Gas market trends

What’s been happening?

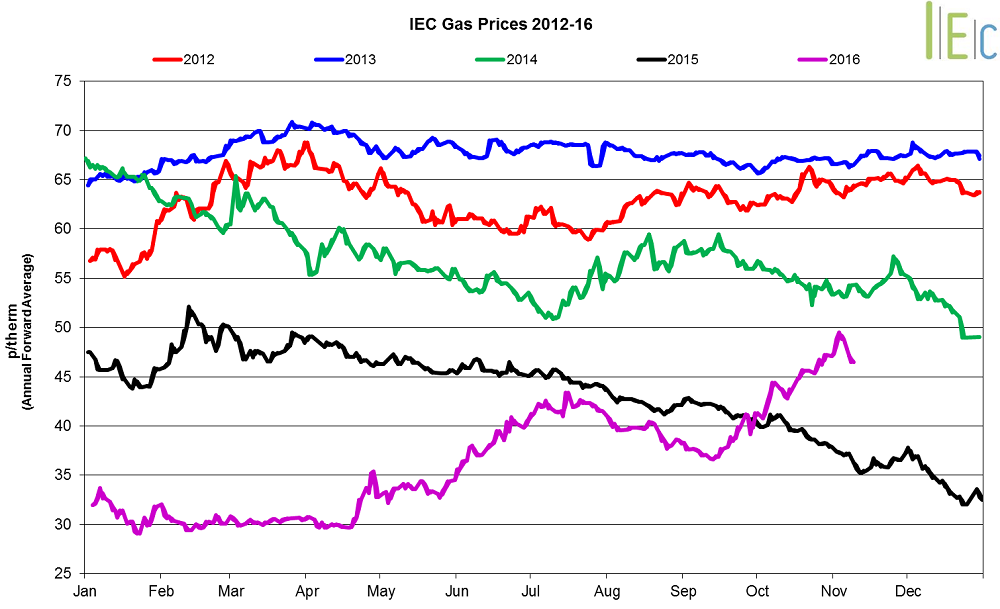

- All seasonal gas prices increased in October. The annual April 17 gas contract climbed 13.9% to 45.3p/th. Summer 17 gas experienced the largest gain of 14.9% to average 42.5p/th.

- Day-ahead gas soared 50.6% higher, the largest monthly gain since at least 2012, to average 43.1p/th. On 26 October day-ahead gas reached 48.0p/th, the highest price since April 2015. The month-ahead contract moved 17.4% higher to average 45.8p/th.

Key market drivers

- At the end of October, Centrica announced it was “still conducting preparatory works and reinstatement testing” at Rough gas storage site, which is expected to be completed in the second half of November. These delays will further tighten supply for the coming winter.

European Gas

- All European gas prices increased in October.

- GB prices ended the month 1.3% lower than Belgian prices, 1.5% higher than German prices and 3.7% above Dutch prices.

- Prices have been supported by Norwegian production outages and colder weather forecasts.

* £ per p/therm (Annual Forward Average)

Power market trends

What’s been happening?

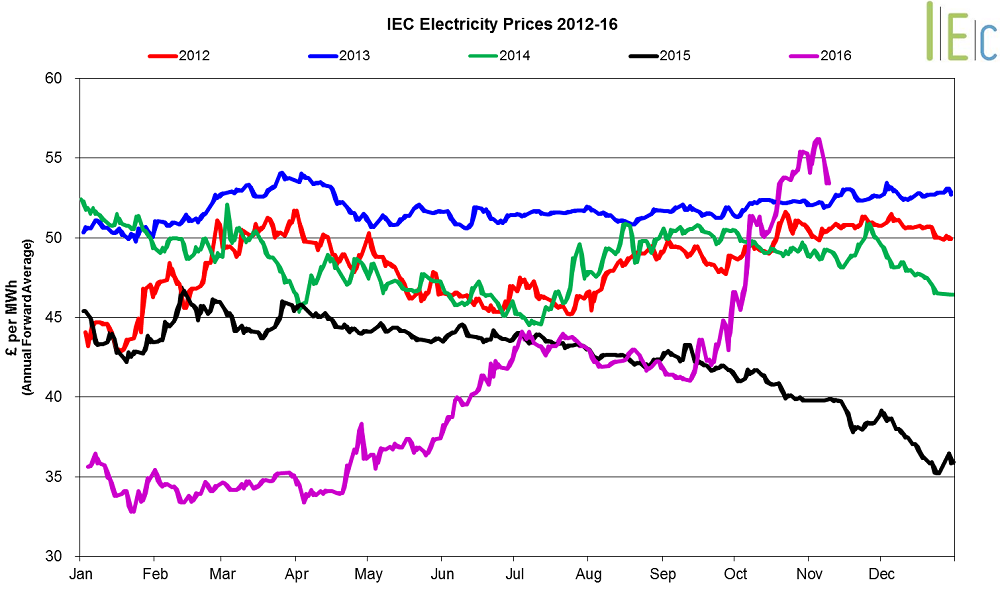

- The annual April 17 baseload power contract rose 13.7% to average £46.5/MWh, following the gas market higher. Seasonal baseload power contracts on average rose 11.4% in October, following their gas counterparts higher. Summer 17 power rose 13.7% to £44.1/MWh.

- Day-ahead power climbed 7.5% to average £56.9/MWh.

Key market drivers

- Supply concerns from last month are expected to continue into winter, amid reports that 20 of France’s 58 nuclear reactors were shut for tests. EDF expects to halt four more in the coming months, sparking concerns over power supply tightness as lower temperatures lift demand. This has boosted French prices and reduced interconnector imports.

European power

- All European power prices gained in October.

- French prices jumped £23.3/MWh to £62.0/ MWh. GB prices ended the month 16.5% below French prices.

- Prices were supported by fears over French power supplies, in the face of expected extended nuclear maintenance shutdowns.

*£ per MWh (Annual forward average)

Commodity markets

- Brent crude oil prices rose 9.5% to average $51.6/bl in October, with prices holding above the $50/bl mark for nearly the entire month. On 10 October prices hit a one -year high of $53.5/bl.

- API 2 coal went up 13.1% to average $66.9/t.

- On Monday 24 October API 2 coal reached $71.0/t, the highest price since December 2014.

- EU ETS carbon jumped 31.6% to average €5.7/t. On Wednesday 26 October prices reached a 20-week high of €6.0/t, supported by stronger power prices and high coal prices.