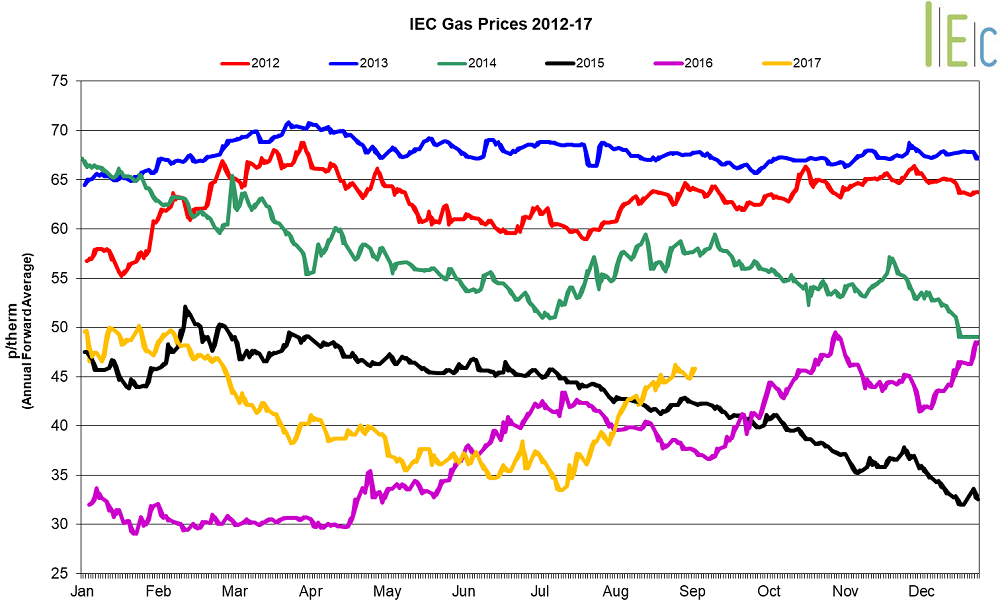

Gas Market Trends

What’s been happening?

- All seasonal gas prices experienced gains in August, rising 3.8% on average, with many hitting multi-month highs

- Winter 17 gas jumped 5.9% to 47.6p/th, 8.9% above its value of 43.7p/th in August 2016. On 30 August, the contract reached a six-month high of 49.7p/th

- Summer 18 gas gained 4.7% to average 40.7p/th. On 21 August, the contract hit a six-month high of 41.4p/th

- In August, day-ahead gas gained 18.0% to average 42.7p/th, its highest monthly average in six months. On 30 August, day-ahead gas reached a six-month high of 46.3p/th

- The month-ahead contract leapt 13.7% to 42.7p/th

Key Market Drivers

- Ongoing maintenance at the Kollsnes gas processing plant in Norway and an unplanned outage at the Cygnus gas field limited supplies throughout the month

- Concerns over winter gas supplies, following extensions to maintenance at a number of gas fields and sparse LNG arrivals supported seasonal prices

* £ per p/therm (Annual Forward Average)

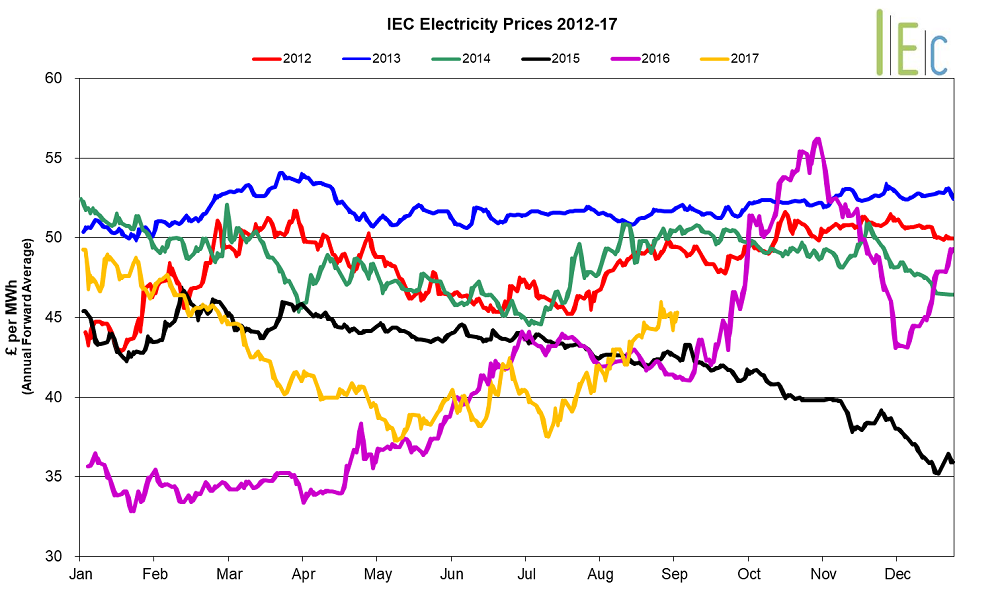

Electricity Market Trends

What’s Been Happening?

- The annual October 17 baseload power contract climbed 4.7% to average £45.0/MWh

- All seasonal baseload power contracts moved higher, with an average increase of 4.1%

- Winter 17 baseload power leapt 5.0% to £48.6/MWh, and the summer 18 contract gained 4.2% to £41.4/MWh

- On 30 August, the winter 17 contract reached a near eleven-month high of £51.1/MWh and the winter 18 contract reached £47.5/MWh, its highest price since July 2015

- Day-ahead baseload power lifted 1.0% to average £43.3/MWh, its highest monthly average in six months

- The month-ahead contract rose 9.3% to average £47.9/MWh

Key Market Drivers

- Concerns over French nuclear plant outages, higher commodity prices, and National Grid’s forecast of tight supply margins drove power prices higher

* £ per MWh (Annual Forward Average)

European Gas

- All tracked European gas markets experienced upward movements in August

- GB prices ended the month 1.3% below Belgian prices, 2.2% higher than German prices and 2.0% above Dutch prices

- Lithuania received its first spot shipment of LNG from the US on 21 August, as the country aims to reduce its dependence on Russian gas and amid a rise in global LNG production capacity. The LNG tanker from Sabine Pass moored in Klaipeda port, with its cargo destined for customers in Lithuania, Latvia and Estonia

- Enagas, the Spanish gas grid operator, expects national gas demand to rise 9% year-on-year in September to 25.3TWh. Gas-for-power demand is expected to increase by 1.1TWh to 6.0TWh, amid lower hydropower generation and less competitive coal prices

- Spanish gas demand in August reached a record high not seen since 2008, as low wind and hydro generation increased gas-for-power demand. Total gas demand reached 25.1TWh, almost 2TWh above grid operator Enagas’ forecast

- A planned outage at an unspecified Norwegian gas field – assumed to be Kvitebjorn – has been postponed for the second time and is now due to take place between 15 and 19 November, instead of 6 to 10 October. Transmission system operator Gassco expects the maintenance to have a volume impact of 23mcm/d

European Power

- All European power prices experienced gains in August

- GB prices ended the month 25.1% above French prices, 25.1% higher than German prices and 29.6% above Dutch prices

- Germany opened its third tender of the year for ground-based solar PV projects. Federal grid agency BNetzA is offering 200MW of capacity with the tender closing on 1 October

German grid regulator BNetzA started consultations on the 2030 power grid expansion plan, aimed to boost power transmission capacity for the expected major changes to Germany’s energy landscape over the next decade - German nuclear output reached its highest level of 2017 (234GWh) on 14 August, with all eight reactors online following an unprecedented winter refuelling schedule and unplanned outages

- Hydro reservoir stocks in France fell for a second consecutive week in the week ending 27 August, according to data from grid operator RTE. Stocks declined 0.8% week-on-week – the biggest drop since the week ended 26 March – to 2.52TWh. French reservoirs were approximately 70% full, their lowest level since 2003 when they were 62% full. This has supported French power prices and hence the costs of importing electricity through interconnectors

World Oil

- Brent crude oil prices climbed 6.0% to average $51.9/bl in August, despite posting a month-on-month loss – prices opened the month at $52.7/bl but ended the month down at $51.0/bl. On 10 August, Brent crude oil hit a three-month high of $53.3/bl. Prices were supported in the first half of the month by falling US crude inventories, supply disruptions in Libya and lower crude supplies from Saudi Arabia. Prices faced severe downward pressure towards the end of the month as Hurricane Harvey struck the Gulf of Mexico, forcing the closure of approximately 4.4mn bl/d (~24%) of the United States’ refining capacity, curbing US oil demand.

Coal

- On average, API 2 coal prices gained 5.8% to $76.6/t during the month. On 30 August, prices reached a three-year high of $79.2/t. Coal prices were supported by continued high demand from China and other Asian countries as well as ongoing supply disruptions in Australia, caused by strike action at a number of the country’s mines.

Carbon (EU ETS)

EU ETS

- Carbon prices jumped 7.8% to average €5.7/t, as concerns over French nuclear availability this winter led to higher demand for EU ETS allowances. On 30 August prices hit a seven-month high of €6.1/t.