Gas Market Trends

What’s Been Happening?

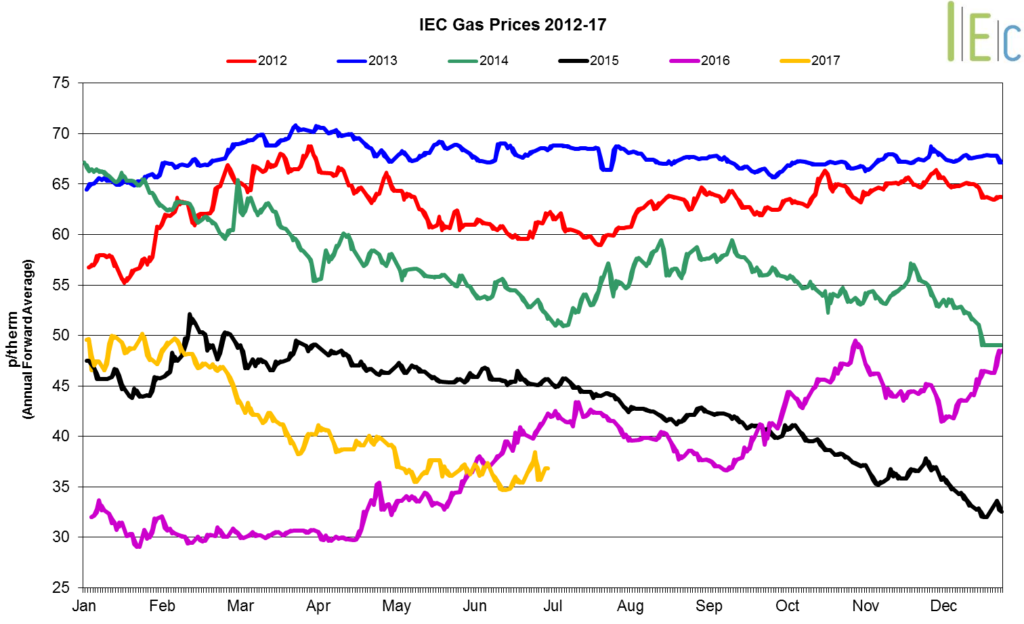

- The majority of seasonal gas contracts increased during June, rising 0.8% on average

- Seasonal gas prices remained higher than their levels last year

- Winter 17 gas fell 0.8% to 45.3p/th, compared to 42.3p/th in June 2016

- Winter 18 gas rose 0.8% to 46.0p/th, compared to 42.4p/th the same time last year

- In June, day-ahead gas extended losses, down 10.6% to 35.0p/th, the lowest monthly average in nine months

- On 15 June, day-ahead gas fell to 23.5p/th, a nine-month low, as warm weather, high levels of forecast renewables output and low continental exports led to lower gas demand

- The month-ahead contract moved 4.1% lower to average 36.0p/th

- Centrica Storage Limited (CSL) announced in June that it intends to permanently close its Rough gas storage facility. Following a number of failures during its well testing program, CSL concluded it cannot safely return the assets and facilities to injection and storage operations.

Key Market Drivers

- High temperatures reduced gas demand for residential heating and high renewables output reduced the need for gas-fired power generation

- Lower spot gas prices can be expected during spring and summer, with reduced demand amid higher temperatures and increased solar output reducing the need for gas-fired power generation.

Electricity Market Trends

What’s Been Happening?

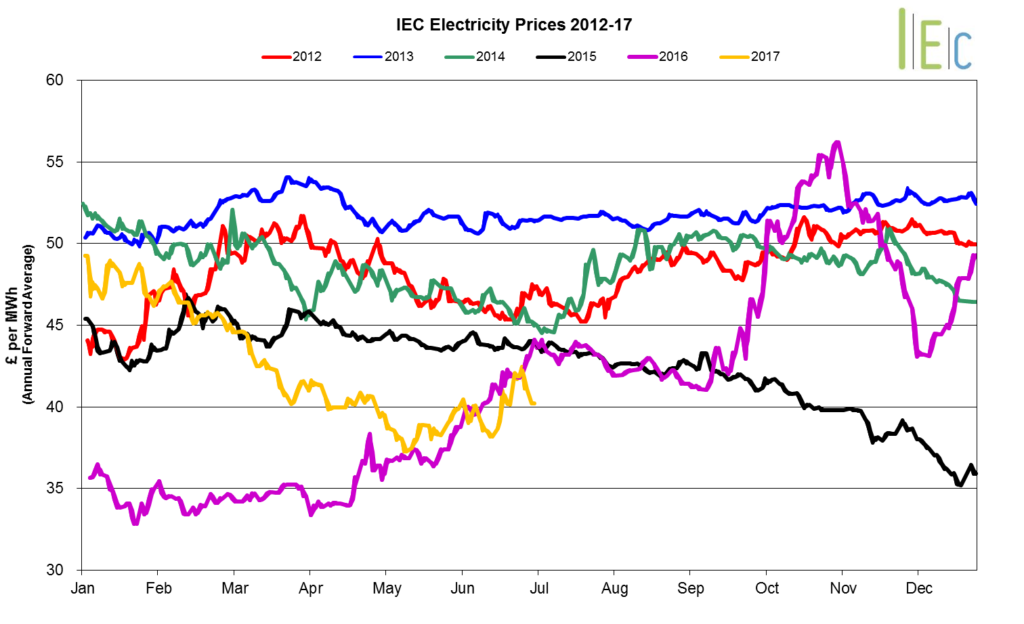

- The annual October 17 baseload power contract gained 1.9% to average £42.9/MWh

- Most seasonal baseload power contracts moved higher, with an average increase of 1.8%

- Winter 17 power was up 1.7% to £46.2/MWh. Summer 18 power went up 2.1% to £39.5/MWh

- Day-ahead baseload power lost 3.4% to average £39.7/MWh. The contract dropped to a nine-month low of £30.8/MWh, on 15 June, with forecasts of high levels of renewable generation

- In contrast, on 23 June, the contract jumped to £64.8/MWh, its highest price since December 2016, as forecasts of lower wind and solar generation and higher demand led to forecasts of tight supply margins for the following day

- The month-ahead contract rose 2.3% to average £39.9/MWh.

Key Market Drivers

- High renewables output pushed near-term power prices lower in June. On Wednesday 7 June, renewables provided 18.7GW of power at 1pm, meeting a new record of 50.7% of total demand

- Lower spot power prices can be expected during spring and summer, with lower demand amid higher temperatures and increased solar output.

European Power

- Most European power prices experienced gains in June

- GB prices ended the month 21.8% above French prices, 27.2% higher than German prices and 35.2% above Dutch prices

- German wind and solar power output climbed above 50GW for the first time on 7 June, according to data from grid operators. Output averaged 51.9GW during hour 13, with onshore wind producing 28.8GW, offshore wind 4.3GW and solar 18.8GW. The output saw some prices turn negative on the intraday market

- Temperatures across the majority of Europe are set to be warmer than normal for the remainder of the summer and into September, according to the Weather Company. Continued dry weather could impact hydro levels in Switzerland, France, Italy and Spain. High temperatures could also lead to increased demand for air conditioning in Spain and Italy, which rely on imports from France and Germany in the summer months

- Due to reduced nuclear generation and a continued heatwave, France turned a net importer during some peak hours on 20 June. France imported power from the UK for six hours with French hourly intraday prices higher than those in the UK

- On 28 June, the European Commission announced it had granted €4mn of EU funding to the 700MW Celtic Interconnector project linking Ireland and France. According to the Commission’s website the interconnector will cost approximately €1bn if built and could be online by 2025.

European Gas

- European gas prices experienced mixed movements in June

- GB prices ended the month 1.4% below Belgian prices, 11.5% lower than German prices and 7.2% lower than Dutch prices

- On 21 June, Spanish gas-for-power demand reached 465GWh, its highest level since summer 2011, according to transmission systems operator Enagas

- Low wind output and hydro stocks and an extended nuclear outage led to the increase in demand as the heatwave across Spain strengthened

- The first two US LNG deliveries to Northern Europe arrived in Poland and the Netherlands on 7 June and 8 June, respectively. The delivery to the Netherlands did not weigh on prices as it was a likely replacement for Statoil with its Norwegian Snohvit LNG facility currently offline due to maintenance

- Higher gas demand levels in Spain led to a 5.2% year-on-year rise, to 29.4TWh, in Spanish gas imports during May. French imports are expected to continue to rise as the discount to Spanish gas prices widened again in May, data from gas grid operator Enagas showed on 14 June.

World Oil

- Brent crude oil prices dropped 7.3% to average $47.8/bl in June Prices started the month above $50.0/bl, but decreased steadily, amid concerns over increasing US crude inventories, rising output from Libya, Nigeria and the US and rising tensions in the Middle East after Saudi Arabia and other Arab states cut diplomatic ties with Qatar. On 22 June prices fell to $45.2/bl, the lowest price since 14 November 2016.

- Reports of high OPEC compliance with production cuts, tropical storm Cindy disrupting US oil operations in the Gulf of Mexico and a weakening US dollar provided some support to prices.

Coal

- On average, API 2 coal prices jumped 4.6% to $68.5/t during the month. On Thursday 29 June, prices reached a seven-month high of $70.5/t, as the euro strengthened against the US dollar. Coal prices were pushed higher by increased demand from China and Europe and higher levels of coal-fired power generation in the US.

Carbon (EU ETS)

- EU ETS carbon prices gained 6.6% to average €5.0/t across the month. However, prices on 30 June were €0.1/t lower than on 1 June. On 27 June, talks begun between the European Parliament and EU Council to decide the rules of the fourth trading phase (2021 – 2030) of the EU Emissions Trading Scheme (ETS). According to Maltese EU Council documents, the key issues under discussion are: strengthening the EU ETS, low carbon funding mechanisms and in particular how to deal with a long-running surplus of CO2 allowances that has kept prices low.