Gas market trends

What’s been happening?

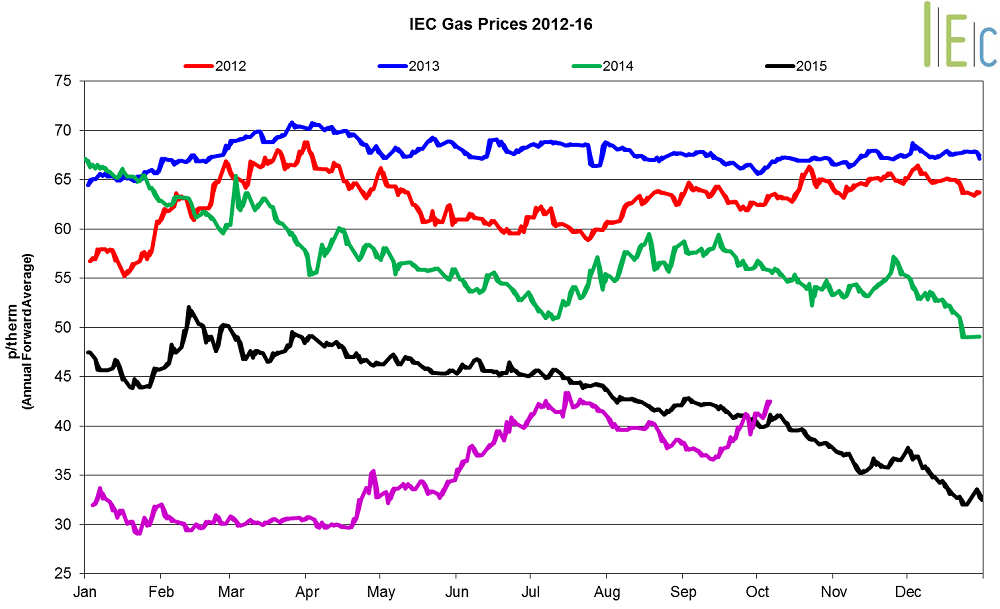

- All seasonal gas prices decreased in September. The annual October 16 gas contract lost 4.3% to 38.2p/th. Winter 16 gas experienced the largest drop (of 5.6%) to average 39.6p/th. Summer 17 gas decreased 3.1% to 36.8p/th.

- Day-ahead gas moved 10.2% lower to average 27.9p/th. The month-ahead contract declined 5.2% to average 33.0p/th.

Key market drivers

- Seasonal gas prices remained below their levels last year. Centrica has said it will make 20 wells available at Rough gas storage facility from 1 November 2016. All 30 wells had been expected to be offline until spring 2017. This has improved the supply outlook for the coming winter and pulled prices down.

European gas

- All European gas prices decreased in September.

- GB prices ended the month 1.3% below Belgian prices, 2.3% higher than German prices and 2.2% above Dutch prices.

- Exports through the UK have remained near capacity, and were at their highest level in more than three years throughout the first half of September

* £ per p/therm (Annual Forward Average)

Power market trends

What’s been happening?

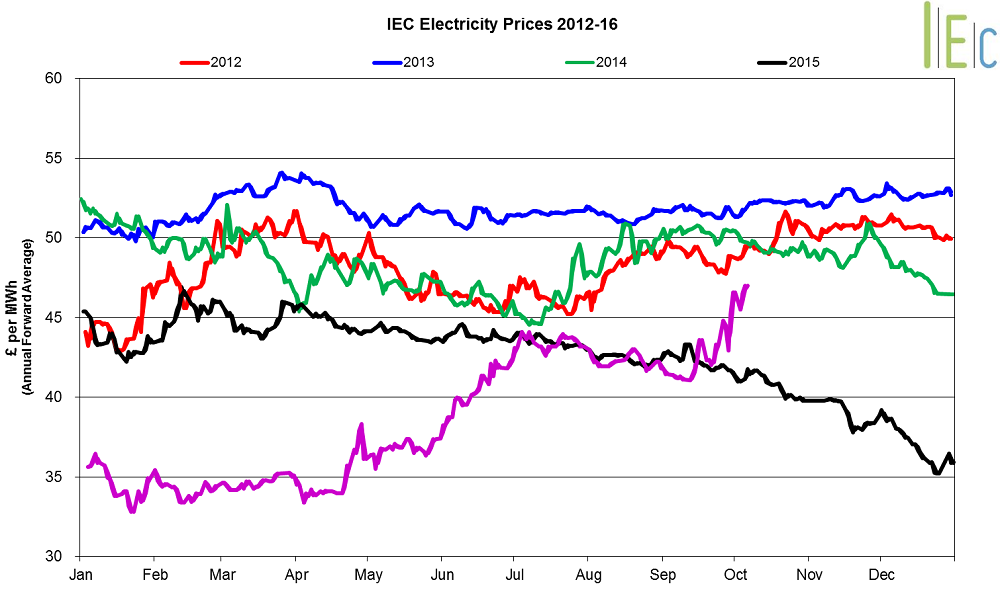

- The annual October 16 baseload power contract fell 0.5% to average £42.2/MWh, following the gas market lower. The month-ahead contract dropped 5.2% to average £42.3/MWh during September.

- Day-ahead power prices soared 45.6% higher to average £53.2/MWh.

Key market drivers

- On Friday 16 September, the day-ahead contract rocketed 339.4% to £157.7/MWh. This was the highest price since March 2006, as peak wind power forecasts dropped below 1GW, tightening margins in the UK. In addition, continental European imports were lowered by 2GW due to planned interconnector outages, further tightening system margins.

European power

- European power prices were mixed in September.

- German prices dropped £6.7/MWh to £20.5/MWh.

- GB prices ended the month 25% above the continental European average of £28.1/MWh.

- French prices rose as a third of French nuclear capacity remained offline.

*£ per MWh (Annual forward average)

Commodity markets

- Brent crude oil prices rose 0.8% to average $47.1/bl in September. OPEC members agreed on a preliminary outline to cut its collective output to between 32.5mn bl/d and 33mn bl/d.

- API 2 coal went up 0.3% to average $58.6/t. On Friday 29 September prices reached $64.8/t, the highest price since January 2015.

- EU ETS carbon lost 10.4% to average €4.2/t. On Monday 5 September, EU ETS carbon fell to €3.9/t, the lowest price in over three years, following a weak auction.