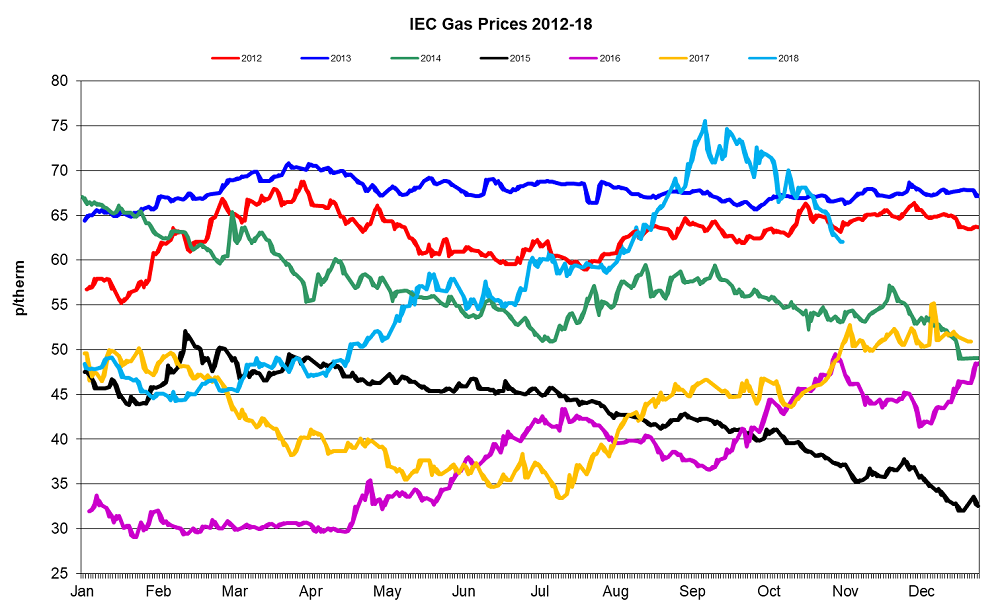

Gas market trends

What’s been happening?

- In October, day-ahead gas prices decreased 9.8% to average 66.9p/th

- The month-ahead (November) gas contract went down 9.6% to average 70.6p/th, dropping to 64.5p/th on 31 October amid high LNG imports

- Most seasonal gas contracts fell in October, down 1.0% on average

- Summer 19 and winter 19 gas averaged 61.6p/th and 69.7p/th, down 1.7% and 0.5% on the previous month respectively. However, summer 19 has grown 46.1% from January 2018 when it averaged 42.1p/th

- Summer and winter 20 gas contracts were the exceptions to the monthly decreases, increasing 0.1% and 0.7% to 54.3p/th and 63.2p/th respectively

- The annual April 19 gas contract fell 1.0% to 65.6p/th

Key market drivers

- Average demand on the National system increased month-on-month, rising from 160.1mcm in September to 220.0mcm in October. Regional gas demand also rose month-on-month, up from 80.7mcm in September to 125.6mcm in October

- Several LNG tankers, including cargoes from USA, Brazil, and Egypt, came to UK LNG terminals in October, leading terminal storage levels to reach 95% capacity – the highest ever. This resulted in high LNG send-out throughout the month, and kept the gas system oversupplied towards the end of the October despite cooling temperatures

- While rising demand as we head into winter acts to push wholesale prices upwards, supplies have been more comfortable than expected and has lowered gas contracts across the coming winter period.

* £ per p/therm (Annual Forward Average)

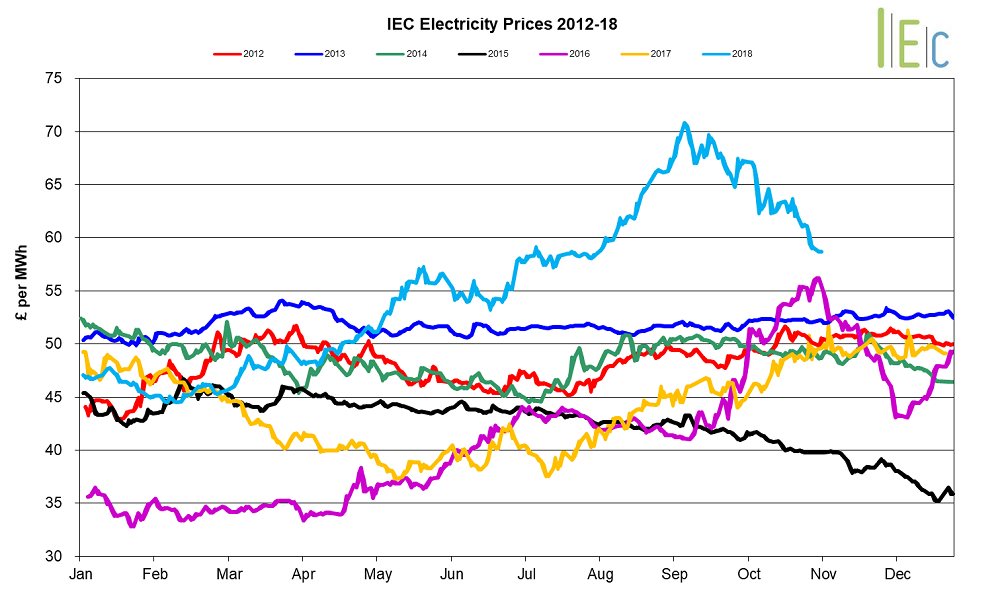

Electricity market trends

What’s been happening?

- Day-ahead power curtailed 4.3% throughout the month to average £64.8/MWh. Day-ahead power dropped to £61.3/MWh on 22 October, a one-month low

- The month-ahead (November) power contract decreased 8.0% to average £67.6/MWh, ending the month at £63.2/MWh on 31 October

- All seasonal power contracts decreased, down 2.7% on average

- Summer and winter 19 dropped 3.1% and 2.1% to £58.8/MWh and £64.1/MWh respectively

- The annual April 19 power contract declined 2.6% to average £61.5/MWh

Key market drivers

- Day-ahead power prices followed gas prices lower

- Average demand increased month-on-month, rising from 0.67TWh per day to 0.74TWh. Average peak demand also rose month-on-month, up from 34.7GW in September to 39.0GW in October. Higher demand acts to put upwards pressure on power contracts

- Increased wind generation weighed on power prices last month, with wind accounting for around 18.1% of total generation in October, compared to 17.6% in September

- Falling EU ETS carbon prices have also pressured the power curve as the cost of emitting carbon is factored into the cost of power generation, meaning lower EU ETS carbon prices lead to lower power prices.

* £ per MWh (Annual Forward Average)

European gas

- All tracked gas markets declined throughout the month. The largest loss was observed on the TTF, falling 9.0p/th to end the month at 60.7p/th. NBP prices eased 5.5p/th to 63.4p/th

- European gas prices predominantly fell amid high LNG sendout across the gas hubs, aided by increased deliveries of LNG from around the globe

- German gas prices increased as gas for power demand rose towards the end of the month. This was due to reduced coal demand following issues transporting the commodity by train and barge to power stations

- European gas storage levels have recovered since the depletion of reserves as a result of the ‘Beast from the East’. At the end of the month storage levels across the tracked hubs was higher than the previous year

- For many hubs on the continent gas is expected to be the marginal source of power generation – meaning the last power plant called upon to meet demand – while coal-fired output is projected to run baseload. This is because higher gas prices in recent months has meant coal-fired output has been more economical than gas-fired output in many countries. However, this may change if gas prices continue to fall.

European power

- GB power prices ended the month at a premium to French power, despite the growth of £3.3/MWh across the month. Germany also remained at a discount to GB

- French power prices were the only tracked power market to fall, dropping £1.9/MWh to £57.7/MWh. Towards the end of the month, France saw an uptick in hydro output and a 1GW decrease in exports to offset reductions in nuclear and wind production

- Announcements of delays to the restart of several French nuclear reactors out for maintenance supported power prices up to £81.6/MWh on 26 October, with the delays to reactor restarts restricting supplies

- German power prices rose £7.7/MWh to £49.1/MWh. This stemmed from forecasts of lower renewables moving into November, despite falling gas prices across the month and robust renewables output throughout October

- On 18 October, Engie announced that it expects to restart four of its Belgium nuclear reactors by the end of the year. Belgium currently faces a winter with six of the country’s seven reactors offline due to concrete degradation and water cooling issues. The outages have supported power prices in the country as well as in some neighbouring countries

- On the continent, the current status of the coal-to-gas switching price remains unchanged, with gas prices far exceeding the switching price, indicating that coal-fired generation continues to remain more economical than gas. The current outlook observes this trend continuing throughout this winter; however, this could change if gas prices continue to fall

World oil

- Brent crude oil prices rose for the second consecutive month, up 2.2% to average $81.0/bl during October.

- Prices rose to a fresh four-year high above $86.1/bl on 4 October as the upcoming US sanctions against Iran drive concerns of a tight market. However, prices fell to $75.2/bl on 24 October, the lowest since August, as Saudi Arabia have warned of oversupply in the market following the announcement the nation would increase production to 11.0mn bpd ahead of the Iranian sanctions coming into effect on 5 November.

Coal

- API 2 coal prices were up 1.3% to average $97.4/t in October.

- Coal prices peaked at $100.2/t on 3 October, a fresh five-year high, as winter restocking efforts in Asia supported prices. However, prices dropped to a five-week low of $94.0/t on 11 October, as European demand dipped amid German ARA terminal coal stocks nearing four-year highs, as water levels in the Rhine dropped to a 15-year low.

Carbon

- EU ETS carbon curtailed 9.0% to average €19.7/t in October, its first monthly decline since December 2017.

- Prices were above €20.0/t for most of the first half of October but remained volatile as temperatures across much of Europe were above seasonal normal levels. Uncertainty surrounding the effects of a no-deal Brexit on the EU ETS has pressured prices, which fell to a 16-week low of €15.8/t on 30 October. This followed the release of the Autumn Budget on 29 October, which clarified the UK’s future position on carbon pricing in the face of a potential no-deal Brexit, suggesting a separate UK carbon tax of £16/t.