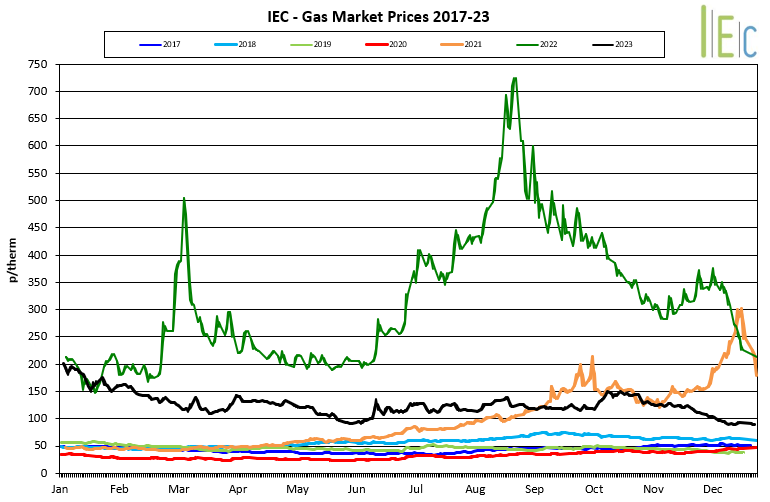

Strong supply fundamentals underpinned bearish market sentiment across December.

EU Gas storage levels sat at just under 90% by the end of the year, boosted by mild temperatures experienced across the period.

Based on the current storage levels and the continuation of further warmer temperatures, storage could potentially exceed 50% as we enter Quarter 2 of 2024.

This would leave the UK and Europe in a very strong position before next Winter, providing there are no sudden unexpected increases in demand. December also saw very healthy Norwegian gas flows as all planned and any unplanned outages were kept to a minimum. The month closed with Summer & Winter contracts fell to 82p/therm and 99p/therm respectively.

Throughout December, LNG imports arriving in the UK were healthy with regular shipments arriving to maintain very high levels of storage.

The geopolitical concerns from the ongoing conflict in the Middle East initially dissipated; however new risks emerged following Houthi Rebels attacking BP ships in the Red Sea.

LNG exports arriving in Europe avoided travelling via this route to prevent any delays but there are concerns this could cause disruptions to future LNG and Oil cargoes.

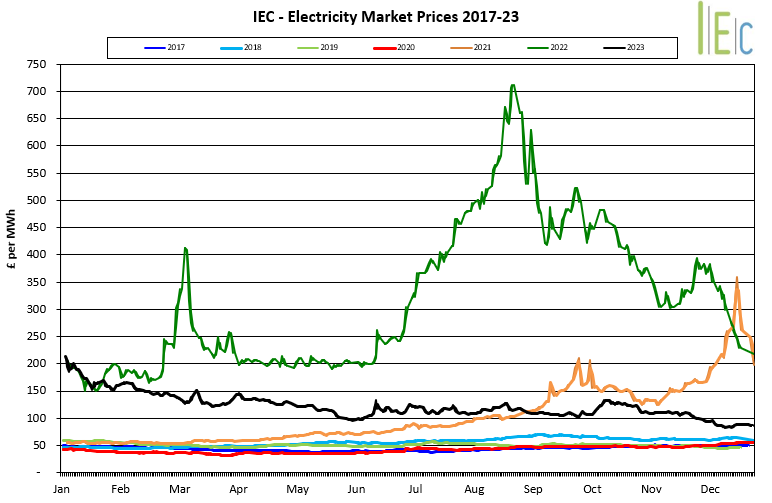

The month saw strong wind generation particularly at the end of December with Storm Gerrit hitting the UK shores, reducing gas demand for power generation.

December ended with Summer & Winter contracts reducing to £80/MWh and £94/MWh respectively. Analysis completed by the Energy and Climate Intelligence Unit’s (ECIU) Power Tracker, have stated that between the 1st January and 31st December 2023 the power generated by wind, hydro and solar was sufficient to power all of the UK’s 28 million homes (estimated to exceed 90TWh).

Oil prices have fallen further across the period, despite the potential risks that further attacks by the Houthi Rebels in the Red Sea could materialise.

With concerns continuing over the global economy, and how this will impact markets. This is despite OPEC suggesting that there could potentially be further production cuts in early 2024.