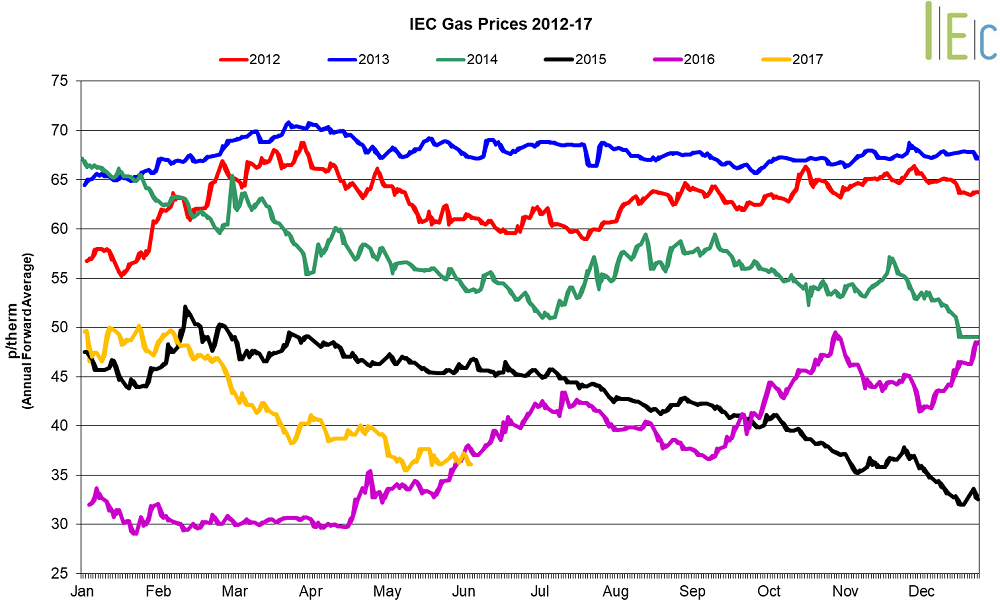

Gas Market Trends

What’s Been Happening?

- The majority of seasonal gas contracts decreased during May, falling 2.5% on average, following oil prices downwards

- Seasonal gas prices remained higher than their levels last year

- Winter 17 gas declined 1.8% to 45.7p/th, compared to 38.3p/th in May 2016

- Summer 18 gas fell 2.2% to 39.4p/th, compared to 34.9p/th the same time last year

- In May, day-ahead gas slipped 1.9% to 39.2p/th, the lowest monthly average in eight months

- On 25 May, day-ahead gas fell to 36.2p/th, a seven-month low, as higher temperatures weakened demand

- The month-ahead contract moved 2.9% lower to average 36.9p/th

Key Market Drivers

- Centrica confirmed in May that the Rough gas storage facility cannot safely re-commence injection operations in the 2017-18 storage year (May 2017 to April 2018). Winter prices are likely to rise due to lower gas supply available for withdrawal during the winter

- Lower spot gas prices can be expected during spring and summer, with reduced demand amid higher temperatures and increased solar output reducing the need for gas-fired power generation.

* £ per p/therm (Annual Forward Average)

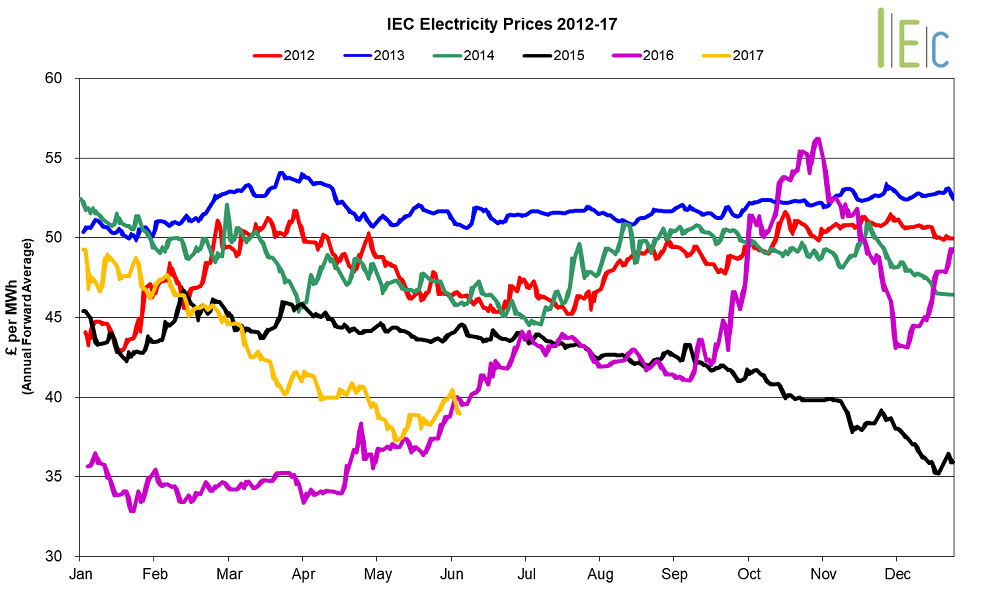

Electricity Market Trends

What’s Been Happening?

- The annual October 17 baseload power contract lost 1.3% to average £42.1/MWh

- Seasonal baseload power contracts experienced mixed movements, with an average decrease of 1.3%

- Winter 17 power was down 1.1% to £45.5/MWh. In contrast, summer 20 power went up 0.2% to £39.3/MWh

- Day-ahead baseload power lost 1.1% to average £41.1/MWh. The contract jumped to a three-month high of £54.0/MWh, on 16 May, with an unplanned shutdown at the Heysham 2-7 nuclear unit, as well as higher demand and a sharp decline in forecast wind generation forecast for the following day

- In contrast, on 26 May, the contract dropped to £36.9/MWh, a near eight-month low, with lower demand forecast for the following day and a reduction in gas prices. Also, the contract was driven down by record high levels of solar PV output, which hit 8.7GW on 26 May

- The month-ahead contract also experienced a loss, down 1.8% to average £38.4/MWh

Key Market Drivers

- Generally decreased near-term gas prices pushed near-term power prices lower in May

- Lower spot power prices can be expected as during spring and summer, with lower demand amid higher temperatures and increased solar output

* £ per MWh (Annual Forward Average)

European Gas

- All European gas prices decreased in May, following the oil market downwards

- GB prices ended the month 1.3% below Belgian prices, 6.7% lower than German prices and 3.8% lower than Dutch prices

- The International Energy Agency reported in May, that it expects European gas demand to be flat in the coming years, with no boost likely in the power generation sector

- Spanish gas use in May was 2.3% higher year-on-year, amid higher power demand and low hydro generation, according to grid operator Enagas

- Hydro generation plummeted 63% year on year leading to a surge in coal generation

- The remainder of the gap was filled by CCGT plants, whilst gas demand for domestic and business use rose 2.4% year on year

- Netherlands Gate LNG terminal is set to receive Northwest Europe’s first ever shipment of US LNG. The Arctic Discoverer, chartered by Statoil, is expected to arrive on 7 June after it set sail from the Sabine Pass LNG export plant in the Gulf of Mexico on 21 May

European Power

European power prices experienced mixed movements in May

- GB prices ended the month 8.1% above French prices, 21.8% higher than German prices and 21.0% above Dutch prices

- German solar power output hit record highs on 27 May, according to EEX Transparency data. Solar production averaged 27.8GW between 13:00 and 13:15 local time, as daily output hit a high of 263GWh. Weekly generation also set a new record at 1.6TWh. Separate data from Fraunhofer ISE showed solar output of 5.5TWh in May, setting a new monthly output record

- The outage at Germany’s 1.4GW Brokdorf nuclear plant was extended to 16 June by E.ON’s nuclear unit, whilst it waits for permission from the state nuclear regulator to restart

- On 18 May, Spain held its most recent renewables auction. The auctions saw nearly all 3GW of renewable capacity awarded to wind generators (2.979GW). 1MW of solar photovoltaic capacity was awarded as well as 20MW of unspecified other technologies. The Spanish government announced on 25 May that it will hold another 3GW auction for renewable capacity before this summer

- Swiss voters backed the government’s energy law to ban new nuclear power plants and increase renewable generation, on 14 May. The law plans to increase renewable output to 11.4TWh by 2035, with 4.4TWh earmarked for 2020

- Between 15 and 18 May, the Dutch “BritNed” interconnector was in its annual planned reduction period for maintenance. During the week, it accounted for 1.5% of the generation mix. From early Monday morning until late Wednesday, Brit-Ned interconnector imports remained at zero

World Oil

- Brent crude oil prices dropped 4.8% to average $51.5/bl in May. On 25 May, OPEC and non-OPEC members met to decide whether to extend current output cuts beyond June 2017. As the meeting approached, prices rose with increasing market confidence that OPEC and non-OPEC members would come to an effective agreement. On the morning of the meeting, prices jumped to a five-week high of $54.4/bl. However, on 26 May, prices dropped to $51.8/bl, amid disappointment that deeper and longer production cuts were not implemented.

Coal

- On average, API 2 coal prices slipped 0.9% to $65.5/t during the month. Prices remain well above the levels last year when the price averaged $46.9/t. In contrast, on 31 May, prices reached an eight-week high of $67.5/t. Prices were supported by a drop in the dollar against a basket of currencies, but gains were limited on weakening Chinese import demand.

Carbon (EU ETS)

- EU ETS carbon prices lowered 2.8% to average €4.7/t. On 12 May, prices hit a hit a five-month low of €4.3/t, following a weak German auction. Although EU ETS carbon decreased on average, prices began to rise towards the end of the month and reached a near twelve-week high of €5.2/t on 30 May. During the month, it was reported if Britain makes a sudden exit from the EU ETS it could have a bearish impact on prices.