UK Gas & Electricity Market Overview – February 2025

19/03/25

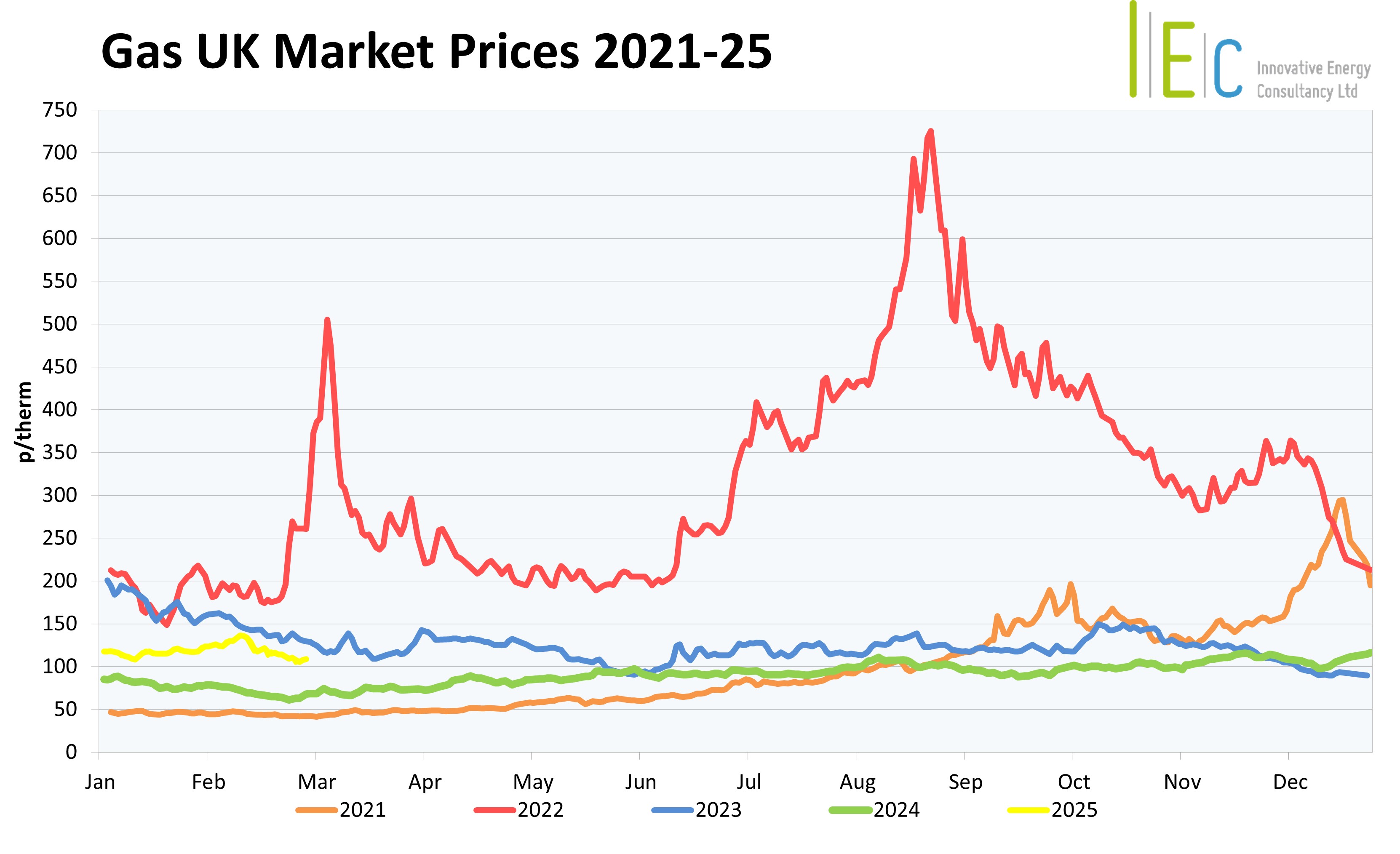

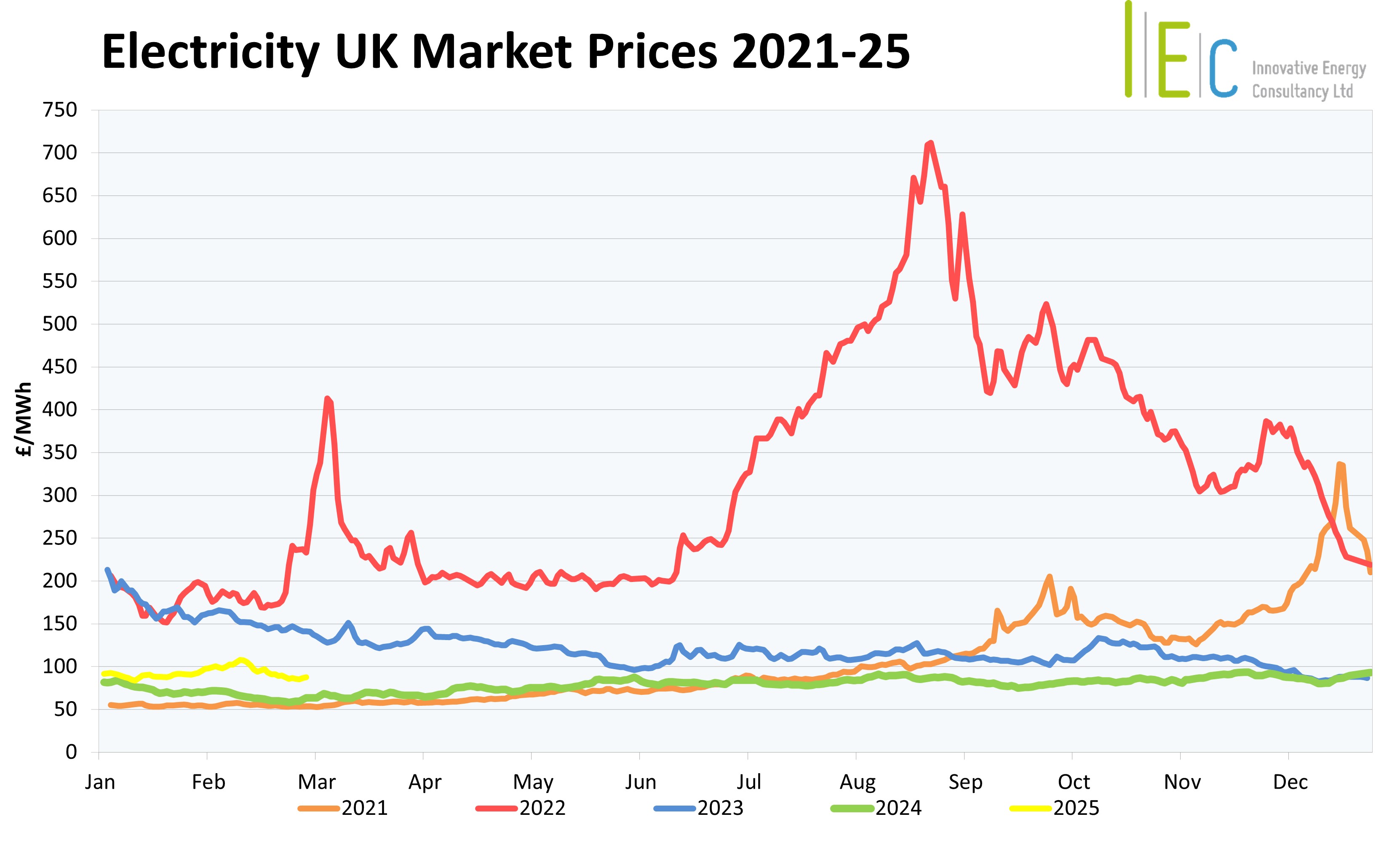

The bullish rally, which has carried UK Energy Markets since December 2024, finally slowed and started reversing mid-February, as optimism in the geopolitical landscape enabled prices to fall by 12% by the month’s close. However, significant volatility remains, as EU nations battle to manage their gas storage levels for both the near-term and ahead for winter 2025-26.

Mixed Supply Factors

Supply-side issues played a crucial role in market volatility, as unplanned outages and maintenance at key Norwegian gas fields, including Njord, Sleipner, Troll, Kristin, Osberg, and Asgard, led to reduced gas flows into North West Europe and the UK. These disruptions tightened the market and contributed to an upward pressure on prices. However, increased imports of liquefied natural gas (LNG) into Europe provided some relief, helping to offset the impact of reduced pipeline flows. Despite this, persistent concerns about low EU gas storage levels, which dropped to 40% by the month’s close and are significantly below the five-year seasonal average, continued to put strain on the market and keep prices elevated.

Fluctuating Weather Patterns Influence Demand

Demand-side dynamics were heavily influenced by changeable weather conditions for North West Europe. February opened with colder-than-expected temperatures, leading to increased gas demand and higher prices, as the need for heating surged during these periods. Mid-month forecasts then switched to predicting milder weather patterns, which helped to reduce demand and ease pressure on inventory levels. The fluctuating temperatures throughout the month created a seesaw effect on consumption, exacerbating the already tight supply situation and contributing to the market's volatility.

Geopolitical Tensions Continue

Geopolitical tensions added another layer of complexity to the UK Energy markets. US-brokered negotiations between Russia and Ukraine raised hopes of the potential return of Russian gas supplies, influencing market sentiment and price movements. The anticipation of a peace agreement created optimism, although any deal would likely take months to finalise. Additionally, the ongoing trade disputes between the US and China, including tariffs on US LNG and Trump's tariff threats towards the EU, created significant uncertainty and volatility. These tensions affected global fuel flows and contributed to price fluctuations. Regulatory actions within the EU, such as debates over price caps and next winter’s storage requirements, further added to market uncertainty, impacting trader behaviour and price dynamics.

Renewable Power Generation Improves

Renewable power improved after a lull in January, reaching close to parity with gas in the UK’s electricity generation mix, both providing 32 and 33%, respectively. This reliance on gas has continued the link between gas and power markets, however improved wind-to-power generation has weakened demand pressures slightly. Nuclear and imported power were stable, each providing 12% of the UK’s electricity. The UK’s Emissions Trading Scheme (UKETS) also dropped 10% after January’s rally, closing the month at £40.15/tonne.

We meet all your

business energy needs

Find out how much money

we’ve saved for our clients,

or to arrange an informal

discussion with one of

our energy experts,

please call 01244 571830