February Market Commentary

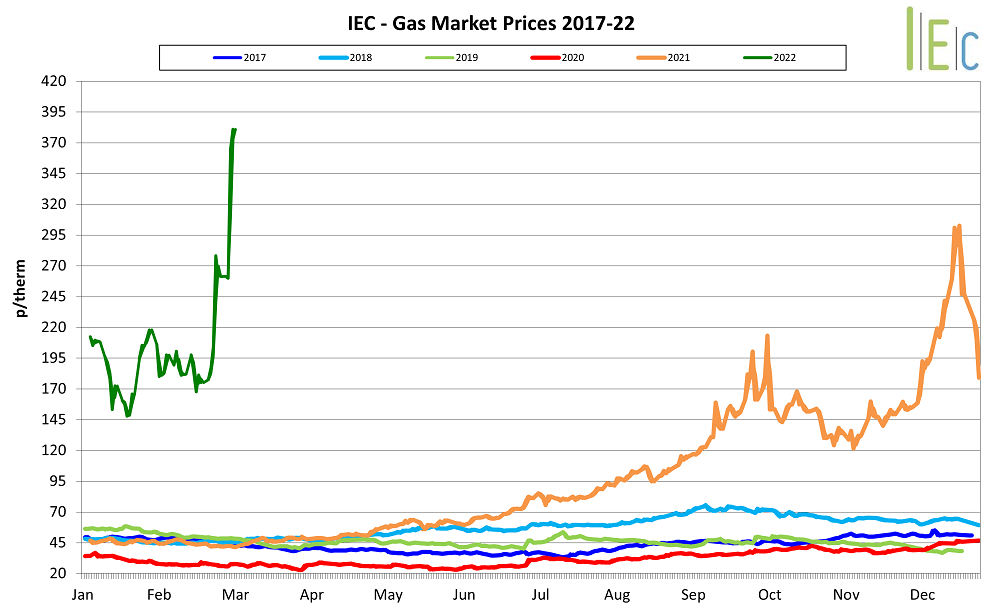

Gas

- The UK gas market opened in February in a bearish trend, softened by positive fundamentals such as strong wind strengths, above-average temperatures, and a steady flow of LNG cargoes arriving throughout the month. Mid-month, the markets were severely disrupted with the news of Russia’s invasion of Ukraine, causing a significant spike that continued increasing for the remainder of the month.

- The Russia-Ukraine conflict has driven the global gas markets into record highs along with major concerns surrounding supply disruption of gas, oil, and all major commodities. Sanctions from the US, the UK, and the European Union have added further market uncertainty by restricting Russian exports and intensifying global competition for acceptable sources of fossil fuels.

- Despite the conflict, some Russian gas continues to flow into Europe. Continental gas storage levels continued to deplete, closing the month at around 30% – a full 10% below the 5-year average.

- The UK gas system remained largely oversupplied throughout February, with minimal supply issues and more than 20 LNG cargoes injected into UK storage stations. This, along with the advantageous weather patterns enabled UK gas storage levels to rise to approx. 88% – significantly above the 5-year average. It also allowed exporting some supply to help the deprived European market.

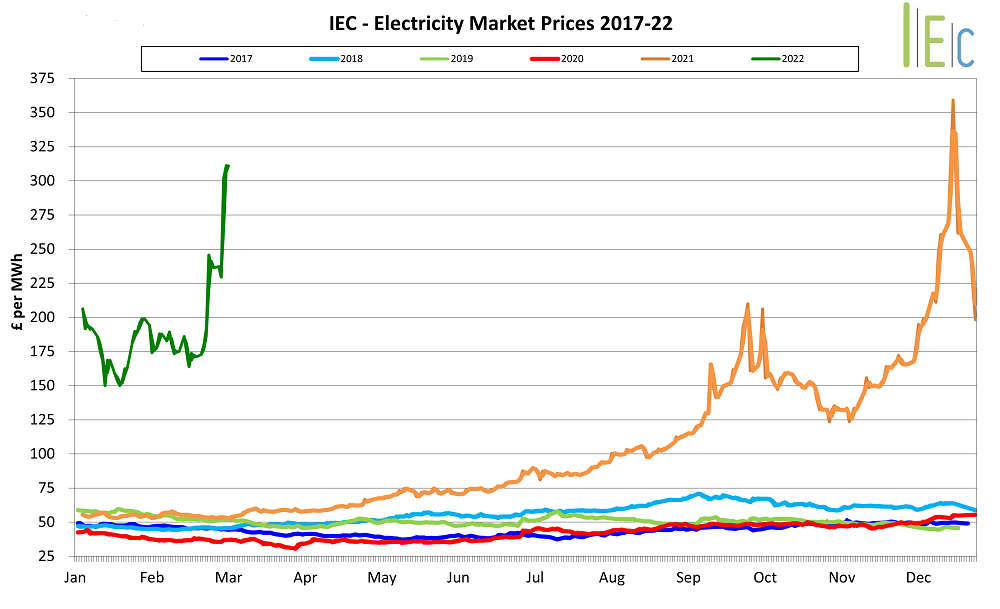

Electricity

- The UK electricity market continues to follow the trends of its gas counterpart, experiencing significant gains through the end of February.

- Improved wind strength helped to limit the UK network’s reliance on fossil fuels thanks to increased renewables generation from both On and Off-shore wind farms.

- There were no major supply issues in February.

- Following the record highs that both EU and UK carbon markets reached at the end of January, the prices remained supported throughout February as compliance deadlines were reached. However, these then plummeted following the news of Russia’s invasion of Ukraine. The forced reduced trading due to high prices was a significant effect on the commodity markets, closing the month at EU ETS €82 and UK ETS £79 per tonne of carbon.

Oil

- Opec+, the oil cartel which includes Russia, agreed to a modest rise to their output (currently at 400,000 barrels per day) for this coming April despite Russia’s invasion of Ukraine.

- The United States and 30 countries aimed to release 60m barrels of oil from strategic reserves in order to help stabilise the market with little impact.

- As global buyers steer clear of conducting business with Russia, JP Morgan & Co. predict Brent (a blend of light crude oil from the North Sea) could skyrocket to as high as $185 a barrel by the end of this year if current conditions continue.

- Indian Oil Corporation (IOC), the country’s largest oil firm, is set to build nine more storage tanks to stock 10 million additional tonnes of crude oil in the northern port of Gujarat and will bump up its Panipat refinery to 25 million tonnes per annum versus 15 million tonnes to meet the nation’s growing demand.

- The U.S. government’s plan to urgently re-negotiate the seven-year nuclear deal with Iran has been hampered by the Middle Eastern country’s association with Russia. The hope is, that with a secure deal, Iran will ramp up crude production within 4-6 months.

Coal

- Thermal coal prices have soared to US $418/tonne in light of the Russian-Ukraine conflict. Russia supplies 70% of Europe’s coal needs and with threats to ban imports, demand from other exporters, such as Australia, is increasing.

- After tight fuel supplies last year caused a nationwide power shortage, China’s central government has approved hundreds of new coal mining projects such as modernising existing mines, enhancing coal reserve capacity, and improving coal transportation. Half of the country’s electricity is generated from coal-fired plants.

- Indonesian coal output will probably not meet its 614-tonne target for the year since the country imposed export restrictions in January. Though some exports have resumed, the government is monitoring monthly domestic sales. Only those companies fulfilling their quotas can release a quantity to export.

- As a result of the Russian-Ukraine war, the government in the Philippines is forced to spend more on fuel subsidies and increase coal supplies since being hit with higher gasoline prices.