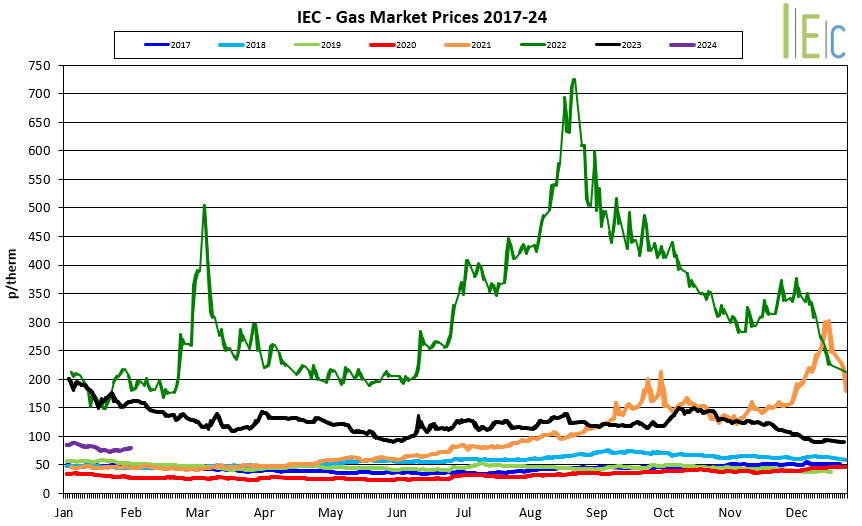

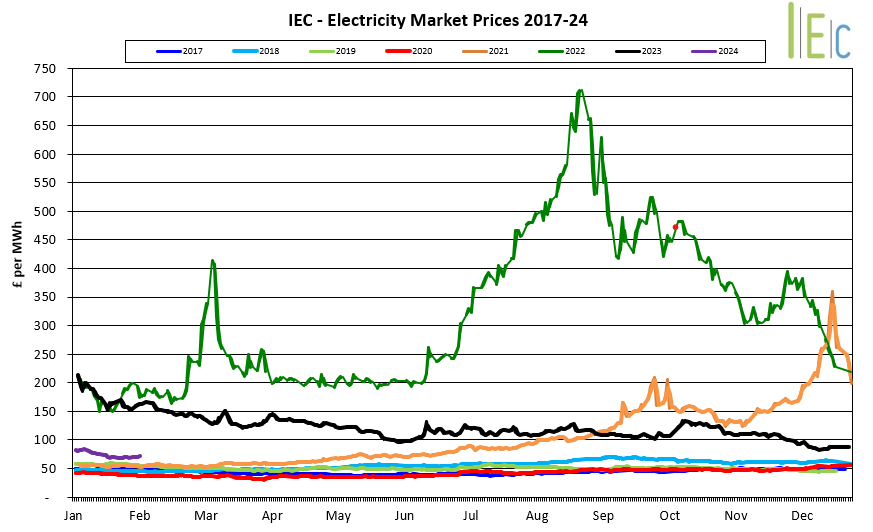

January saw a further reduction in markets across the curve, as mild temperatures and the continuation of strong supply factors put further downward pressure on prices.

However, as the potential for the war in the Middle East persists, following the Houthi Rebels militant group continuing attacks on cargoes in the Red Sea and the US and UK retaliating, this has limited any further market softening during the month.

Gas storage levels remain extremely high throughout Northwest Europe and the UK, with capacity in excess of 70%.

Based on current withdrawal rates analysts believe inventory levels may be in excess of 50% when we approach Summer 2024, adding to the bearish market sentiment. Flows via Norwegian gas pipelines have been strong in January with limited maintenance and outages occurring. January also saw temperatures in line with or even above historical levels, with a repeat of this forecasted to occur in February too.

LNG imports have remained high throughout the period, despite potential delays from cargoes departing from the Middle East being impacted by the Houthi Rebels. Qatar took the step to inform European countries that there will be delays with some cargoes arriving as ships are re-routed around Africa to avoid the area. To date this has not greatly impacted markets, but if these delays continue in the long-term, then it’s likely to generate price support in the future.

Wind generation throughout January was high, adding to the strong supply picture at present. The International Energy Agency (IEA) has reported that renewable energy grew by 50% last year to 510GWh in 2023. The IEA report said three-quarters of the new renewable energy capacity installed last year was solar, mostly built in China. By 2028, forecasts show renewable energy sources will account for more than 42% of global electricity generation.

Oil prices increased in January in response to the attacks in the Red Sea and subsequent response from the US and UK. The ongoing hostilities resulted in Oil exceeding $80/Bbl due to concerns of future supply disruptions and the continued production cuts agreed by OPEC+. An expectation of increased demand in 2024 further supported prices, however with concerns still persisting over the economic recovery of some large economies, these increases were mitigated.