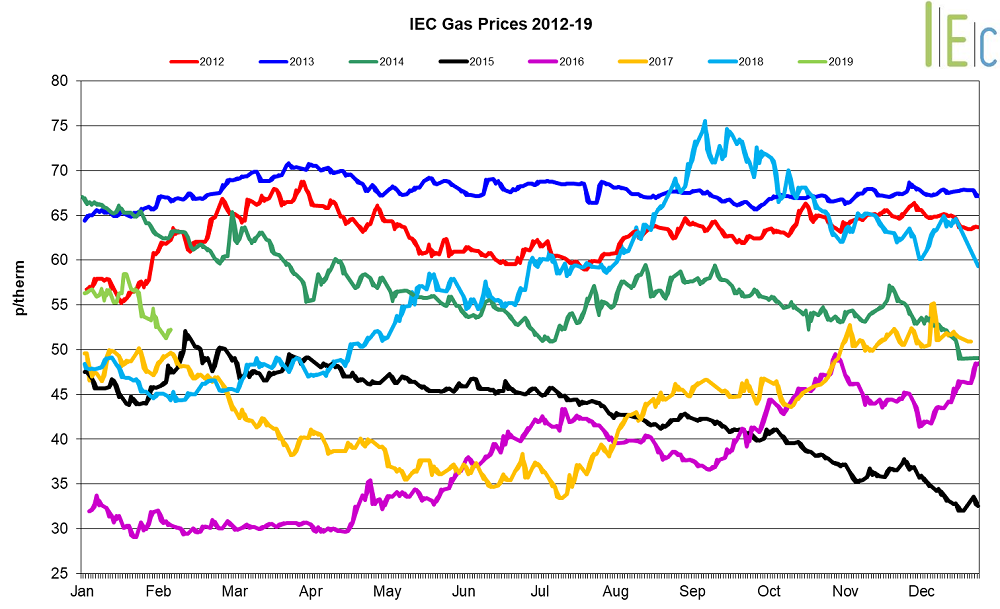

Gas market trends

What’s been happening?

- In January, day-ahead gas fell for the fourth consecutive month, down 9.1% to average 58.5p/th

- The month-ahead (February) gas contract dropped 14.7% to average 59.5p/th, ending the month at 52.8p/th

- All seasonal gas contracts fell in January, dropping 4.2% on average

- Summer 19 gas saw the biggest change, decreasing 7.4% to average 52.6p/th, and hitting a five-month low of 48.9p/th on 31 January. The summer 19 contract is 24.7% higher in January 2019 than in January 2018, when it was 42.1p/th

- The annual April 19 gas contract decreased 5.9% to 57.3p/th, 23.9% higher than in January 2018 when it averaged 46.2p/th

Key market drivers

- Month-ahead power prices dropped amid revised temperature forecasts expecting milder weather in February, with near or slightly above seasonal normal temperatures into the middle of the month. The expected arrival of several LNG tankers in February also pressured prices

- Average demand on the National system increased month-on-month, rising from 284.2mcm/d in December to 335.2mcm/d. Regional gas demand also rose month-on-month, up from 197.7mcm/d in December to 234.3mcm/d in January

- A total of 16 LNG tankers arrived at UK terminals last month, ensuring comfortable gas supplies during periods of colder weather and reducing the need to withdraw gas stocks from medium range storage, despite an increase in gas demand from the previous month

* £ per p/therm (Annual Forward Average)

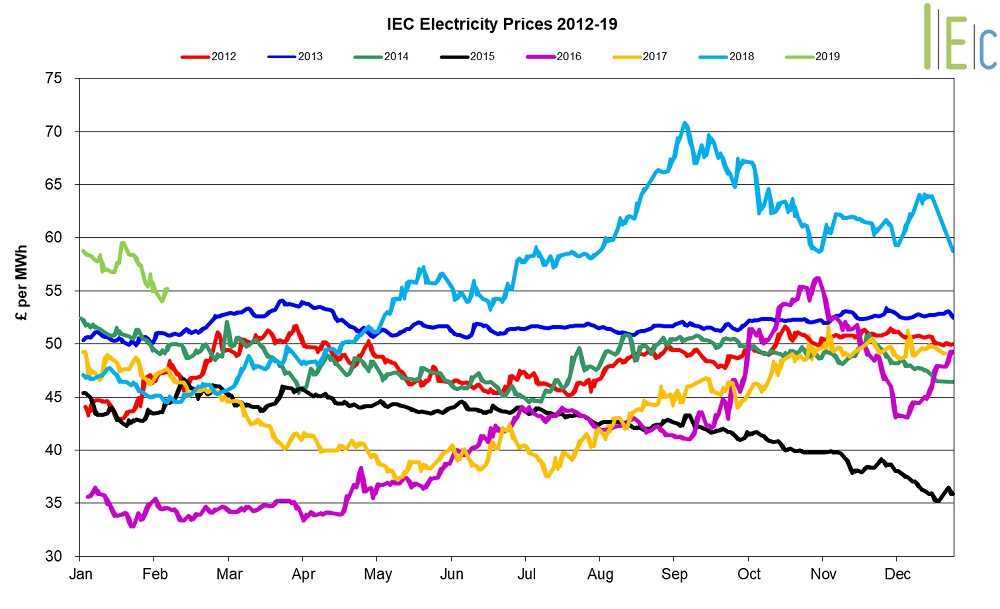

Electricity market trends

What’s been happening?

- Day-ahead power dropped 2.6% to average £62.3/MWh in January. However, the contract rose to a 10-month high of £73.0/MWh on 23 January as wind generation was forecast below 1GW the following day

- February 19 power fell 6.6% to average £61.8/MWh

- All seasonal baseload power contracts decreased in January, down 2.3% on average

- Summer 19 power fell 4.4% to average £55.1/MWh, ending the month at a five-month low of £52.2/MWh

- The annual April 19 power contract dropped by 3.4% to average £58.5/MWh, 32.5% above its price in January 2018 when the contract was at £44.1/MWh

Key market drivers

- Day-ahead power prices have followed their gas counterparts lower, despite a rise in EU ETS carbon prices and periods of weaker wind generation. Gas-fired power generation accounted for 48.6% of the generation mix in January, up from 41.2% in December 2018.

- Average daily demand increased month-on-month, rising from 0.823TWh/d in December to 0.885TWh/d in January. Average peak demand also rose month-on-month, up from 42.9GW in December to 45.4GW in January – this is 5% below the five-year average for January of 47.7GW

- Electricity contracts fell despite an increase in both oil and carbon prices, which were up 2.4% and 4.0% respectively

* £ per MWh (Annual Forward Average)

European gas

- All tracked gas markets fell in December. The largest decline was observed in Germany’s NCG, which dropped 7.9p/th to end the month at 52.1p/th

European prices fell in the middle of the month amid forecasts of milder temperatures and lower gas demand in the latter half of January, with further pressure from continued high volume of LNG deliveries throughout Europe - A total of 27 LNG tankers arrived in GB, Netherlands and Belgium in January, up from 25 in December 2018. This continuing trend is expected to remain into February as Asian demand is weaker, with warm temperatures dampening demand for LNG in the region and keeping gas stocks near full capacity

- A milder start to the year has been responsible for pressuring gas prices lower as, despite below seasonal normal temperatures towards the end of January in GB, temperatures remained mild across Europe throughout most of the month

- Further pressure has come from forecasts of milder temperatures across Europe into February, with high volumes of LNG, comfortable gas production and strong Russian gas flows into Europe also easing supply concerns in the event of any unexpected cold spells.

European power

- Tracked European power contracts experienced mixed movements in January. Both GB and German power prices dropped, down £7.5/MWh and £4.3/MWh to £58.5/MWh and £54.9/MWh respectively. In contrast, French and Dutch power prices rose, up £8.7/MWh and £9.1/MWh to £57.8/MWh and £63.7/MWh respectively

- Revised temperature forecasts across Europe expect near or slightly above seasonal normal level weather in February, providing bearish momentum to gas prices and feeding into power prices

- French power prices increased towards the end of the month due to ongoing strikes at nuclear plants including EDF’s Cordemais (1.2GW) reactor, which has been extended until 13 February. This was despite the return of the country’s Flamanville 1 (1.3GW) and Belleville 1 (1.3GW) nuclear reactors bringing online capacity above 57GW, the highest for winter 18/19 so far.

World oil

- Brent crude oil prices rose for the first time in three months, up 2.4% to average $60.1/bl in January.

- Brent crude oil prices have been supported by the start of the latest OPEC production cuts, which aim to reduce the group’s oil production by 1.2mn bpd until June 2019. The rise in oil prices has been despite news that US crude production hit a record 11.9mn bpd in January, and growing concerns that weaker economic growth will dampen global oil demand as ongoing trade wars and sanctions hamper global economies.

Coal

- API 2 coal prices went down 3.5% to average $84.4/t in January.

- Coal prices have been pressured by a milder start to the year, with full coal stocks and increasing competition from gas in European markets. Despite temperatures dropping well below seasonal normal levels towards the end of January, forecasts of milder weather across Europe and the UK in February caused coal demand to fall, leading prices lower towards the end of the month as a result.

Carbon (EU ETS)

- EU ETS carbon rose for the second consecutive month, up 4.0% to average €23.5/t in December.

- The introduction of the Market Stability Reserve (MSR) in January resulted in a 40% reduction in EUA auction volumes, with only 38.8mn EUAs being available for auction in January, compared to a 2018 monthly average of 76.6mn EUAs. However, later in the month, EEX announced that German carbon auctions will resume on 1 February and will include the 21.8mn unauctioned EUAs from the postponed auctions since 14 November 2018.

- The return of German auctions, and forecasts of near or slightly above seasonal normal temperatures, eased buying concerns for EUAs towards the end of the month, with conventional power generation expected lower in February.