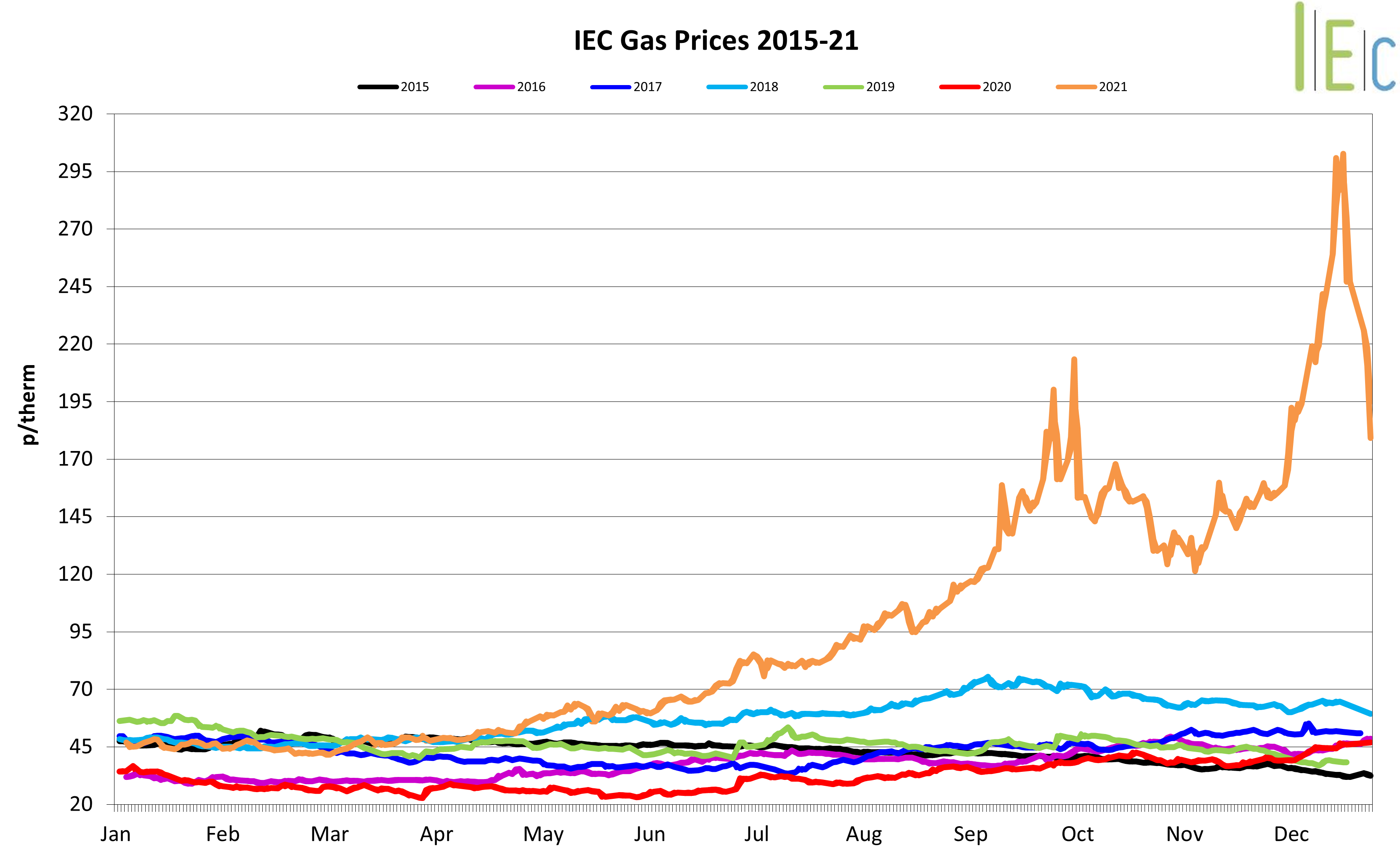

Gas

- Following a bullish November, gas market rises continued and gathered pace through December, rocketing to new heights in time for the holiday period, before reversing sharply into New Year. The same issues continue to trouble the European market – anxiety from reduced storage levels and tensions with Russia affecting supply.

- Europe’s storage levels remain a prime concern, with December closing at around 52% capacity against the 5-year average of 72%. There are predictions that if extractions remain at their current rate, then the EU’s storage levels could be fully depleted before spring arrives. In contrast, UK storage levels stands at 93% and above the 5-year average.

- With no monthly Russian capacity booked in for December, this forced the markets to wait on the daily auctions to discover supply levels. This lack of transparency has added further stress to the market. Although daily flows remained close to previous quantities for the first half of the month, they dropped sharply mid-month and, consequently, drove the price up to records levels.

- Political tensions between US, Europe and Russia continue to simmer due to the latter proceeding to strengthen its military presence on the Ukrainian border. These have thwarted little progress for the completion of Nord Stream 2 and no clear resolution is in sight.

- Barring two short-lived cold snaps, the original forecasts of low temperatures remaining until mid-January have been unfounded. Instead, December temperatures followed close to, or above, seasonal norms. This improved outlook for December and January helped to curb the market rises and ease the markets at the end of the month.

- The UK received a total of 18 LNG cargoes during December, as the premium which had privileged Asia through the Autumn has now fallen away. These deliveries have allowed the UK to comfortably meet its supply demand and boost its storage levels in addition to exporting surplus into Europe.

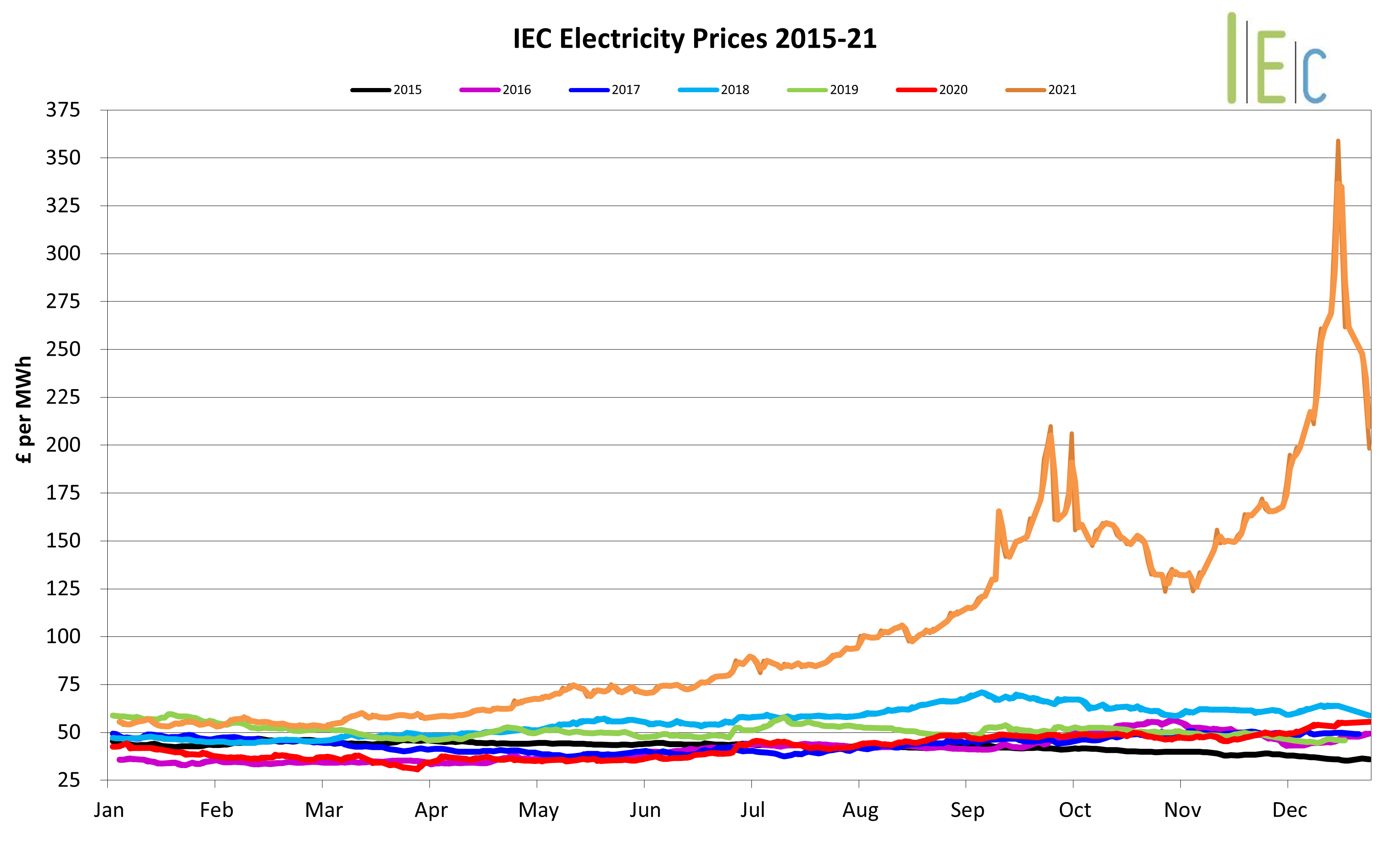

Electricity

- As usual, the overall electricity market trends continue to follow its gas counterpart and reached record highs in December.

- A month of mostly high pressure reduced wind strength and limited renewable generation to well below average levels normally seen during this time of year. This resulted in increasing the reliance on gas-to-power generation which then strengthened the relationship between both markets.

- There were also supply issues on the continent as France saw 10% of its nuclear capacity drop offline – possibly until spring, due to unplanned maintenance.

- Volatility in both gas and electricity markets has seen increased switching of fuels, which continues to support the carbon markets. Both the UK and EU prices ended December at around 80 £/€ per tonne of carbon, respectively.

Oil

- Increases in fuel prices led to civil unrest between protesters and police in Kazakhstan which represents 2% of global crude production. The nation’s President accepted the resignation of many government officials in the wake of 164 deaths and the call for military aid from Russia. Any potential disruption to the nation’s oil industry could be significant if it lasts for an extended period of time.

- Experts in the industry report that, outside of Saudi Arabia, OPEC has been unable to demonstrate adding 400,000 barrels a day of supply. Skepticism is increasing whether OPEC and its allies can successfully raise output as much as they intend.

- Currently, the average price of petrol at the pump for UK consumers is £1.45.5/litre while wholesale prices stand at £1.06.7/litre. The increase in consumer costs is due to the surge in demand post-lockdown and rising electricity prices and wage bills. The government, however, isn’t likely to cut tax on petrol any time soon. Fuel duty provides a significant source of revenue for the government: £28bn in 2019-20, according to the Office for Budget Responsibility.

Coal

- Following a call from Japan, South Korea and the Philippines, the nation of Indonesia lifts a ban on thermal coal exports alleviating concerns about supply disruptions. The export ban, which came into force at the beginning of the new year, was introduced by state power utility, Perusahaan Listrik Negara (PLN), due to critically low coal stockpiles.

- Australian coal producer, Glencore, is undergoing a range of studies related to the Valeria coal resource option in Queensland. State and federal approval and investment is dependent on assessments meeting the company’s climate change strategy and stated emission reduction targets. Several of the company’s other mines will be closed and repurposed within the next five years as it aims to reduce emissions by 15% by 2026, 50% by 2035 and become a net-zero total emissions business by 2050.