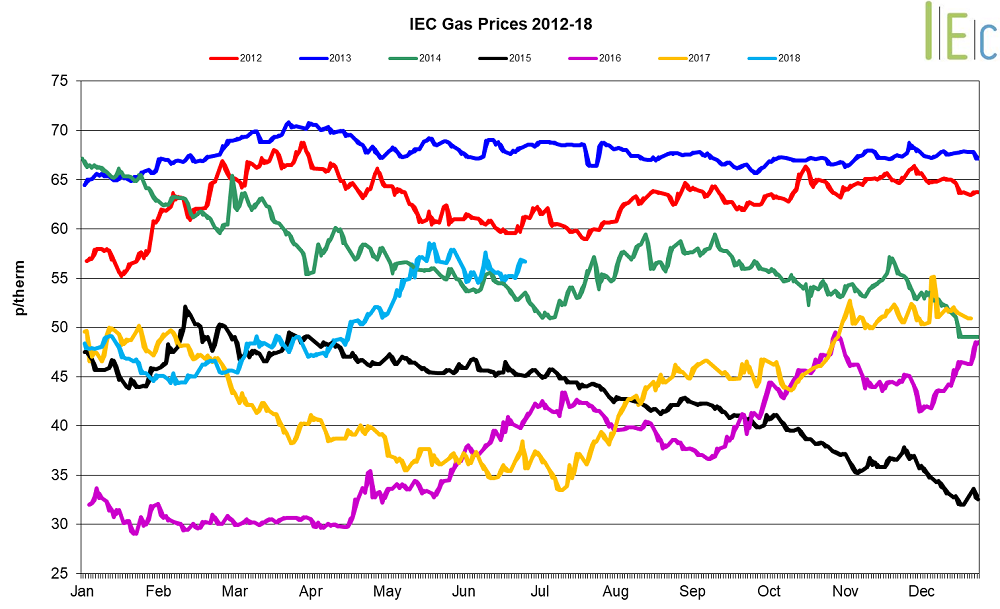

Gas market trends

What’s been happening?

- In June, day-ahead gas prices decreased 1.2% to average 55.5p/th.

- The month-ahead (July) gas contract went down 0.6% to average 54.6p/th, dropping to a low of 52.2p/th on 21 June.

- Gas prices witnessed bullish growth in May, with seasonal contracts from winter 18 to winter 20 rising 11.5% on average.

- Contracts on the near-curve both grew 0.5%, with winter 18 and summer 19 gas increasing to average 62.7p/th and 48.4p/th respectively. Winter 18 has grown 20.1% from January 2018 when it averaged 52.2p/th.

- Winter 19 and summer 20 gas lowered 0.7% and 0.2% to 55.9p/th and 43.8p/th respectively. Winter 20 gas climbed to 52.5/th (up 0.1%).

- The annual October 18 gas contract grew 0.5% to 55.5p/th.

Key market drivers

- Warmer temperatures have driven demand down.

- An interconnector outage between 13-28 June also weighed on prices with the reduced ability to export gas.

- Prices were supported by increased gas demand for power generation which resulted from low wind output towards the end of the month.

* £ per p/therm (Annual Forward Average)

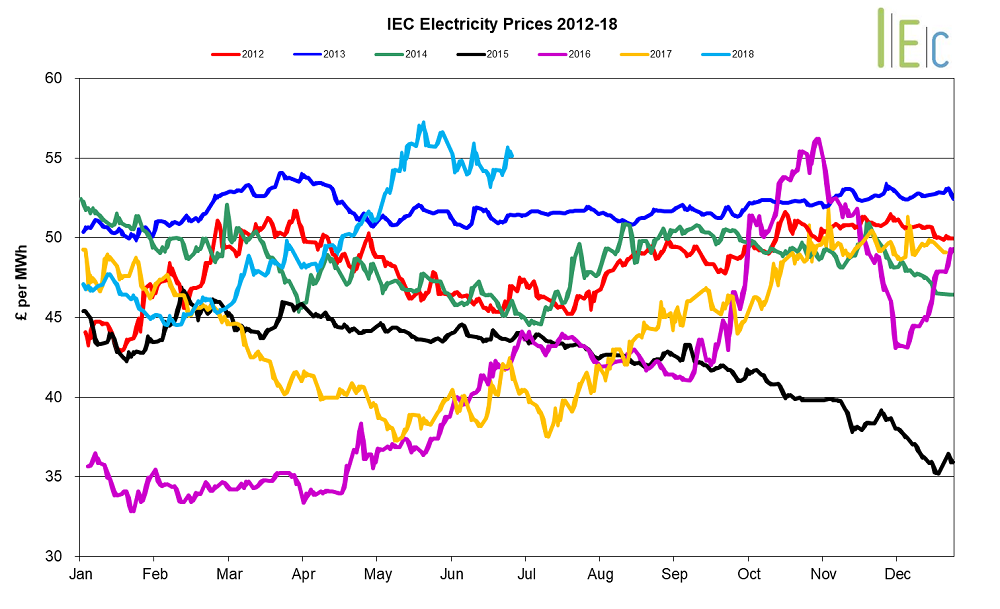

Electricity market trends

What’s been happening?

- Day-ahead power fell 0.2% throughout the month to average £54.2/MWh. The month-ahead (July) power contract dropped 1.2% to average £53.7/MWh.

- Winter 18 was the only contract to rise, gaining 0.5% to £60.2/MWh, despite increased supply security in UK gas storage levels.

- Summer 19 and winter 19 power lost 0.3% and 0.7% to average £48.7/MWh and £54.5/MWh respectively.

- Contracts for summer 20 and winter 20 delivery also subsided, down 0.9% and 0.8% to £44.7/MWh and £52.6/MWh.

- The annual October 18 power contract increased 0.1% to average £54.5/MWh.

Key market drivers

- Prices have reflected falling commodity prices, with gas directly affecting power prices, particularly in periods of lower renewables generation.

* £ per MWh (Annual Forward Average)

European market trends

- Despite growth on the NBP in the first week of June, all other tracked gas markets underwent bearish movement, declining 0.6% on average. Towards the end of the week Belgium and Dutch prices eased with the expected arrival of LNG cargoes, strengthening supplies. Lower demand across Northwest Europe added to bearish fundamentals.

- The second week of June saw a decline in all gas markets, with the Dutch TTF experiencing the biggest change, falling 2.9% to 56.1p/th last week. LNG tanker arrivals on 8 June for the Netherlands and UK boosted gas supplies. Al Bahiya from Qatar arrived into the UK’s Dragon terminal and Vladimir Rusanov from Russia arrived into Rotterdam.

- Tracked gas markets rose in the middle of the month, increasing 2.3% on average. Dutch TTF saw the biggest change, gaining 4.4% to 58.6p/th last week. The Dutch TFF was supported on 14 June as planned and unplanned outages in Norway supported day-ahead prices.

- Towards the end of the month, gas markets lost the previous week’s gains, decreasing 1.6% on average. Dutch TTF continued to experience the largest changes. Prices were impacted by temperatures falling below seasonal norm levels in Holland.

- EU gas prices have been weighed on by volatile oil prices and pressured by the ongoing trade dispute between the US and China.

European power

- European power prices saw predominantly bullish movement in May, with Dutch power prices experiencing the greatest growth, rising 4.1% across the month.

- GB prices were the exception, dropping 2.9% across the month. British prices remain higher than other European power prices; 31.6% higher than French prices, 36.3% above German prices and 13.3% more than Dutch prices.

- German prices were driven higher by low renewables generation at the start of June but were capped by falling carbon prices. A rise in wind output throughout the rest of the month led to German prices dropping as low as £18.2/MWh within-day.

- A German nuclear plant outage supported prices in the first half of the month but drove prices downwards when the country’s nuclear capability came back online on the 14 June.

French prices have been influenced by nuclear outages, lower wind generation and increased demand as temperatures were lower than forecast.

World oil

- Brent crude oil prices fell 1.9% to average $75.4/bl during June.

- Prices continue to respond with volatility to ongoing geopolitical tensions including the US/ China trade war. Brent crude oil fluctuated throughout the month in the run up to the OPEC meeting in Vienna on 22 June, with prices falling as low as $73.5/bl on 21 June. The meeting resulted in OPEC agreeing a 600,000bpd increase in production. Within-day prices rose to over $78.0/bl on 27 June as disruptions in Canada’s Syncrude production facility is expected to last throughout July and will see an additional 300,000bpd of capacity offline, adding to reduced production from Venezuela and Libya.

Coal

- API 2 coal prices rose 0.8% to average $88.0 /t, peaking at $89.8/t on 13 and 14 June. Coal prices continued to track fluctuations in oil prices throughout the month, but could see bearish behaviour as coal has been included in the list of 650 items facing increased tariffs from China as part of the ongoing trade dispute with the US. This comes just a month after Chinese officials had been encouraging businesses to buy more US coal to reduce the trade gap, with coal arrivals into China at 26.4mn tonnes, up 22% from June 2017.

Carbon (EU ETS)

- EU ETS carbon prices gained 3.0% to average €15.2/t, hitting €16.7/t on 5 June – a fresh seven-year high.

- Prices were supported by the MSR which is expected to see a reduction in the availability and supply for EUAs from 2019, and a reduction in the number of surplus allowances. A deal from EU lawmakers could see the renewable energy target increased from 27% to 32% for 2030, acting to reduce future demand for EUAs. EU ETS prices fell below their 50-day average towards the end of June, but experienced strong auction results in the final week.