June saw price volatility return as energy markets reacted to an increase in gas supply disruption and further concerns over Russian conflict.

June resulted in a reduction in LNG cargoes arriving in the UK and Europe across the month. This was mainly due to annual maintenance being completed at a number of US terminals. Hopefully this reduction should be short-term with these LNG facilities expected to come back online in July. At present Asian LNG demand continues to be low, particularly in China. However, if additional demand is needed in this part of the world then LNG will likely be needed to meet this requirement.

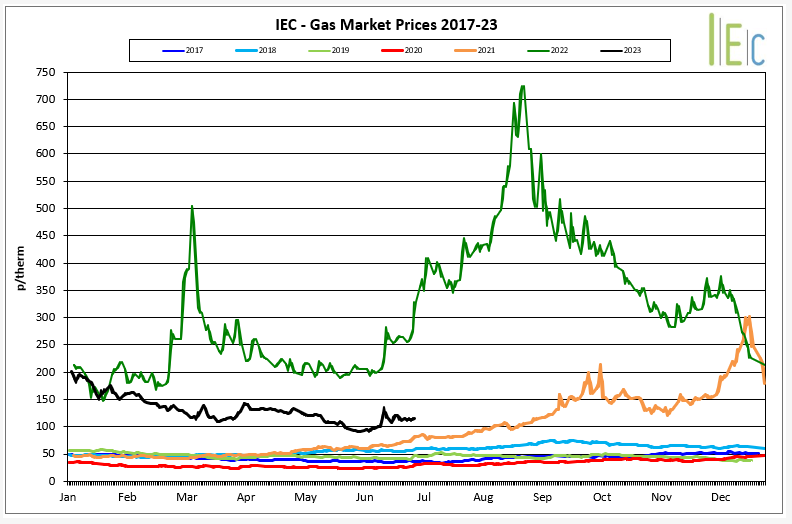

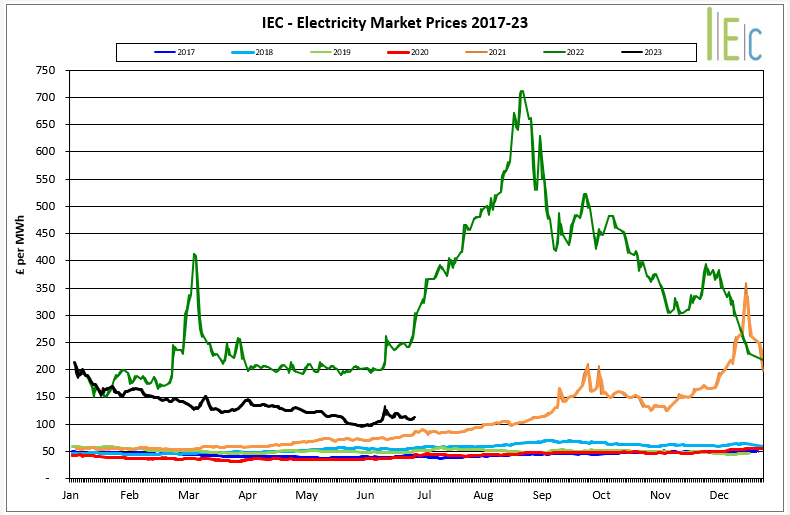

Gas & Electricity

European Gas storage was at a very healthy 78% level by the end of the month. Should injections into storage continue at the current speed then prices could start to see further reductions as Winter supply and demand concerns ease. June did experience price spikes partly due to the maintenance in Norway. Planned maintenance impacted Norwegian gas flows across the period but prices were further supported by the announcement that maintenance at the Nyhamna gas plant would be extended until the 15th of July. Supply concerns should be reduced by the expectation that warmer weather will continue, although with some regions of Europe forecasted extremely high temperatures throughout July an increase in gas may be required to meet any additional cooling load.

Renewable generation is supporting the generation mix but due to their intermittent nature, this creates further market volatility. PV generation was high across June but wind generation was more volatile. In the middle of the month, the UK needed to use the Ratcliffe-on-Soar coal power station to meet the required demand. This ended a 46-day run where coal had not been used to generate electricity in the UK. Coal generation was required to react to an increase in cooling demand, a reduction in supply from a faulty Sea Link interconnector between Norway and the UK, and scheduled maintenance at the Torness nuclear power station in Scotland.

The attempted coup by the Wagner group in Russia resulted in a price rise despite no impact on gas flows. Dmitry Medvedev also stated that Russia would be within its rights to retaliate if it discovered who had caused the Nord Stream pipeline gas damage which happened last year. This has resulted in markets remaining nervous, particularly to any further escalation of the Russian conflict with Ukraine.

Brent crude oil prices showed their first monthly gain this year as a steep drawdown in oil stocks and OPEC’s plans to further reduce output outweighed any demand fears rising interest rates could cause. China’s reopening has not been as strong as anticipated and demand in the OECD (Europe in particular) is languishing because of a slowdown in industrial activity.