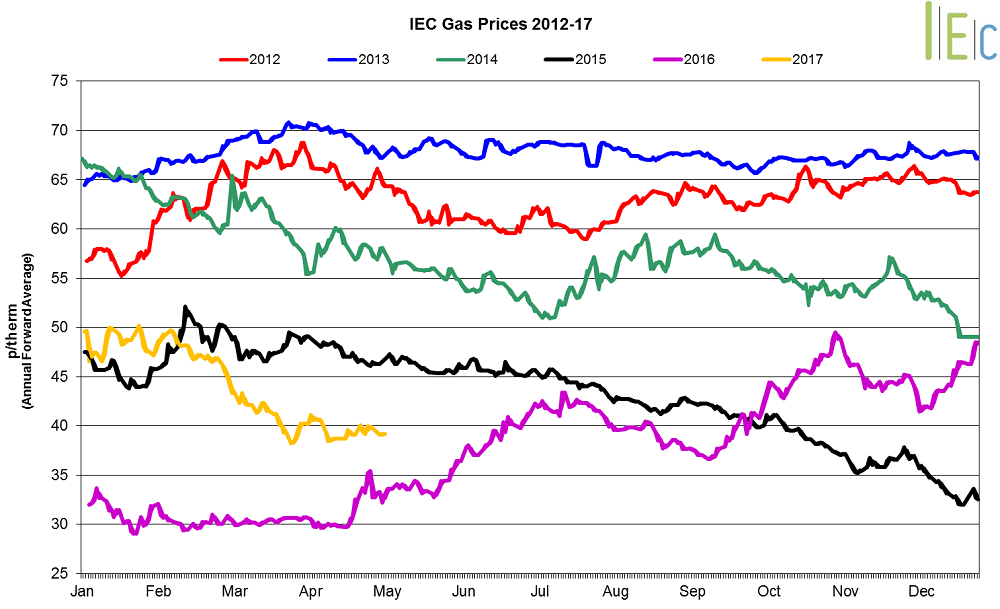

Gas market trends

What’s Been Happening?

- The majority of seasonal gas contracts decreased during April, falling 0.4% on average

- Seasonal gas prices remained higher than their levels last year

- Winter 17 gas declined 0.6% to 46.5p/th, compared to 36.1p/th in April 2016

- Summer 18 gas fell 0.2% to 40.3p/th, compared to 32.7p/th the same time last year

- In April, day-ahead gas slipped 2.8% to 39.9p/th, the lowest monthly average in seven months

- On 12 April, day-ahead gas fell to 38.3p/th, a two-week low, amid lower than seasonal normal demand

- The month-ahead contract moved 2.9% lower to average 39.5p/th

Key Market Drivers

- Centrica confirmed this month that the Rough gas storage facility cannot safely re-commence injection operations in the 2017-18 storage year.

- Winter prices are likely to rise due to lower gas supply available for withdrawal during the winter

- Lower spot gas prices can be expected during spring, with reduced demand amid higher temperatures and increased solar output reducing the need for gas-fired power generation.

* £ per p/therm (Annual Forward Average)

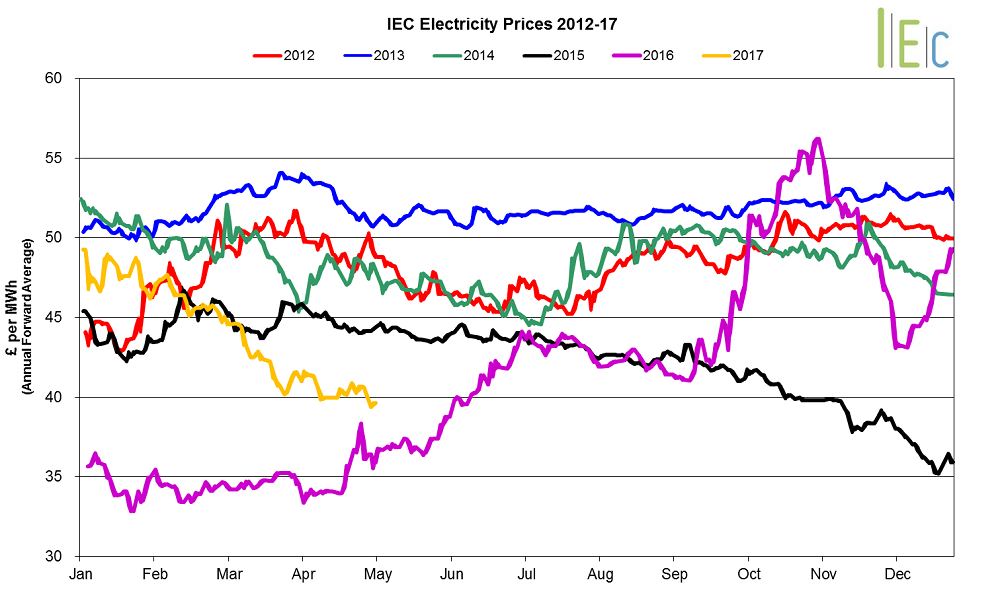

Electricity market trends

What’s Been Happening?

- The annual October 17 baseload power contract rose 0.3% to average £42.6/MWh

- Seasonal baseload power contracts experienced mixed movements, with an average decrease of 1.6%

- Winter 17 power was down 0.1% to £46.0/MWh. In contrast, summer 18 power went up 0.7% to £39.3/MWh

- Day-ahead baseload power lost 1.1% to average £41.5/MWh

- On 11 April, the day-ahead contract dropped to £38.4/MWh, a six-month low, with high wind generation forecast for the following day

- The month-ahead contract also experienced a loss, down 2.4% to average £40.5/MWh

Key Market Drivers

- Generally decreased near-term gas prices pushed near-term power prices lower in April

- Lower spot power prices can be expected as we move into spring, with lower demand amid higher temperatures and increased solar output

* £ per MWh (Annual Forward Average)

European gas

Most European gas prices increased in April.

- GB prices ended the month 1.3% below Belgian prices, 0.8% lower than German prices and 0.6% above Dutch prices

- During May, temperatures are set to be cooler for the far west of Europe, including the UK, France, Iberia and Scandinavia, according to the Weather Company’s latest forecasts. In contrast, the start of summer is forecast to be warmer across the continent

- Following the news of GB’s Rough gas storage facility being unable to inject for the 2017-2018 storage year, market participants have cited imports from Continental Europe and LNG supplies as being key for the winter 2017-18 delivery period to make up the loss from Rough

- During the month, it was reported by Eurogas that EU natural gas demand rose 7% on the year to 456.3bcm in 2016, after rising 4% on the year in 2015. The main growth areas were heating and power generation, driven by cold weather and gas-fired power plants replacing or backing up other fuels.

European power

European power prices experienced mixed movements in April

- GB prices ended the month 22.4% above French prices, 48.9% higher than German prices and 40.7% above Dutch prices

- During April, it was reported that the outage at Germany’s 1.4GW Philippsburg 2 nuclear reactor had been extended by another two weeks to 11 May

- Last month it was announced that Germany’s 1.4GW Brokdorf nuclear reactor outage had been further extended by E.ON to 14 May. The reactor was taken offline for a refuelling stop on 4 February and was originally expected to return before the end of February

- It was announced that three of Spain’s seven functioning nuclear plants will be taken offline for refuelling stops during the second quarter of this year. This will lower power supplies in Spain, potentially pushing up Spanish and other European power prices

- Last month, it was reported that EDF had approved the closure of Fessenheim nuclear power plant, France’s oldest reactor, once the new Flamanville-3 nuclear plant comes online. Flamanville-3 is expected to come online toward the end of 2018 or early 2019

- An Austrian-based company, LUNA Group, has announced plans to install the world’s biggest battery storage pool (with a combined capacity of 100MW) in Austria and Germany. Increased battery storage will encourage increased generation from renewable sources, potentially pushing power prices downwards

In March, wind and solar power production in Europe’s five biggest markets (Germany, France, UK, Italy and Spain), reached a new monthly record at 30.5TWh, up 13% year-on-year amid continued growth in installed renewables capacity

World oil

- Brent crude oil prices rose at the start of April, supported amid optimism that OPEC and other crude oil producing nations will extend production cuts beyond June. However, prices then retreated towards the end of the month. On average prices gained 2.6% to $54.1/bl. On 27 April, Brent crude oil dropped to $50.7/bl, a four-week low, driven lower by continued global oversupply, an increase in US gasoline inventories and as Libya’s largest oilfield, Sharara, came back online following protest blockages.

Coal

- On average, API 2 coal prices rose 1.8% to $66.1/t during the month. Prices remain well above levels last year when the price averaged $43.7/t in April 2016. The National Grid confirmed on 21 April that it had supplied Great Britain’s electricity demand for the first 24-hour period without coal generation since the 1880s.

Carbon (EU ETS)

- EU ETS carbon prices varied between €4.6/t and €5.1/t, and on average slipped by 5.8% to €4.8/t. On 26 April, EU ETS carbon lowered to €4.6/t, a five-month low.