UK Gas & Electricity Market Overview – January 2025

14/02/25

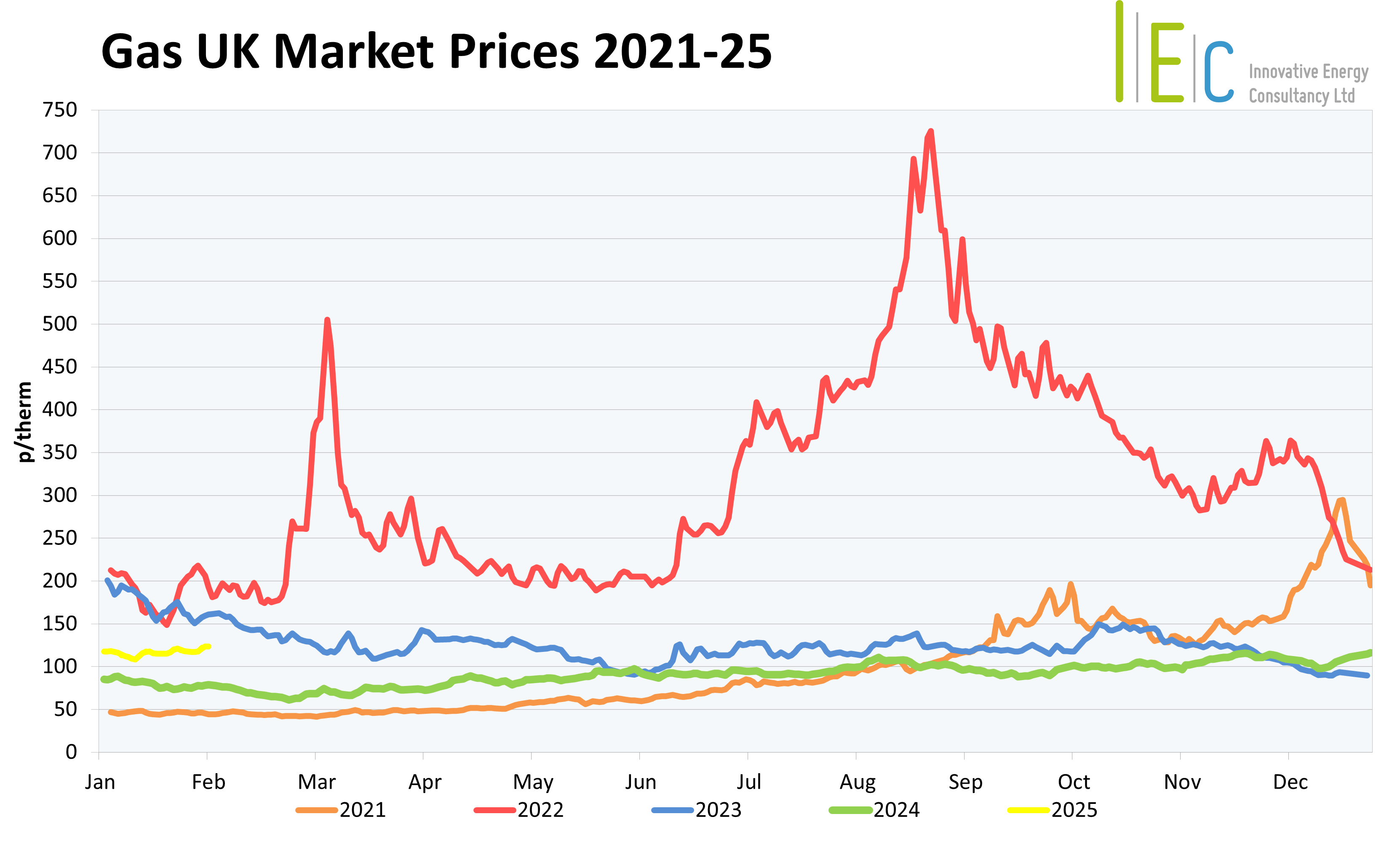

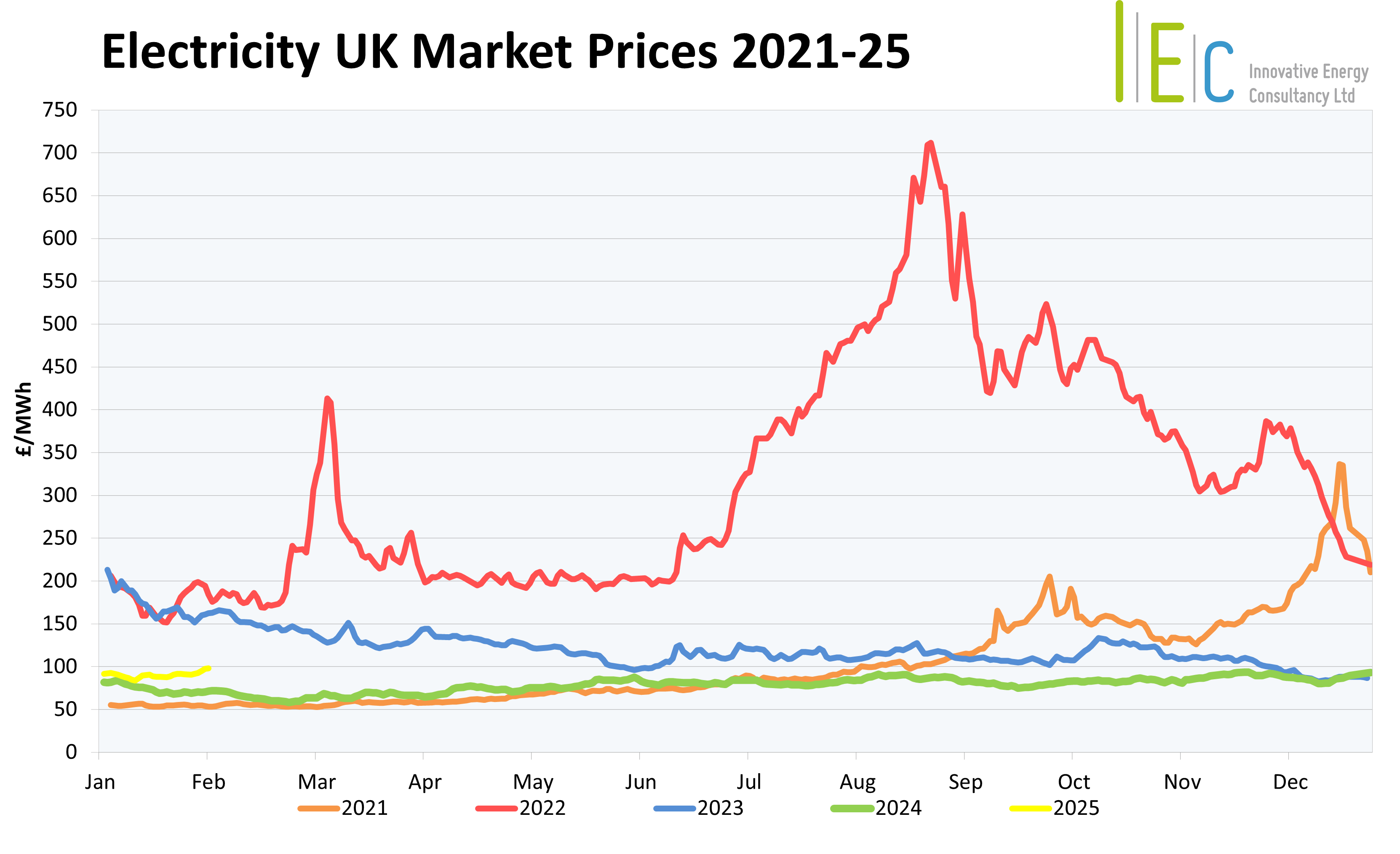

In January 2025, UK energy prices continued the bullish trend set at the start of the winter season. This has been driven by the volatility of various factors, including the disruption to European supply, cooler weather conditions, ongoing geopolitical tensions and prospective US trade tariffs. Additionally, the European Union's efforts to diversify its energy supplies, while managing current storage levels with an eye on stockpiling for Winter 2025, have played key roles in influencing market movements.

Mixed Supply Factors

Supply disruptions have been a major factor affecting energy prices in January. The month opened with the Russian gas transit agreement with Ukraine terminating. This created uncertainty of supply to Central Europe and increased supply chain volatility in the region. Later, several unplanned outages at Norwegian gas fields occurred, and the suspension of operations at facilities, such as the Hammerfest LNG plant, further tightened Northern European gas supply. However, on a positive note, there has been an ample supply of LNG to help counter these concerns, as this alternative energy source has grown. Flows to NW Europe exceeded the 30-day average and contributed 22% of UK gas usage during the month. The stable supply has been linked to weakening Asian demand and the easing of US export restrictions, allowing cargoes to head towards Europe.

Demand Factors

As Europe reaches its mid-winter point, gas demand has been close to its peak, with colder weather forecasts driving up domestic heating requirements and supporting higher prices. These high prices have had a knock-on effect on energy-intensive industries, with industrial production levels continuing the decline started in 2023. These factors have caused EU storage levels to reduce much faster than in recent years, leading to lower-than-expected inventory levels for mid-winter, dropping almost 20% through January alone. This severe drop has triggered EU nations to turn their focus towards next winter and the potential volumes required to meet future demand. Additionally, UK renewable power generation dropped, leading to increased demand on gas, for power generation.

Geopolitical Factors

The ongoing conflict between Russia and Ukraine – and its repercussions on the energy infrastructure – has continued to heighten uncertainty within European energy markets. The suspension of Russian gas supplies via Ukraine has meant that a further 5% of European gas supply has been cut, heavily effecting central states including Moldova, Slovakia, Hungary and Austria. Potential sanctions against Russian LNG, from both the EU and US, have contributed to volatility, as markets try to forecast possible outcomes and risks of further sudden cuts to supply. Additionally, political influences from newly inaugurated President Trump have muddied the outlook, with drastic changes to the US's stance on fuel production and LNG exports, combined with the anticipated efforts to resolve the Ukraine crisis, expected.

Gas Drives Power Generation

Low renewable generation and colder temperatures saw January reverse its major source of power generation back from wind (27%) to gas (38%), in comparison to December. This reliance on gas has continued the link between gas-power markets, to add to demand pressures and support both markets further. The UK was also required to increase dependance on EU imports to balance its power network, with over 12% transferred into the UK from the continent throughout January. This has helped alleviate some pressure on storage levels with LNG. The UK’s Emissions Trading Scheme (UKETS) was supported during January and ended the month at £45.66/tonne. This was in response to reports that the Labour government could seek EU-UK ETS linkage ahead of the EU's Carbon Border Adjustment Mechanism (CBAM) implementation in 2026.

We meet all your

business energy needs

Find out how much money

we’ve saved for our clients,

or to arrange an informal

discussion with one of

our energy experts,

please call 01244 571830