Gas market trends

What’s been happening?

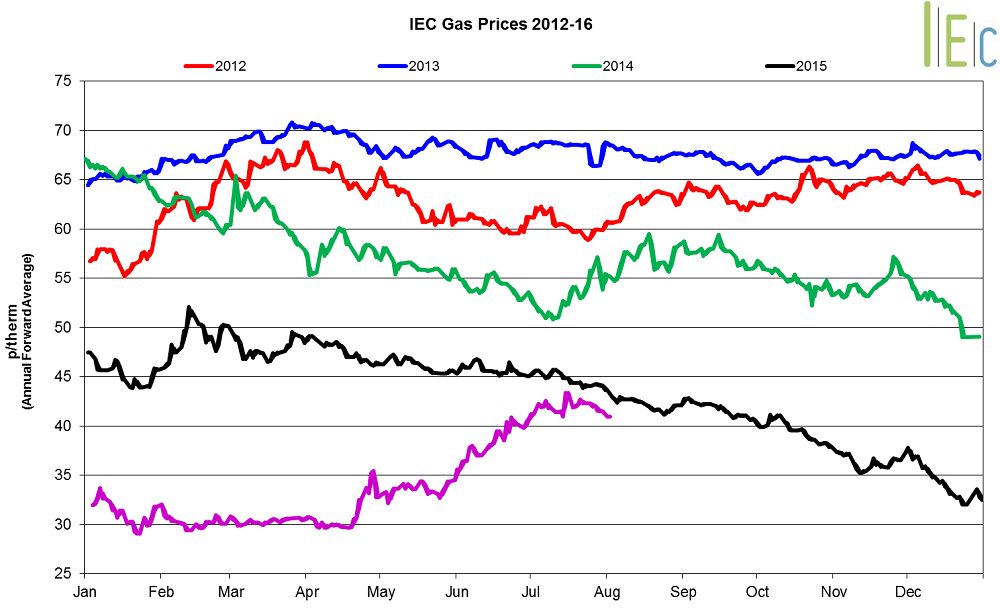

- All seasonal gas prices increased in July. The annual October 16 gas contract rose 9.0% to 42.6p/th. Winter 16 gas experienced the largest increase of 10.2% to average 44.7p/th, a new average nine-month high. Summer 17 gas boosted 7.8% to 40.4p/th.

- Near-term gas prices also rose in July, with day-ahead gas lifting 0.5% to 34.5p/th. The month-ahead contract gained 2.7% to average 35.2p/th.

Key market drivers

- Centrica announced it had extended the closure of its Rough gas storage site, the UK’s largest, until spring 2017 following the discovery of an issue with one of its wells. This has caused concerns around storage supplies for the coming winter, and has caused large rises in the winter 16 contract.

- All European gas prices increased in July. Prices, when expressed in p/th, increased due to the weaker pound.

- GB prices ended the month 5.8% above Belgian prices, 0.8% above German prices and 2.8% above Dutch prices.

* £ per p/therm (Annual Forward Average)

Power market trends

What’s been happening?

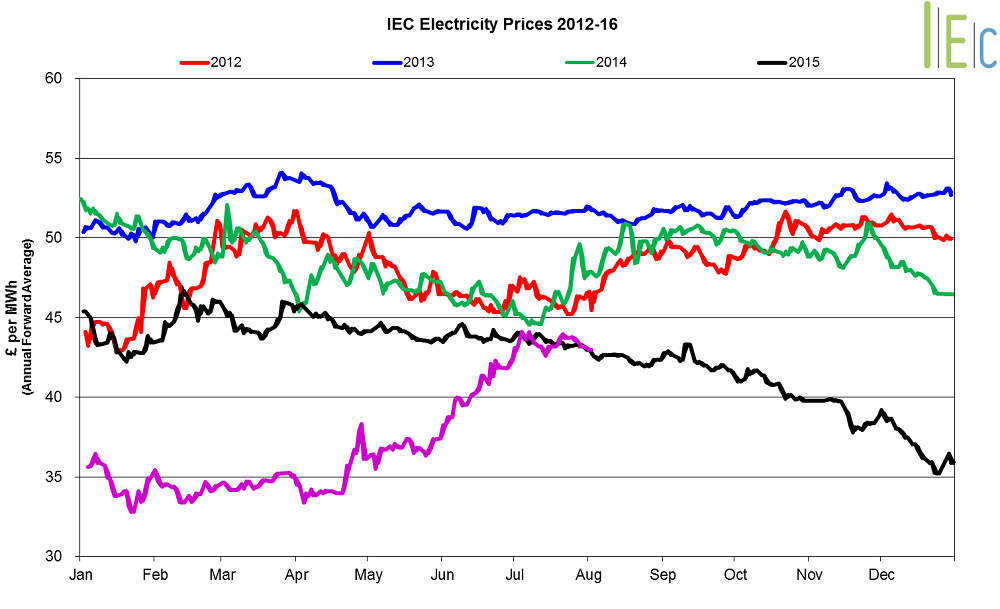

- The annual October 16 baseload power contract rose 7.3% to average £43.8/MWh, following the gas market higher. Winter 16 power gained 7.7% to average £47.2/MWh. The contract reached a high of £48.3/MWh on 18 July, the highest price since March 2015.

- Near-term power prices moved 2.6% higher to average £38.2/MWh, the highest average in nine months. The contract followed its gas counterpart higher. The month-ahead contract grew 4.4% to average £37.3/MWh during July.

Key market drivers

- The winter 16 contract followed its gas counterpart upwards, which was supported by news that the Rough gas storage facility could be closed until spring next year. Summer 17 increased 7.0% to £40.4/MWh.

- All European power prices increased in July.

- French prices experienced the largest overall gain, up £6.6/MWh to £29.9/MWh.

- GB prices ended the month 37.2% above the continental European average of £28.2/MWh.

*£ per MWh (Annual forward average)

Commodity markets news

- Brent crude oil prices lost 5.3% to average $47.2/bl in July.

- Prices reached $44.3/bl on 27 July, the lowest price in three months.

- Prices fell due to oversupply and as Asia weakened economically.

- API 2 coal rose 9.1% to average $58.8/t. On 18 July prices reached a 16-month high of $60.5/t. Recent gains can be largely attributed to reduced Chinese production.

- EU ETS carbon dropped 17.4% to average €4.7/t. According to Thomson Reuters, carbon prices have fallen almost 20% since the UK voted to leave the EU on 23 June.