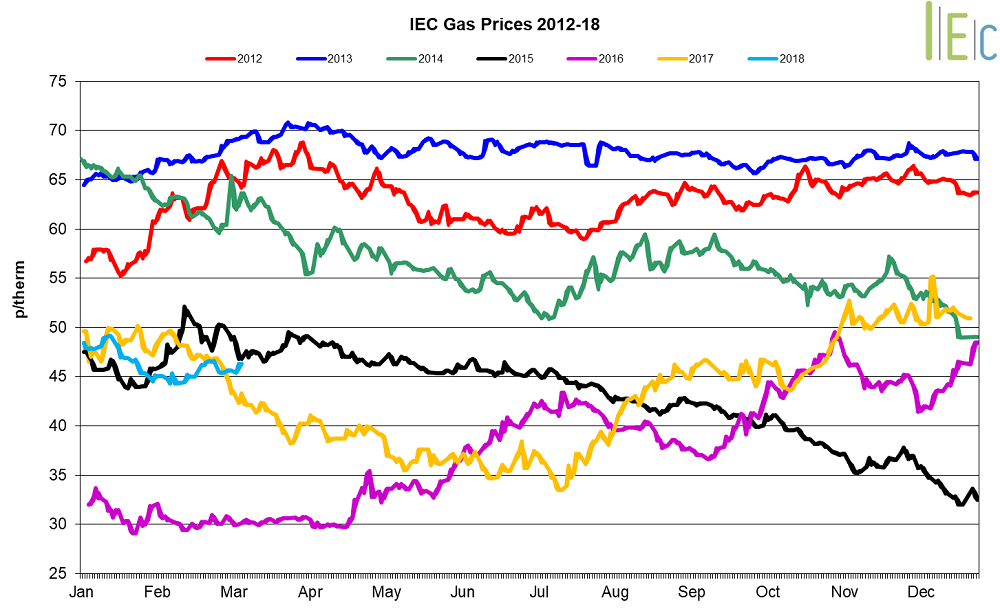

Gas market trends

What’s been happening?

- Day-ahead gas prices rose across the month, up 6.5% to average 54.4p/th. On 28 February, prices hit a five-year high (105.0p/th)

- The month-ahead (March) gas contract lifted 1.9% to average 51.8p/th, rising from 50.8p/th the previous month

- Throughout February seasonal contracts decreased from the previous month. On average these fell by 5.3% out to summer 2020. The largest loss was observed in the summer 20 contract which lowered 6.6% to average 37.6p/th

- The summer 18 contract slipped 3.8% to average 42.4p/th, and summer 19 gas curtailed 6.0% to average 39.6p/th. On 9 February, the summer 19 contract fell to 38.9p/th, a seven-month low.

- Winter 19 and 20 gas declined 5.4% and 5.3% to average 47.6p/th and 45.8p/th respectively

- After a two-month period a relatively little change to the annual April-18 contract throughout last month the contract decreased by 4.2% to average 46.3p/th

Key market drivers

- Below average temperatures driven by arctic winds from Eastern Europe and Siberia caused a surge in demand. Low imports of LNG and numerous supply outages also acted to support prices

- Lower oil prices put downwards pressure on contracts further along the curve. Despite short-term supply worries seen at the end of February, the supply outlook remains relatively comfortable in the longer-term

* £ per p/therm (Annual Forward Average)

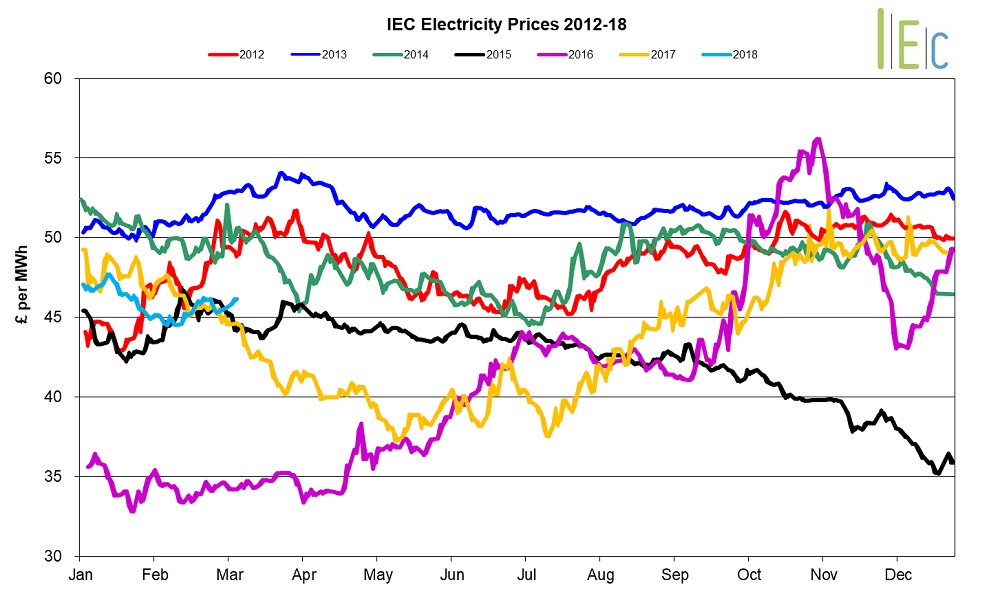

Electricity market trends

What’s been happening?

- Average day-ahead power prices increased 1.3% to £51.5/MWh, regaining from the previous month’s losses. On 28 February prices reached a one-and-a-half year high of £83.5/MWh

- The month-ahead (March) power contract experienced an uptick of 0.6% to average £49.8/MWh

- Despite signs of growth during the previous month, seasonal baseload power contracts reversed gains and subsided 2.1% on average

- Near-curve seasonal contracts summer 18 and winter 18 subsided 2.4% and 2.6% to average £43.2/MWh and £48.9/MWh respectively

- Winter 19 power experienced the largest loss, declining 2.7% to average £45.9/MWh. The summer 19 and 20 power contracts lost 2.3% and 0.2% to average £40.1/MWh and £40.4/MWh respectively.

- The annual April 18 power contract slipped 2.5% to £46.1/MWh

Key market drivers

- Early month gains in the day-ahead contract were driven by reduced nuclear capacity across the UK amid planned maintenance. End of month price spikes stemmed from a surge in gas prices amid cold weather, as well as numerous unplanned power plant outages

- Seasonal prices curtailed amid falling gas and commodity prices, despite gas supply concerns towards the end of the month

* £ per MWh (Annual Forward Average)

European Gas

- Most tracked European gas markets reversed the previous month’s losses during February

- GB prices ended the month 40.3% above Belgian prices, 86.5% higher than German prices and 42.5% greater than Dutch prices

- Below average temperatures towards the end of the month bolstered demand across Europe and strained gas supplies. This led to intense spot price rises (most notability on the within-day market). Low LNG imports and gas supply outages also supported prices rises

- As a result of substantial increases in demand throughout the Netherlands and Germany, flows from Norway into the Emden-Dornum gas terminal on the Dutch-German border increased in order to cover the spike in demand

- On 1 February, the Dutch gas regulator recommended that production at Groningen gas field should decline to 12Bcm per year from current 21.6Bcm levels. This could act to put upwards pressure on European gas prices. Gas production at Groningen dropped to a two-month low in January, representing a 8.7% month-to-month reduction and a 17.4% reduction year-to-year

- As the energy market moves into the shoulder season it is expected that Asian demand for LNG is set to decline as the region moves out of its peak seasons (mid-winter/mid-summer). As a result we should expect to see more shipments reaching Europe. This should improve gas supplies in the future months and could act bearishly upon gas prices

European power

- European power prices experienced substantial gains across February. The most notable of these was observed in France

- GB prices ended the month 26.8% below French prices, 57.7% higher than German prices and 18.5% below Dutch prices

- Bullish prices throughout Germany and France originated from the start of the month due to low renewables output and rising demand. Price spikes at the end of the month were caused by a surge in gas prices and power demand amid cold weather conditions

- As with the previous month, high water levels on the Rhine continued to impede the transportation of coal throughout Germany, resulting in low coal availability at the start of the month, also supporting power prices. However, German gas and coal-fired power generation climbed to 3.7TWh in the week ending 9 February, its highest level since the week ending 17 February 2017

- EDF delayed the restart of its 1.3GW Paluel-2 nuclear reactor this month. It was due to restart on 15 April, though this has been updated to 5 June. The unit has been offline since May 2015

- It was reported this month that 16.8GW of new wind capacity was installed in 2017 with 178GW of wind capacity now operational according to WindEurope. A total of 12.6GW of capacity was installed across Germany (6.6GW), the UK (4.3GW) and France (1.9GW). Renewables have the tendency to depress power prices when generation is high

World oil

- Brent crude oil prices declined 4.5% to average $65.7/bl during the month, down from $68.8/bl the previous month. On 14 February prices fell to a nine-week low of $62.4/bl.

- Prices were driven down by concerns of rising US oil output, as the US rig count reached a three-year high. Additionally, an unexpected rise in US crude stockpiles, coupled with a drop in global equities conspired to weigh on prices.

Coal

- API 2 coal prices dropped 10.0% to average $80.7/t in February, down from $89.7/t the previous month.

- Coal prices declined at the start of the month due to robust output from Australia and South Africa. Mid-month, rising production from Russia, Colombia and America also lowered prices. However, towards the end of the month prices rose amid cold weather throughout Europe causing high levels of coal-fired output.

Carbon (EU ETS)

- EU ETS carbon prices extended from the previous month’s gains, growing 12.5% to average €9.4/t (up from €8.3/t). On 28 February prices reached €10.1/t, a six-year high. Growth stemmed from heavy buying from speculators with expectations of increased demand from emitters preparing for 2017 compliance. Towards the end of the month, more favourable spreads for coal-fired power generation, which caused a rise in coal-fired output, supported prices.