During February the energy markets started to reflect the initial impacts of coronavirus.

Low prices at the start of the month recovered only to fall again by the end of the month. We will have to wait and see how the pandemic pans out and how the market reacts during March.

In the longer-term, there are various factors that are likely to contribute to volatility, on top of coronavirus. April is set to be colder than normal; there are concerns that a weakened Chinese economy could contribute to another recession and gas is currently over-supplied.

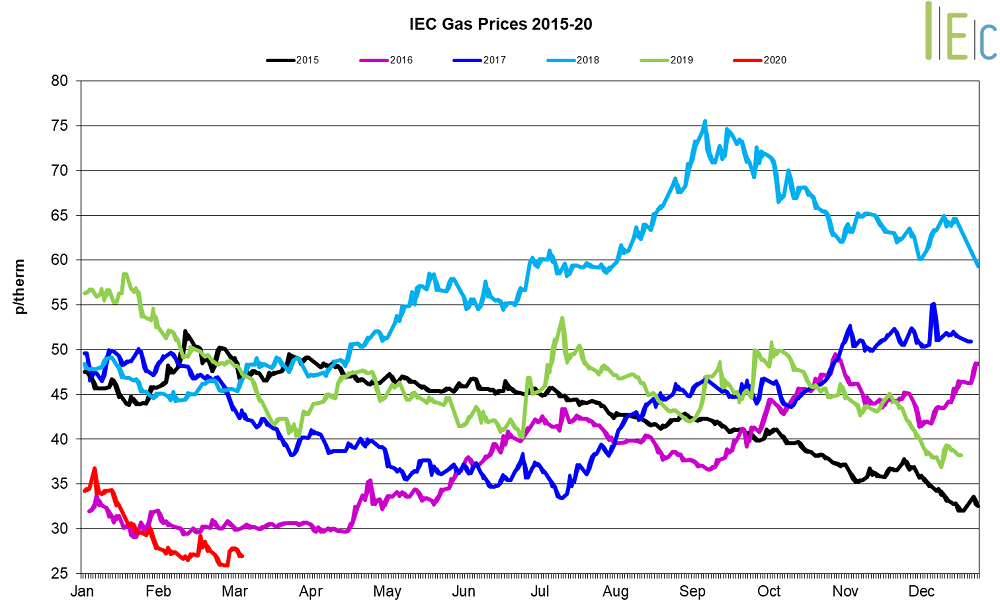

Gas

- Month-on-month gas prices remained stable throughout February though forward prices moved up slightly.

- Upward movement was driven by a significant increase in volatility due to coronavirus.

- There is plenty of oversupply of gas and LNG though short-term indicators show prices are likely to rise.

- Unsettled weather conditions meant gas was required for power generation, adding to demand.

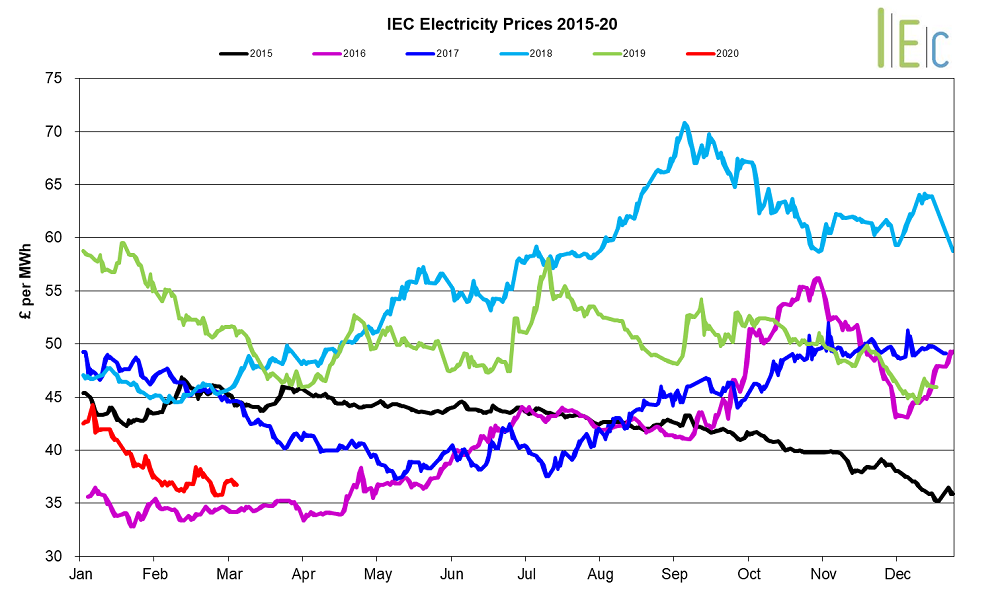

Power

- Day-ahead power prices were volatile due to coronavirus and unsettled weather.

- At the end of February, forward prices were only slightly above the previous month.

- Whilst the UK power market remains relatively weak, there are indicators that this may change in the short-term.

Coal

- Coal prices experienced volatility and moved sideways affected by EU/UK trade negotiations continued.

Oil

- Oil prices were also volatile during February, partly due to the likelihood of reduced global demand, particularly from China and discussions about OPEC production cuts.