UK Gas & Electricity Market Overview – March 2025

16/04/25

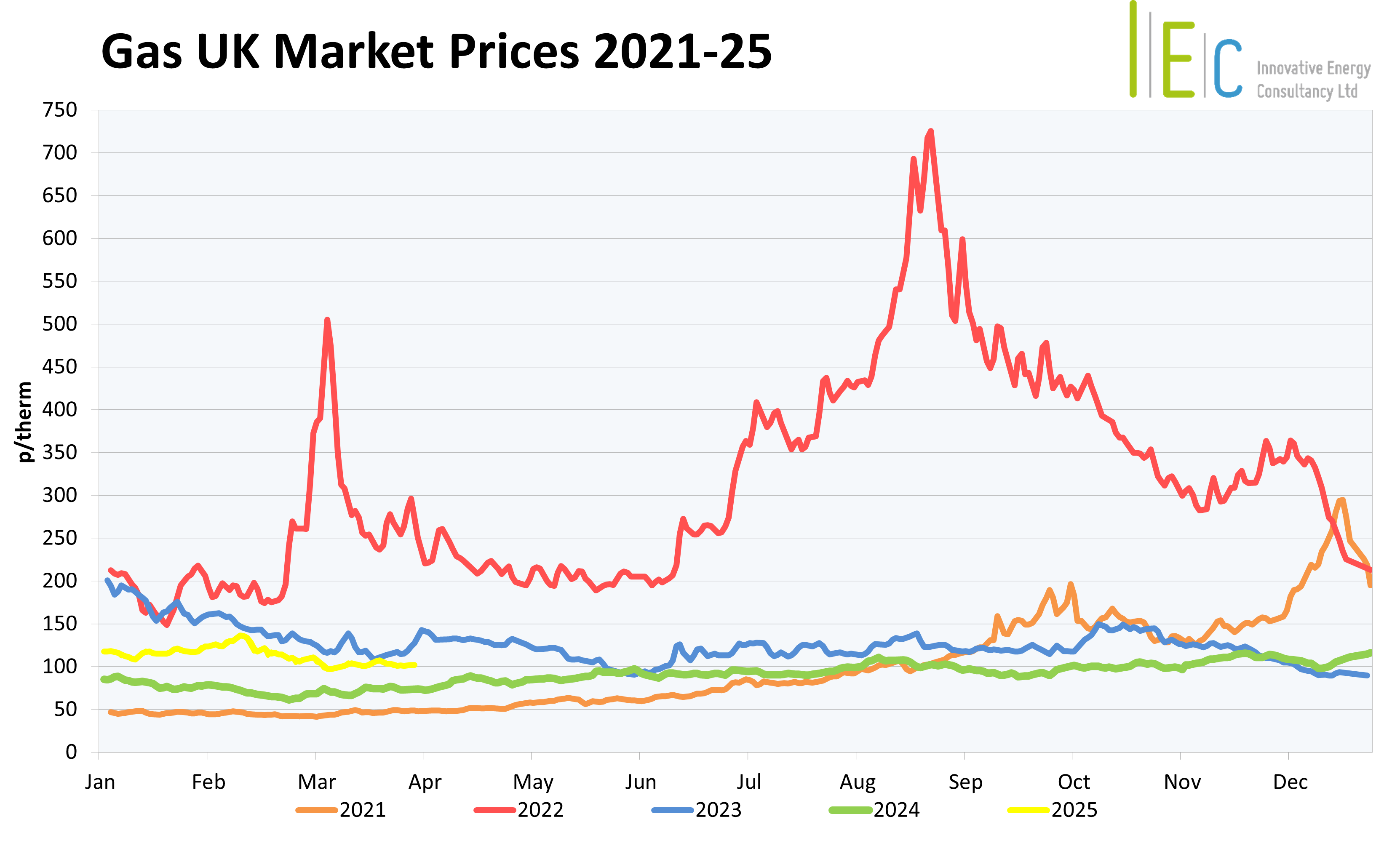

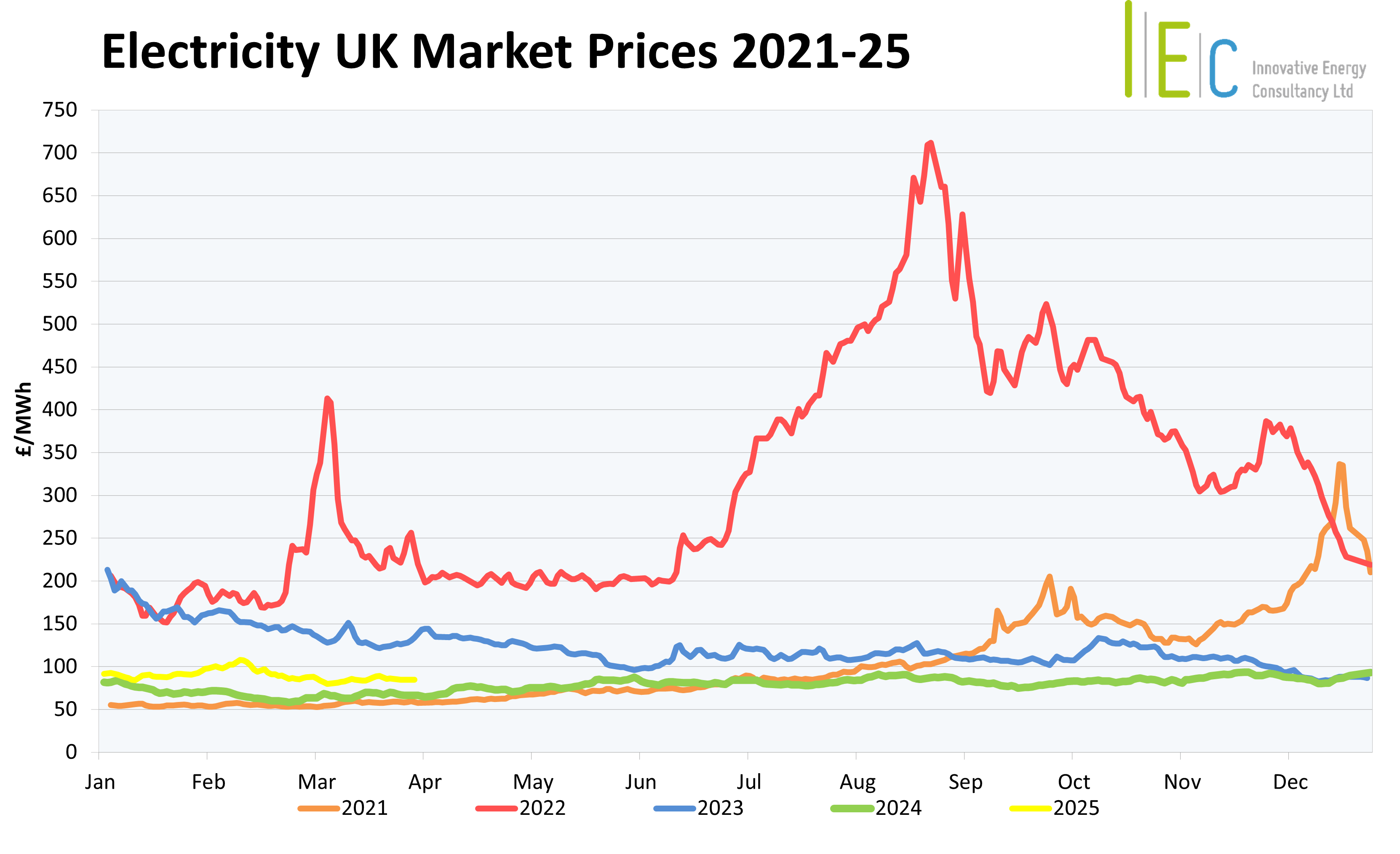

March 2025 was characterised by significant shifts in the UK energy markets. These were driven by a convergence of geopolitical developments, supply-demand dynamics, and fluctuations in renewable power generation. Gas prices were influenced by ongoing peace negotiations between Russia and Ukraine, warmer-than-average weather patterns, and the evolving role of LNG imports in meeting energy needs. As the heating season drew to a close, market participants faced challenges and opportunities in navigating these volatile conditions.

Supply Factors

The UK’s gas supply averaged 234 mcm/d in March, a 19% drop from February but 8% higher year-on-year. Domestic gas production from the UK Continental Shelf and Norwegian gas fields contributed 71% of supply, with the rest being met by LNG imports and storage withdrawals. LNG reserves rose from 51% to 75% capacity throughout the month, with 22 tankers arriving in UK ports, 77% of which originated from the US. EU gas storage levels continued to deplete and dropped to 34%-full by the end of the month, hindered by below-seasonal temperatures in early March and low renewable output, leading to increased withdrawals. Norwegian imports were adversely affected by outages at facilities such as Kårstø, Vesterled, and Åsgard, which cut 920 mcm in capacity. EU LNG imports reached a 29% year-on-year increase, mitigating the absence of Russian pipeline gas but exposing markets to increased competition.

Demand Factors

UK gas demand in March 2025 averaged 190 mcm/d, a decline of 25% compared to February 2025. This reduction was primarily driven by warmer average temperatures, which were 2.4°C higher than the previous month, reducing heating requirements and leading to a 26% fall in industrial and domestic demand. However, periods of fluctuating weather, including a cold spell mid-month, created significant swings in daily demand, ranging up to 137 mcm/d.

Gas-for-power demand decreased by 17% month-on-month, averaging 43 mcm/d, primarily due to the significant growth in solar generation, and an easing reliance on gas-fired power during daylight hours. Nonetheless, wind generation fell by 2.3 GW in March, requiring gas-fired power to bridge the gap during periods of low wind, especially in early mornings and evenings. This interplay between renewable outputs and gas-for-power usage highlights the complexities of balancing the UK's energy needs. Year-on-year, total gas demand remained steady, as increased reliance on gas for power offset declines in industrial and domestic consumption.

Geopolitical Factors

Geopolitical dynamics remained a dominant influence on the UK energy market in March 2025. Peace negotiations between Russia and Ukraine continued to shape market sentiment, with US President Donald Trump playing a central role in mediating discussions. Despite heightened speculation about the potential resumption of Russian gas flows, ongoing attacks on energy infrastructure and stalled agreements deepened uncertainties.

The EU has expressed mounting concerns about meeting storage targets for the upcoming winter, with current storage levels substantially lower than recent years, raising alarm about the ability to rebuild inventories in time for next winter. Strict stockpiling goals have placed pressure on fuel injection demand, further exacerbated by price volatility. Traders are closely watching these developments, especially as debates over extending EU storage mandates through 2027 continue. This focus on next winter’s readiness reflects the critical challenge facing Europe in balancing immediate supply needs against long-term energy security.

Power Generation

Renewable power generation displayed mixed outcomes in March 2025. Solar generation saw significant growth, driven by longer daylight hours and added capacity. Yet, wind generation faced difficulties, falling by 5% against February, highlighting the need for complementary power sources. Therefore, reliance on gas-fired power plants remained critical, while imports also saw a substantial increase accounting for 31% and 18% of the UK’s total power supply, respectively. The UK’s Emissions Trading Scheme (UKETS) climbed 10% closing the month at £44/tonne.

We meet all your

business energy needs

Find out how much money

we’ve saved for our clients,

or to arrange an informal

discussion with one of

our energy experts,

please call 01244 571830