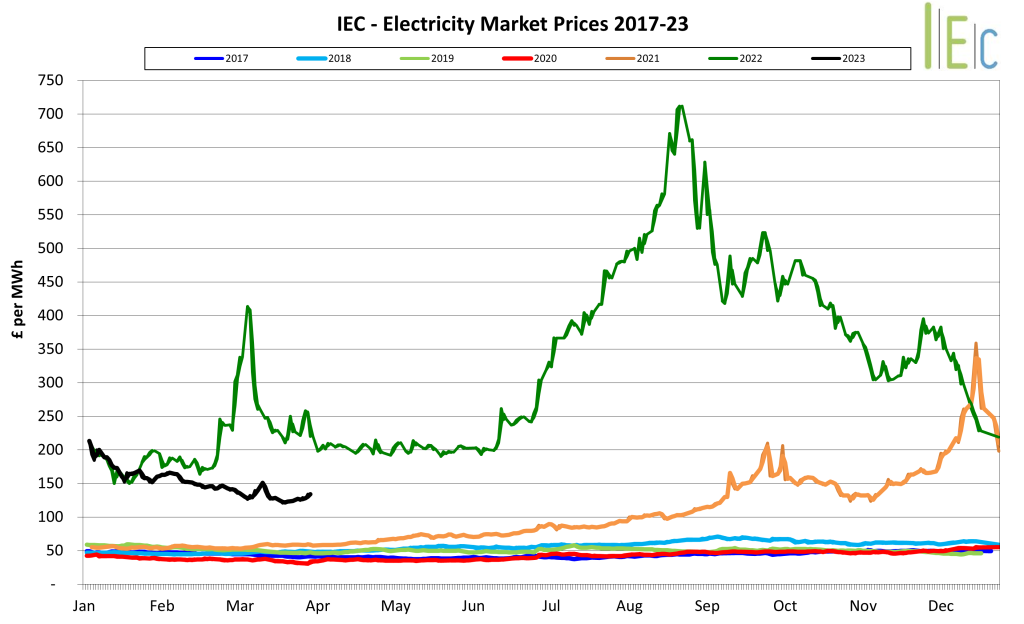

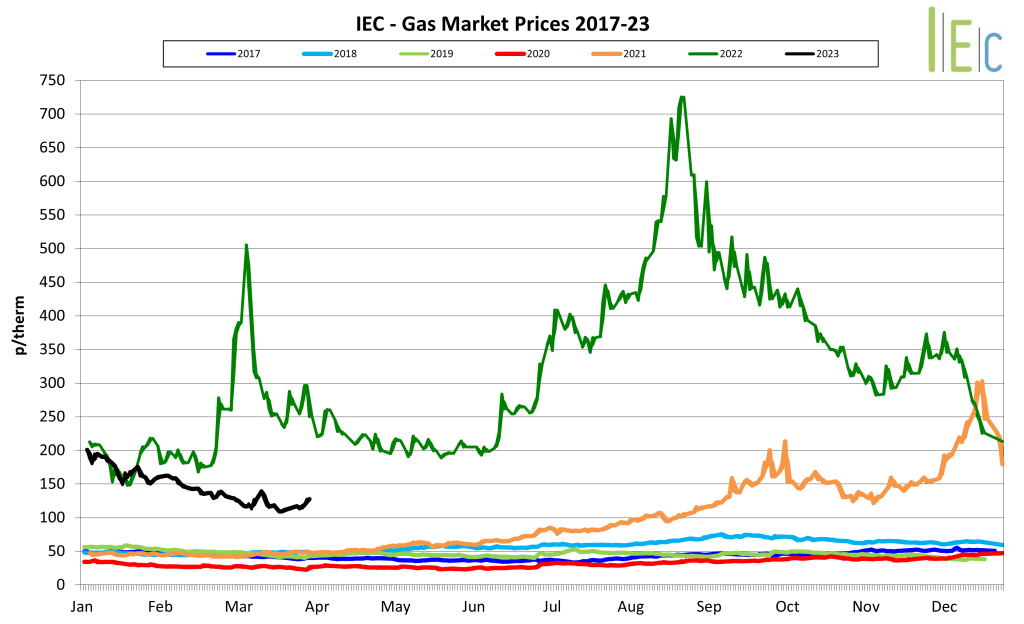

Both gas and electricity markets remained on a bearish trend in March although the trajectory was not as steep as was experienced in February.

At the start of the month, markets were weak due to the healthy supply picture in the UK, with high Norwegian flow levels to the UK and Russian gas flows through Ukraine at their highest level since the start of the year.

Sub-zero temperatures in the UK and Europe in the middle of the period resulted in market increases, as snow and ice warnings saw gas prices trading higher. However this volatility was temporary with milder weather forecast the following week which subsequently led to markets reverting to previous levels.

The month closed out with temperatures remaining above seasonal norms and a high wind generation yield. This was partially mitigated by lower temperatures forecasted across Europe in early April and some minor supply issues with Norwegian gas flows. As of the end of the month EU Gas storage remains extremely high at 56%, compared to the 5-year average of 34%. The mild temperature experienced in March allowed for injections into storage to recommence.

Throughout March LNG (Liquified Natural Gas) continued to boost the level of gas supply across the UK and Europe further, with the Freeport Plant in Texas now moving towards full operations following the fire at the facility last year. Norwegian flows were impacted earlier in the month due to scheduled maintenance but strong LNG deliveries helped alleviate the impact. Although there is some caution that the amount of LNG arriving on European shores may reduce in the coming months if greater demand from the Far East materializes.

March saw a significant reduction in French LNG, Nuclear & Hydro output, due to the ongoing industrial action and operatives striking. French Nuclear output has also been reduced following the identification of various cracks located in pipes at reactors in numerous facilities. This could potentially result in a significant maintenance schedule as was experienced last year. River water levels in Europe are also currently lower than usual following a fairly dry winter. This could also potentially impact Summer generation.

Oil rallied to $78/bbl by the end of the month as measures taken to curb the banking crisis resulted in increased demand. This coupled with bullish Chinese demand forecast and supply issues between Kurdistan and Turkey also contributed to supporting oil prices further.

Concerned about the cost of business energy? Please contact us for further information or advice regarding business energy purchasing.