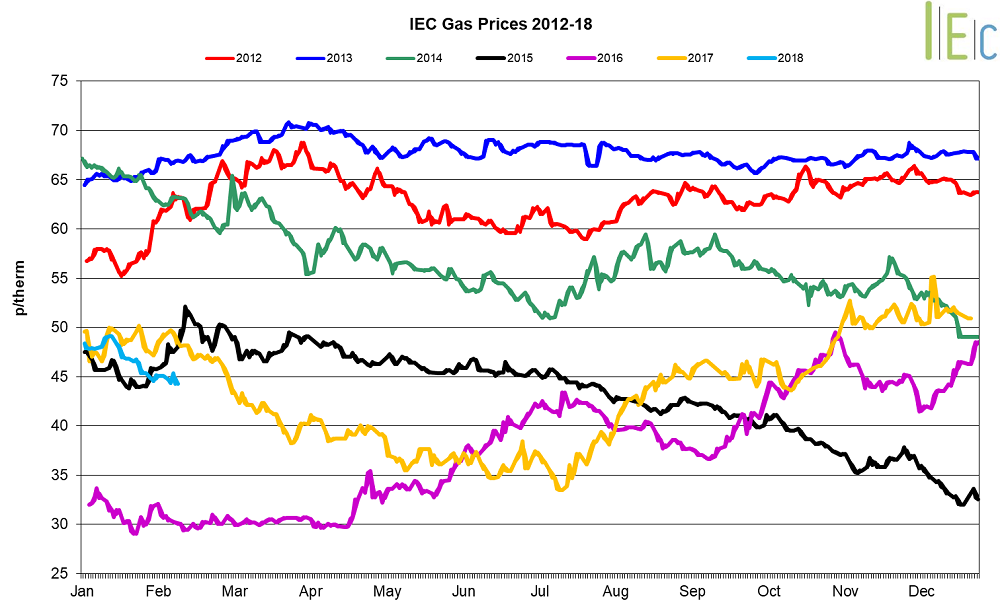

Gas market trends

- Across January seasonal contracts experienced mixed movements from the previous month. This resulted in contracts remaining relatively static on average. The largest loss was observed in the summer 20 gas contract, which fell 1.2% to average 40.4p/th

- The summer 18 gas contract slipped 1.0% to average 44.1p/th, while winter 20 dropped 0.7% to average 48.5p/th

- However, gains were experienced across winter 18, 19 and summer 19 contracts, which all rose 1% to 52.7p/th, 50.3p/th and 42.3p/th respectively

- The winter 18 gas contract reached 54.6p/th on 12 January, its highest price since February 2015

- After a period of sustained growth, the annual April 18 gas contract remained unchanged, remaining at 48.4p/th

- Day-ahead gas prices across the month curtailed 13.6% to average 51.4p/th. On 29 January prices hit a three-month low (47.8p/th)

- The month-ahead (February) gas contract fell 12.0% to average 52.3p/th, down from 59.4p/th the previous month

Key market drivers

- Prices were driven down by the return of the Forties pipeline, which is now back to full operation following an unplanned outage in December

* £ per p/therm (Annual Forward Average)

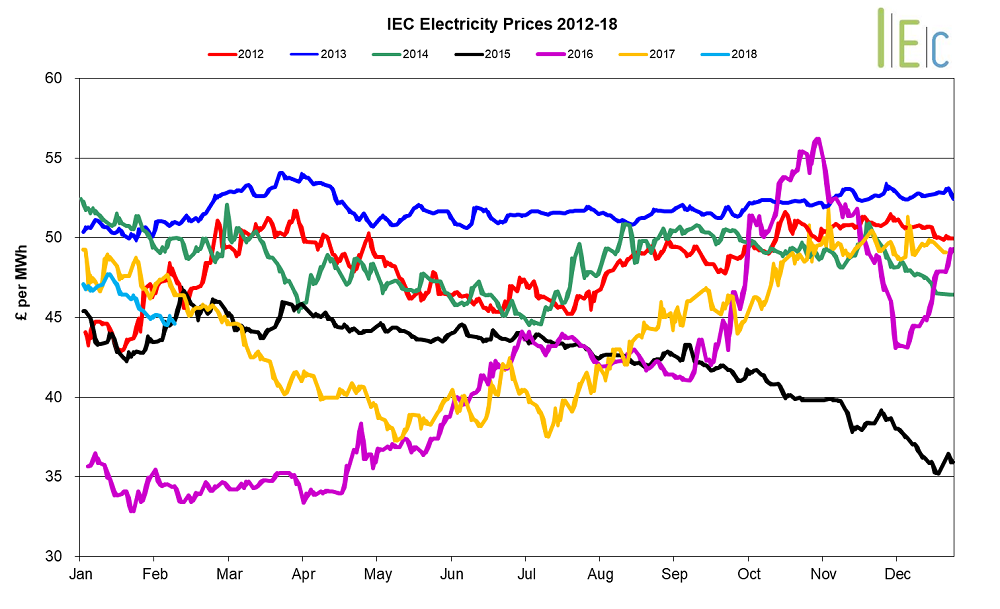

Electricity market trends

- Seasonal baseload power contracts experienced subtle growth during January, with contracts gaining 0.4% on average

- Winter 18 power experienced the largest growth, rising 1.2% to average £50.3/MWh. Summer 19 power lifted 0.8% to average £41.1/MWh. The winter 19 contract rose 0.3% to £47.2/MWh

- In contrast, summer 20 power lost 0.5% to average £40.5/MWh

- Across the month the summer 18 contract lifted 0.1% to average £44.3/MWh. On 12 January, the contact hit £45.4/MWh, its highest level since February 2015

- The annual April 18 power contract climbed 0.7% to £47.3/MWh

- Average day-ahead power prices declined 8.6% to £50.9/MWh, easing away from the previous month’s bullish activity

- The month-ahead (February) power contract dropped 8.5% to average £51.2/MWh

Key market drivers

- Early month gains in the day-ahead contract were capped by the news of returning French nuclear power stations. Falling demand and steady gas, coal and nuclear output pressured prices throughout the month

- News that Sizewell B nuclear power plant is expected to return to operation early February after a period of extended maintenance, added to the end of month bearish movements

Seasonal prices shrugged off upwards pressure from rising commodity prices amid easing gas supply concerns

* £ per MWh (Annual Forward Average)

European gas

- Most tracked European gas markets experienced losses across January, with notable activity observed in the Netherlands

- GB prices ended the month 2.3% below Belgian prices, 4.5% higher than German prices and 4.9% over Dutch prices

- Milder temperatures and easing demand across the continent occurred during the month to weaken gas prices. In addition, stable supplies and low gas-to-power demand also aided in lowering prices. The return of the Forties pipeline in the New Year added to bearish fundamentals

- Mid-month production at the Groningen gas field was briefly halted after a seismic tremor of 3.4 occurred near the site. Following the event, the Dutch gas regulator stated that a substantial cut in production at the gas field was needed to reduce the risk of further earthquakes

- Towards the end of the month, the news that the LNG cargo Qatari Al Thakhira is forecast to arrive at Zeebrugge in early February strengthened supply forecasts and eased prices

- LNG regassification in southern Europe increased 26% throughout 2017. The region experienced higher LNG volume arrivals, along with greater use of gas in power generation. This trend is in contrast to the rest of the continent which has failed to attract LNG deliveries from the likes of Qatar

European power

- European power prices experienced mixed movements in January, with notable gains seen in Germany

- GB prices ended the month 33.4% above French prices, 41.1% higher than German prices and 32.8% above Dutch prices

- Higher prices in Germany likely stemmed from rising coal and carbon prices during the course of the month

- High water levels on the Rhine during mid-to-late January potentially impeded transportation of coal throughout Germany, as coal availability fell

- Despite bullish prices, French hydro stocks rose 9% at the start of the month to 1.7TWh, with high levels of precipitation throughout the country leading to reservoirs becoming 48% full.

- Hydro stocks in 2018 remain above the seasonal record low (42%, a 20-year low), experienced in the same period last year

- On 9 January, EDF announced plans to extend the outage at the 1.3GW Belleville-2 nuclear plant until the end of the month. Despite this news, nuclear output in France remained stable throughout the mouth

- Net French power exports rose recently to a seven-month high, with the UK and Spain the main recipients of the exports

World oil

- Brent crude oil prices lifted 8.0% to average $68.8/bl during January, up from $63.6/bl the previous month. On 25 January prices reached a fresh three-year high of $70.8/bl.

- Growth stemmed from tightening supplies from OPEC and non-OPEC members. Prices rose following the IMF’s improved forecast depicting stronger economic global growth across 2018 and 2019. Comments by the Russian and Saudi Arabian Energy Ministers suggesting an extension to production cuts beyond 2018 added support.

Coal

- API 2 coal prices lifted 2.1% to average $90.0/t in January. On 3 January, prices rose to their highest level since March 2013 of $91.50/t.

- Early month highs were driven by strong Asia-Pacific demand, coupled by a weakening US dollar. Robust Chinese demand also supported prices, with concerns of coal shortages ahead of the Lunar New Year. However, by the end of the month weak European demand and high carbon prices pressured the coal market.

Carbon (EU ETS)

- EU ETS carbon prices leapt 11.6% to average €8.3/t. On 25 January prices reached €9.4/t, a six-year high. Despite bearish conditions during the middle of the month prices continued to grow. It was suggested that the driver was new speculators in the market forward buying allowances, and assuming tighter supplies in the future.