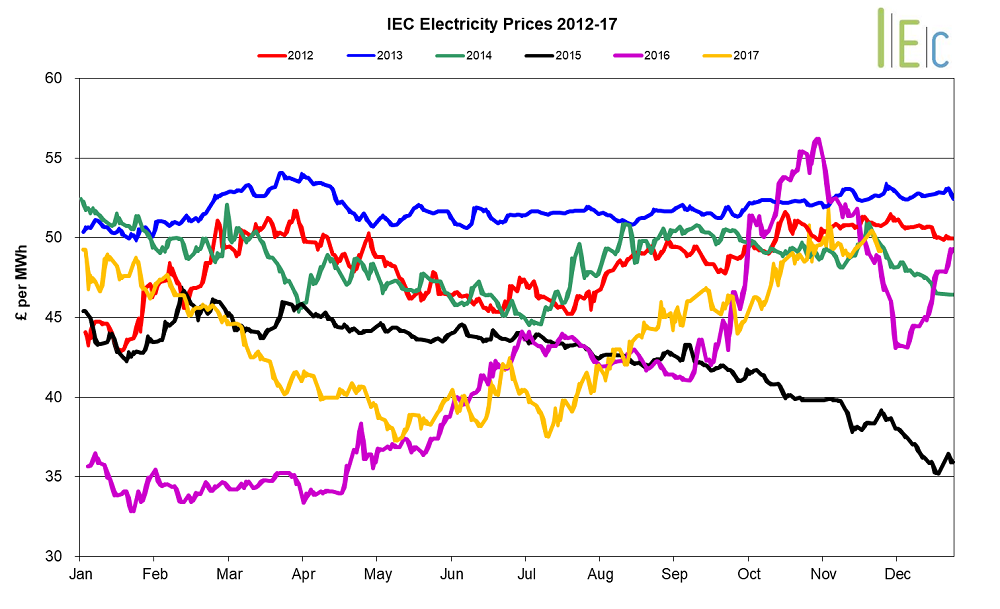

Electricity market trends

What’s been happening?

- The annual April 18 power contract went up 3.7% to £47.0/MWh

- All seasonal baseload power contracts increased during November, with contracts from summer 18 to summer 2020 averaging a rise of 3.2%

- Summer 18 power expanded 3.8% to average £44.4/MWh, growing from £42.8/MWh the previous month. Winter 18 power lifted 3.7% to £49.6/MWh and grew to a two-year high of £50.4/MWh on 24 November. Summer 19 power rose 3.3% to £41.7/MWh

- After the previous month’s losses, average day-ahead power prices climbed 9.0% to £50.9/MWh, reaching a 30-month high (£53.5/MWh) on 27 November

- The month-ahead (December) power contract experienced an uptick of 0.9% to average £52.9/MWh

Key market drivers

- Power prices were supported throughout the month by rising gas prices, following greater demand as temperatures fall. Tighter supplies have additionally supported power prices

- A series of planned nuclear outages throughout the UK aided in tightening supplies, outages included Dugeness B, Hartlepool and Sizewell B, with the latter not in full operation until 22 December

* £ per MWh (Annual Forward Average)

European Gas

- All tracked European gas markets experienced gains across November, with colder weather throughout Europe increasing demand

- GB prices ended the month 1.4% below Belgian prices, 4.6% higher than German prices and gained 5.2% over Dutch prices

- At the start of the month gas flows from the Oseberg gas field in the Norwegian North Sea were lowered by 1.9mcm per day to 3.4mcm due to maintenance. Towards the end of the month an unplanned outage at the gas field tightened supplies. Both events proved bullish for gas prices

- On 15 November the Dutch Council of State ruled to uphold the government plans to lower production at the Groningen Gas field to 21.6bn cubic meters per year, for a one-year period for ministers to draft an improved policy on output

- With colder temperatures across Europe, increased demand for gas was one of the primary reasons for the gains experienced in European gas prices throughout the month. Gains in prices generally aided growth in neighbouring countries – for example Belgian Zeebrugge prices were supported by gains in Dutch TTF

- Towards the end of the month reduced flows into the Emden-Dornum complex from Norway aided in a tightening of supplies and supported German and Dutch prices

European Power

- European power prices experienced bullish growth in November, with notable gains seen in Germany and the Netherlands

- Towards the end of the month, GB prices were 20.3% below French prices, 9.5% lower than German prices and 11.8% below Dutch prices

- Towards the end of the month German power prices experienced periods of high volatility stemming from fluctuations in wind production. Outages across a variety of power stations in the country supported prices, the most notable being the 1.4GW Grohnde nuclear power station

- At the start of the month French power imports rose with low nuclear output, primarily with imports from Germany. Additionally, demand for power increased after the country returned from All Saints’ Day holiday, coupled with colder temperatures throughout the month

- Data from French grid operator RTE showed nuclear output during November declined 2.7% to 30.2TWh compared to the same period last year. This means record December highs for nuclear output are needed to reach EDF’s reduced nuclear output target

- Despite French gains, prices were capped by the EDF announcement that 14 nuclear reactors with a combined capacity of 16GW will return to operation by the end of the month

- Near-term Dutch power prices experienced notable gains mid-month with continued French nuclear outages raising concerns of the possibility of lower cross-border flows into the Netherlands, ultimately supporting Dutch power prices. Colder temperatures throughout the month aided in lifting power demand

World Oil

- Brent crude oil prices rose 9.3% to average $62.6/bl throughout November, up from $57.3/bl the previous month. On 7 November prices reached a 28-month high of $64.1/bl.

- Early month highs owed to rising tensions between Saudi Arabia and Iran concerning recent conflicts in Yemen. Such events dominated much of the start of the month, leading to concerns it may damage OPEC relations and consensus upon extending production cuts on the cusp of their meeting on 30 November. Large periods of the month were dominated by expectations that OPEC and non-OPEC members would extend cuts to the end of 2018.

Coal

- API 2 coal prices lifted 3.0% to average $85.0/t in November. On 10 November prices reached $88.9/t, a fresh four-year high.

- Prices started at $87.8/t and increased steadily across the month. News of commencing strike action across South African coal mines supported early month highs. Coal prices were additionally supported by strengthening oil prices. Nevertheless, price gains were capped by weakening Chinese demand due to efforts to meet tough domestic air quality targets.

Carbon (EU ETS)

- EU ETS carbon prices grew 4.5% to average €7.6/t. On 6 November EU ETS carbon reached €7.9/t, a 22-month high, with prices boosted by burgeoning European coal demand. Prices experienced gains towards the end of the month with reports that the UK government would attempt to obstruct post-2020 EU ETS reform agreements. However, such concerns did not come to fruition, with reforms agreed on 22 November.