Gas Market Trends

What’s Been Happening?

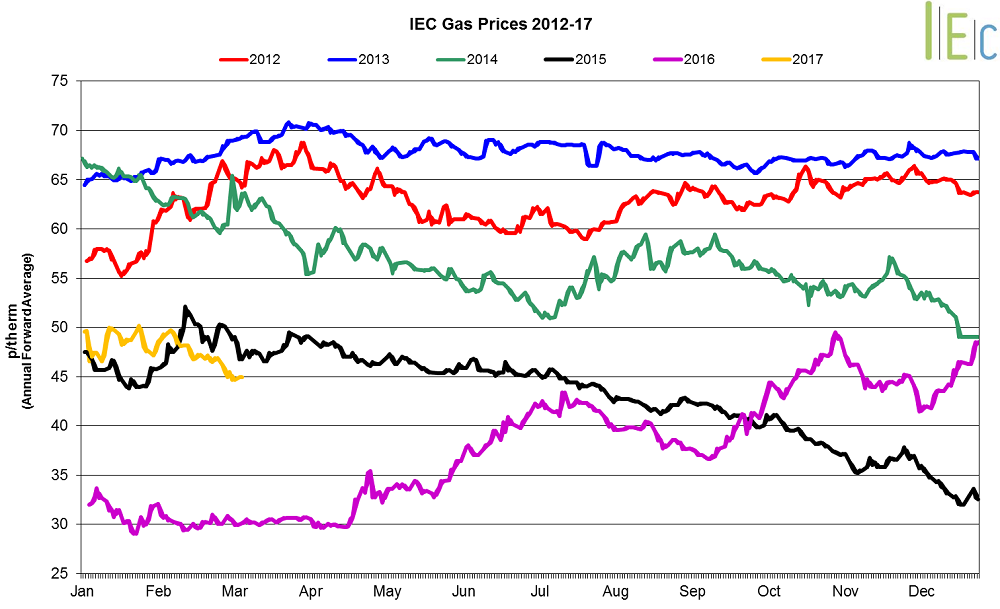

- All seasonal gas prices lost during February, falling 2.7% on average

- Seasonal gas prices remained higher than their levels last year

- Summer 17 gas slipped 2.7% to average 44.7p/th, higher than the price at the same time last year (31.9p/th)

- Winter 17 gas went down 1.5% to average 50.2p/th, also higher year-on-year (37.4p/th)

- In February, day-ahead gas fell 3.2% to average 51.6p/th, amid milder temperatures

- The month-ahead contract moved 1.8% lower to average 51.3p/th

Key Market Drivers

- Ongoing withdrawal capacity reductions at GB’s largest gas storage site, Rough, continued to support near-term contracts. Further restrictions to injection at Rough gas storage facility could lead to lower near-term prices due to reduced injection demand. However, winter prices may be higher amid less storage supply availability.

* £ per p/therm (Annual Forward Average)

Electricity Market Trends

What’s Been Happening?

- The annual April 17 baseload power contract decreased 2.9% to average £46.1/MWh

- Most seasonal baseload power contracts moved lower, with an average decrease of 1.2%

- Summer 17 power was down 3.7% to £44.1/MWh. Winter 17 power slipped 2.2% to £48.0/MWh

- Day-ahead baseload power decreased by 7.0% to average £49.5/MWh in February, after experiencing gains in January

- The month-ahead contract went down 4.4% to £49.4/MWh

Key Market Drivers

- Interconnector issues continued during February, with the French interconnector at reduced capacity for most of the month

- The Moyle interconnector between Northern Ireland and Scotland suffered a fault on 18 February, and is set to operate at reduced capacity for up to six months whilst repairs take place. This will reduce overnight imports to GB and lessen peak-time exports from GB

- Decreased gas prices pushed power prices lower in February

* £ per MWh (Annual Forward Average)

European Gas

- European gas prices all decreased in February

- GB prices ended the month 1.3% below Belgian prices, 3.1% higher than German prices and 5.4% above Dutch prices

- Continental Europe is expected to be warmer than normal between March and May, the Weather Company said in an update during February. This could weigh on European power and gas prices

- Spanish gas usage in February rose 0.9% year-on-year to 29.2TWh, owing to higher demand from gas-fired power generation. Spanish power demand fell 4.6% year-on-year to 19.9TWh in February, breaking the upward trend seen since August

- European gas and power prices were supported by OPEC’s historic agreement from the meeting held on 30 November. At the meeting, OPEC agreed on its first oil output reduction since 2008, in a move to support oil prices

European Gas

- European power prices all experienced losses in February. GB prices ended the month 21.5% above French prices, 98.6% higher than German prices and 51.5% above Dutch prices

- The 2GW UK-France interconnector returned to full capacity from Thursday 2 March. This followed damage to the subsea cables during a storm in the English Channel in November 2016, which caused reduced flows over the winter months

- German wind power output reached a new hourly record above 37GW on 22 February, with weekly output forecast to top 4TWh for the first time ever. High wind output pushed power prices downwards

- The Moyle Interconnector between Northern Ireland and Scotland is to operate at a reduced capacity of 250MW following a “serious operational problem”. The issue with the 500MW electrical link arose on Saturday 18 February and, depending on the availability of resources, such a repair could typically take an estimated six months

- Work has begun on the ElecLink interconnector between Britain and France. The cable will have a capacity of 1GW, and is being funded by Eurotunnel

- Germany’s 1.4 GW-Brokdorf nuclear reactor will remain offline until 15 March after the operator further extended the outage. This could push European power prices upwards.

- German nuclear power output this February dropped to its lowest monthly level since the early 1980s as unprecedented winter refuelling stops and additional maintenance and repairs left just five of the remaining eight reactors online

World Oil

- Brent crude oil prices rose 0.9% to average $56.1/bl in February. Prices remained above the $50.0/bl mark for the third consecutive month. They remained well above the level in February 2016, when prices averaged $33.7/bl. Prices were heavily influenced by the output cuts of OPEC and non-OPEC members, which came into action at the start of January and are expected to last through until June.

Coal

- API 2 coal prices fluctuated throughout the month, but on average went up 0.6% to $67.0/t.

On 20 February, prices reached a three-month high of $69.2/t.

Prices remained well above levels last year when the price averaged $38.0/t in February 2016.

Carbon (EU ETS)

- EU ETS carbon prices varied between €4.9/t to €5.5/t, and on average decreased 2.3% to €5.2/t. The process of backloading allowances ended at the start of 2017. This means that more allowances are now available at auction, which increases supply and lowers carbon prices