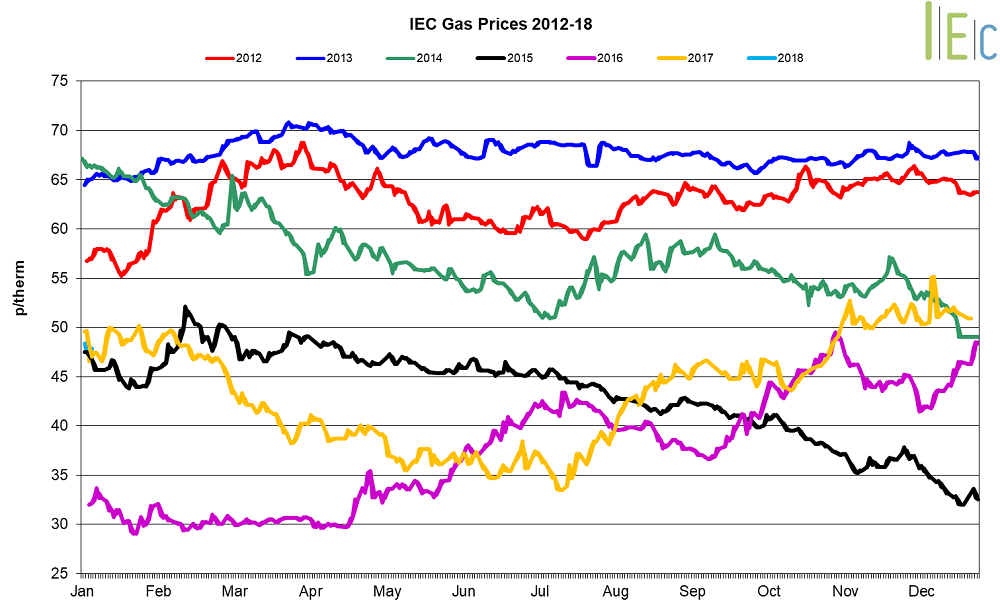

Gas market trends

- Across December seasonal contracts remained largely unchanged from the previous month, declining on average just 0.2%. The largest loss was observed in the summer 19 gas contract, which fell 1.5% to average 41.8p/th

- Despite this downward trend, the front two seasonal contracts experienced minimal gains, as the summer 18 contract lifted 0.1% to 44.5p/th. The largest gain occurred in the winter 18 contract which rose 0.7% to average 52.2p/th across the month

- The winter 18 gas contract reached 53.1p/th on 29 December, its highest price since March 2015

- After the previous month’s robust growth, the annual April 18 gas contract continued to rise, lifting 0.4% to average 48.4p/th

- Day-ahead gas prices across the month leapt 12.8% to average 59.5p/th, extending upon the gains observed across November where prices averaged 52.8p/th. On 12 December prices hit a four-year high (78.0p/th)

- The month-ahead (January) gas contract grew 7.5% to average 59.5p/th, up from 55.3p/th the previous month

Key market drivers

- Higher demand with colder temperatures was a key driver of contracts, along with tightening supplies which forced near-term prices upwards

- On 12 December the explosion at the Baumgarten gas pipeline in Austria, coupled with an outage at the Forties oil and gas pipeline and the Troll gas fields in the North Sea, limited supplies and forced prices to multi-year highs

* £ per p/therm (Annual Forward Average)

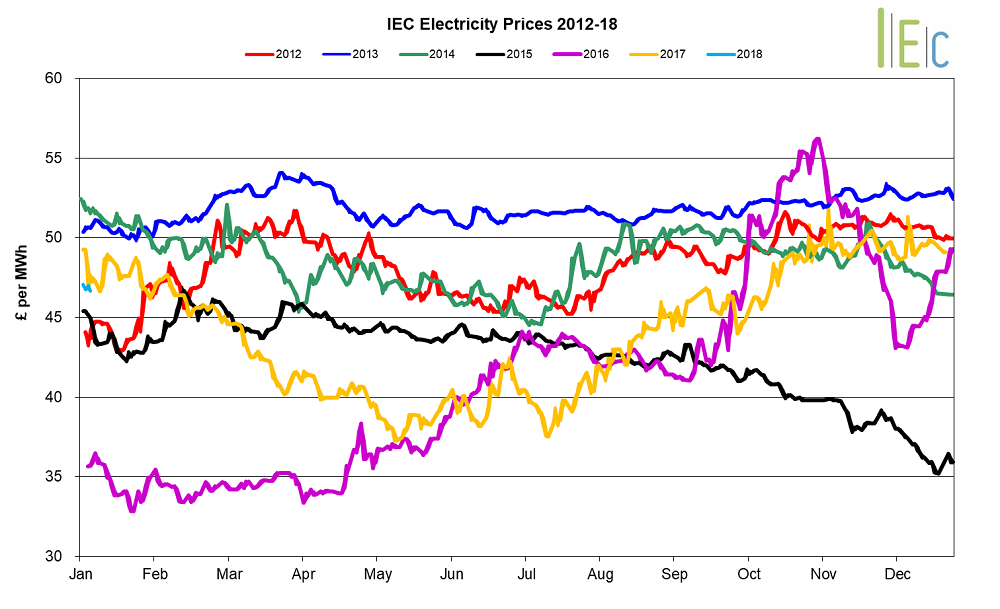

Electricity market trends

- Seasonal baseload power contracts experienced mixed movements during December, with contracts on averaging falls of 0.2%

- Summer 19 and summer 18 power declined 2.2% and 0.4% to average £40.8/MWh and £44.2/MWh respectively. In contrast, summer 20 and winter 18 power rose 1.5% and 0.1%, to £40.7/MWh and £49.7/MWh

- On 28 December, the winter 18 contract hit £50.45/MWh, a near three-year high

- The annual April 18 power contract dipped 0.2% to £46.9/MWh

- Average day-ahead power prices boosted 8.3% to £55.7/MWh. Prices reached a six-month high (£63.5/MWh), supported by higher gas prices following major outages across Europe

- The month-ahead (January) power contract experienced growth of 1.9%, rising to average £56.1/MWh

Key market drivers

- The cacophony of outages across Europe (e.g. Forties, Baumgarten) resulted in higher of gas prices for power generation, which aided in driving power prices upwards

Burgeoning demand also led to bullish movements - However, price gains were capped somewhat towards the end of the month by the restart of nuclear power stations across the UK (e.g. Sizewell B and Dungeness B) after planned outages. News of seven French nuclear power stations coming back online during the same period also helped ease prices

* £ per MWh (Annual Forward Average)

European gas

- Most tracked European gas markets experienced gains across December, with notable activity observed in Germany and the Netherlands

- GB prices ended the month 1.4% below Belgian prices, 4.4% higher than German prices and 5.6% over Dutch prices

- Tightened gas supplies throughout the month, largely stemming from unplanned outages aided in higher gas prices across Europe. Colder temperatures and the winter holidays increased demand towards the end of the month, further supporting price movements

- A power failure at the Troll offshore gas field in Norway caused an initial reduction of 47mn cu meters of volume, though this was raised to just over 50mn cu meters on 12 December. The event lasted between 10-16 hours. This aided in forcing European gas prices higher due to tighter supplies

- The outage at the Forties pipeline in the North Sea during mid-December aided in supporting gas prices across Europe. This trend only intensified amid the explosion on the Baumgarten gas pipeline in Austria, resulting in tightened European supplies, forcing prices upwards

- LNG regassification in southern Europe increased 26% throughout 2017. The region experienced higher LNG volume arrivals, along with greater use of gas in power generation. This trend is in contrast to the rest of the continent which has failed to attract LNG deliveries from the likes of Qatar

European power

- European power prices experienced mixed movements in December, with notable losses seen in France

- GB prices ended the month 15.6% above French prices, 60.0% higher than German prices and 29.5% above Dutch prices

- High levels of renewable output across the month in Germany and France, predominantly regarding wind generation and increasing nuclear availability in France towards the end of the month helped to ease power prices in the two nations

- Higher power prices in France during November, the previous month, led the country to become a net importer of power for the first time since January 2017. France imported up to 4.9TWh worth of power, up 44% for the same period last year and accounted for the highest import figures in the past three years

- Despite losses experienced in French, mid-month power prices lifted due to a strike by EDF workers across four nuclear reactors (1.3GW Belleville, 1.3GW St-Alban-1 and two at 0.9GW Bugey). Two EDF coal mines were also impacted by strike action on 13 December

- The 0.9GW Tricastin-2 nuclear power station in France was taken offline on 14 December, amid a six-day outage. Additionally, the restart of the 1.3GW Belleville-2 reactor was delayed by four weeks. The reactor was due to restart 15 December, but is now projected to restart 12 January

World oil

- Brent crude oil prices lifted 1.5% to average $63.7/bl during December, up from $62.8/bl the previous month. On 29 December prices reached a fresh two-year high of $66.4/bl.

- Early month highs were owed to news that OPEC and non-OPEC members would extend production cuts to the end of 2018. Price support aided by tensions between Israel and Palestine, and the Forties oil and gas pipeline outage. Towards the end of the month, threats of mass strikes by Nigerian oil union Pengassan further lifted prices upwards.

Coal

- API 2 coal prices lifted 3.6% to average $88.2/t in December. On 12 December prices reached $90.5/t, a fresh four-year high. Prices started the month at $85.0/t and increased steadily across the month. Initial growth stemmed from increased demand as Europe entered the winter season. Early growth was capped by weakening Chinese demand, though by the end of the month this trend would reverse as the Chinese eased their gasification campaign efforts, therefore increasing demand for coal. Prices hit highs mid-month amid tighter gas supplies after the Forties pipeline outage.

Carbon (EU ETS)

- After six bullish months of growth EU ETS carbon prices declined 2.2% to average €7.4/t. Despite this bearish trend EU ETS carbon prices reached a two-year high of €8.2/t on 27 December.

- Carbon prices started the month in a bullish mood driven by strengthening coal demand across Europe. Despite this continued demand for coal, weak auction results pegged back gains and depressed prices. However, prices at the end of the month showed signs of growth amid the EU ETS auction pause over the winter holidays.