January Market Commentary

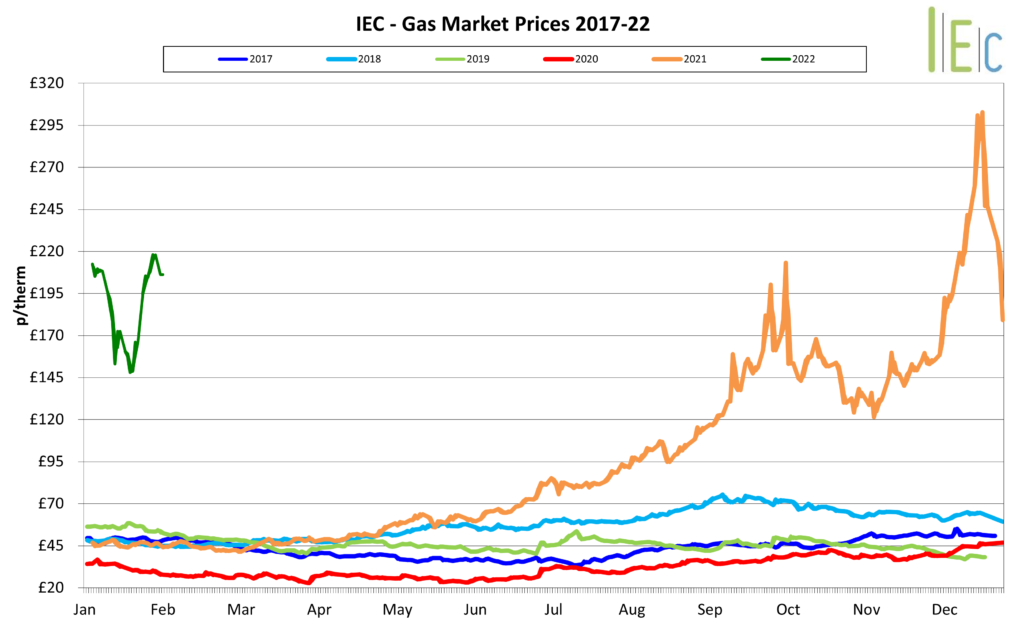

Gas

- The UK gas market softened through the start of January, on the back of improved forecasts of milder weather, stronger winds for renewables, and reports of record numbers of LNG cargoes scheduled for delivery during January. However, as the geopolitical tensions around the Ukrainian border came to a head, the decline halted and the markets rebounded mid-way through January.

- Again, Russian capacity failed to book any guaranteed monthly capacity for Europe in January, resulting in the market waiting on daily auctions to discover supply levels. The resulting flows were short at around 60% of volumes delivered at this time last year further sustaining its squeeze on European supply.

- European gas storage levels continue to deplete at a high rate and remain below the 5-year average at approximately 38%. With the future Russian supply exacerbating the storage concerns, the Netherlands has announced that they would be doubling production at the Groningen gas field to try and help limit the burden. UK gas storage is approximately 73%.

- The geopolitical tensions from the Ukrainian border remain, with the US now deploying 2,000 troops to Europe to provide a “robust defense of our NATO allies”. The posturing from both Russian and European diplomats has done little to calm the hostility around a potential invasion into Ukraine, with Nord Stream 2 becoming a minor component in discussions.

- Despite the European supply issues, the UK has been boosted by a record 34 LNG cargoes in January, allowing the network to be largely over-supplied and to be able to export gas onto the continent.

- Weather-wise, it has been a mostly mild January with the temperatures sitting above seasonal norms and reducing the domestic heating requirements. The winds from storms Malik and Corrie at the end of the month helped drive renewable power generation, reducing the need for additional gas capacity.

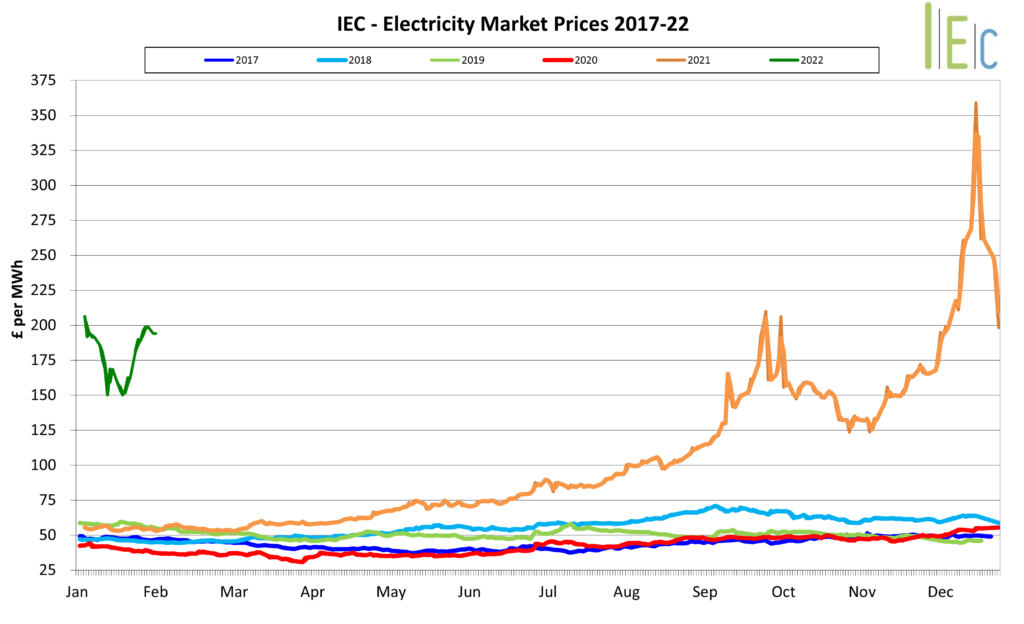

Electricity

- The electricity market continues to follow the trends of its gas counterpart, falling until rebounding mid-January.

- Another month of low wind strength in January has underpinned the UK network’s reliance on fossil fuels against renewables, with on-average gas accounting for over half of the daily power generation across the month. However, storms Malik and Corrie did provide a welcome boost at the month’s close, helping the markets to soften.

- There were no major supply issues in January.

- High commodity prices, increased trading and the approaching compliance deadlines have supported the carbon markets throughout January, eventually hitting new records at the end of the month – EU ETS €89 and UK ETS £87 per tonne of carbon.

Oil

- Six North Sea oil and gas fields are to be approved this year as the UK Treasury expresses concerns about the economic impact of making the nation a “net zero” carbon emitter by 2050, scuppering some of the government’s green initiatives.

- Conversely, following the North Sea Transition Deal signed in March 2021, which works to deliver skills, innovation, and infrastructure to meet the UK’s carbon reduction targets, a Methane Action Plan has been launched as well as Carbon Capture Storage projects in the North East and North West of England.

- Saudi Arabia’s Aramco raised oil prices for the US, European and Asian markets after crude surged to almost US $95 a barrel. Its key Arab Light oil increased by 60 cents from February to US $2.80 a barrel.

- Royal Dutch Shell has discovered oil in Namibia where other exploratory drills have failed. The company will evaluate the data and continue its exploratory search to determine the size of the system.

Coal

- Canada’s coal mining industry is under threat as a new Canadian clean fuel standard comes into effective in December 2022 after confirming in June 2021 it will not approve any new thermal coal mining projects.

- S. coal production rose 5.1% to 11.9 million tons year over year for the week ending January 29th

- Following Indonesia lifting their ban on coal exports, the residual effects on the demanding export market have seen thermal coal rise to US $220 a ton.

- The European Commission has warned Poland it will cut budget payments due to the country’s refusal to close its Turow mine. The country refused to pay a fine of EUR €500,00 for each day the mine continues to operate. The fine, ordered by the European Court of Justice, relates to the cross-border environmental impact on the Czech Republic.