Gas Market Trends

What’s been happening?

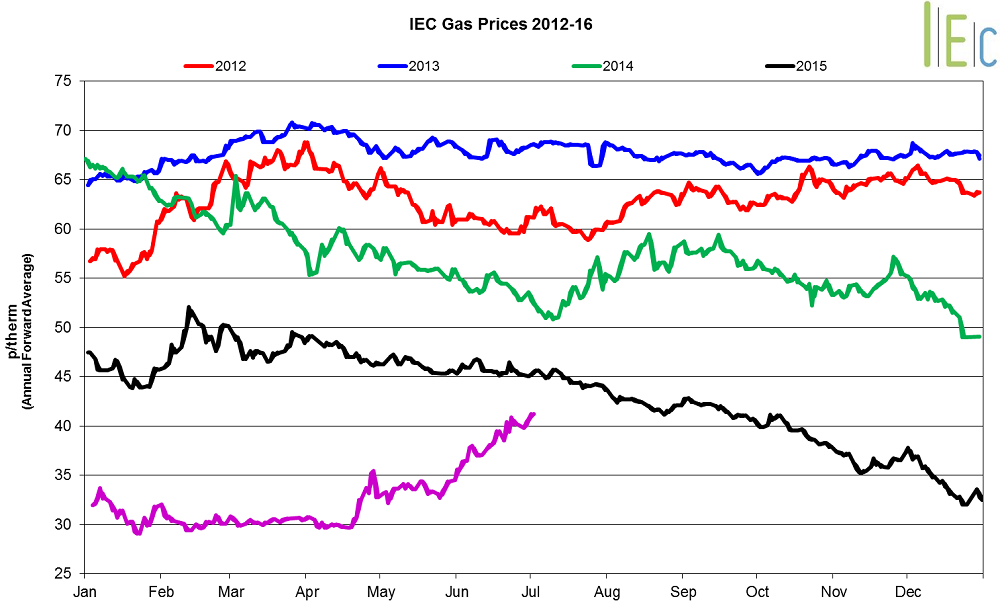

The annual October 16 gas contract rose 12.4% to 39.1p/th, the highest average in eight months. Winter 16 gas experienced the largest increase of 12.2% to average 40.6p/th, while summer 17 gas was up 12.0% to 37.5p/th.

Spot gas prices also rose in June, with day-ahead gas lifting 13.2% to average 34.3p/th. The month-ahead contract gained 12.9% to average 33.7p/th.

Key market drivers

Rises in oil prices have fed directly into the GB gas market, supporting seasonal contracts.

Following the referendum vote, gas contracts gained due to increased trading and a weaker pound. This made UK gas less expensive to buyers with foreign currencies.

* £ per p/therm (Annual Forward Average)

Power market trends

What’s been happening?

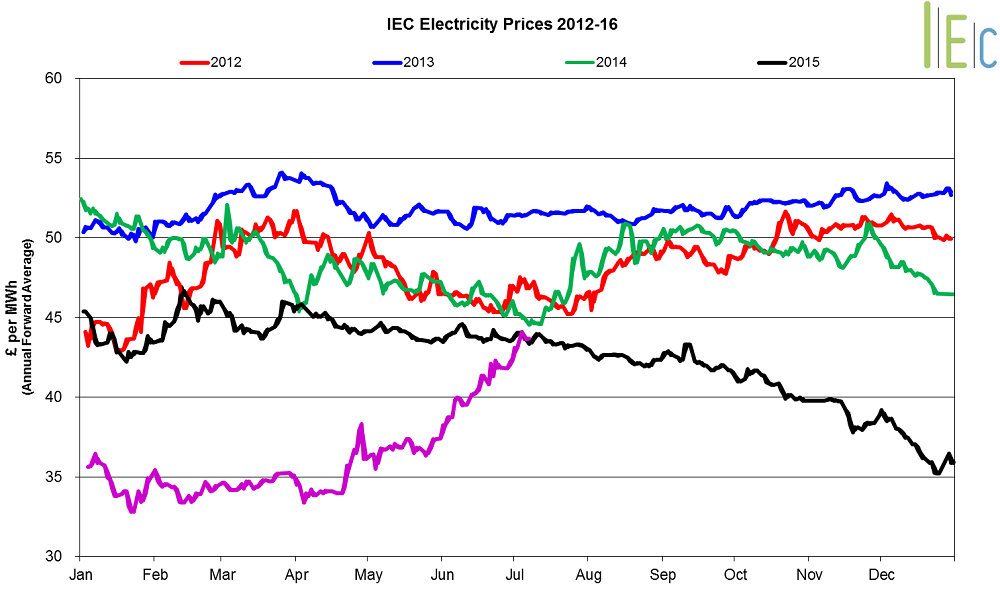

The annual October 16 baseload power contract rose 9.1% to average £40.8/MWh. Winter 16 power rose 9.2% to average £43.8/MWh, while summer 17 increased 9.1% to £37.7/MWh.

Spot power prices jumped by 8.8% to average £37.3/MWh. The contract followed its gas counterpart higher. The month-ahead contract grew 8.6% to average £35.8/MWh during May.

Key market drivers

A recent surge in oil, coal and gas prices have helped to support seasonal power contracts. In addition, the recent closure of multiple coal-fired power stations may cause prices to rise.

In the shorter term, spot contracts also followed gas prices higher, while a reduction in wind generation compared to the previous month also supported power prices.

*£ per MWh (Annual forward average)

European market trends

All European gas prices increased in June, following a rise in commodity prices. Prices, when expressed in p/th, increased due to the weaker pound.

GB prices ended the month 1.3% below Belgian prices, 1.3% below German prices and 0.3% below Dutch prices.

All European power prices increased in June. Dutch prices experienced the largest overall gain, up £3.2/MWh to £25.1/MWh. GB prices ended the month 50.8% above the European average of £24.7/MWh.

Commodity markets

Brent crude oil prices rose 4.9% to average $49.9/bl. Prices were at their highest on 9 June, at $52.2/bl. The OPEC meeting, UK referendum and various supply disruptions supported prices.

API 2 coal was up 14.9% to average $53.9/t. On 20 June prices reached $58.9/t, their highest level since July 2015.

EU ETS carbon dropped 5.4% to average €5.6/t. Prices are expected to be depressed by the UK’s vote to leave the EU.