The period began with outages at the Norwegian Troll gas field which had limited impact to flows into the UK and North West Europe.

Mid-month saw maintenance at the Ormen Lange Norwegian gas field extended by a few days and unplanned outages at Barrow North, UK, boosting gas prices.

Markets were further exacerbated when Norwegian gas flows fell to their lowest level in 2 months during August due to restricted capacity at the Troll and Aasta Hansteen gas fields. The month closed out with further market uncertainty with seasonal maintenance scheduled again at the Troll gas field and the Kollsness processing plant in early September. Despite these supply concerns EU Gas storage sat at 93% of capacity by the end of the month, compared to the 5-year average of 80%. This far exceeds the 90% target set by The European Commission which they aimed to achieve by November.

LNG supply had the most significant affect on market prices over the month as proposed industrial action at LNG facilities in Australian saw market surges in relation to global LNG supply. Workers at a number of sites operated by Woodside Energy planned a walkout in September if improved salary conditions were not met. Eventually an agreement was made towards the end of August between all parties, which temporarily provided some reassurance to markets. However shortly after this news an additional two LNG facilities in Western Australian operated by Chevron proposed partial strike action in early September, which has the potential to impact 7% of global LNG supply. Consequently, markets rallied on the prospect of future supply concerns.

LNG flows into the UK were low over the period but remained stable, with a slight increase towards the end of the month. August saw Chinese LNG reserves reach 68% capacity, resulting in 10% growth in LNG stockpiles for the year to date.

The French Nuclear fleet is in a stronger position than originally envisaged earlier in the year. Concerns regarding the maintenance work required across the fleet after the identification of reactors sensitive to stress corrosion has been alleviated, with 11 of the 16 reactors already being repaired. Maintenance on a further 4 reactors is expected to be completed by the end of the year, which should put less stress on Winter demand.

The recent Contract for Difference (CfD) auction saw Offshore wind developers stay away, arguing the price offered by the government wasn’t reflective of increasing industry costs. This is against the backdrop of Britain’s 2050 net zero emissions target, which calls for 50 GWh of offshore wind capacity to be achieved by 2030 and which currently stands at 14 GWh. The UK nuclear industry is showing a significant increase in employment with over 77,000 workers currently employed, which is the highest level in 20 years. The Hinkley Point C Plant is the largest employer with 9,500 workers currently working on the site.

After a 7-week upward trend, Brent crude oil prices reduced as a result of poor Chinese economy growth data and the prospect of future interest rate rise in the US. Japan factory output also fell for a third consecutive month, with a contraction in the UK economy this quarter (increasing the risk of recission) also suppressing oil prices. The end of August saw Brent sit at $85/bbl as the poor economic data was countered by Saudia Arabia announcing they will extend the supply cuts until October (and potentially the remainder of the year).

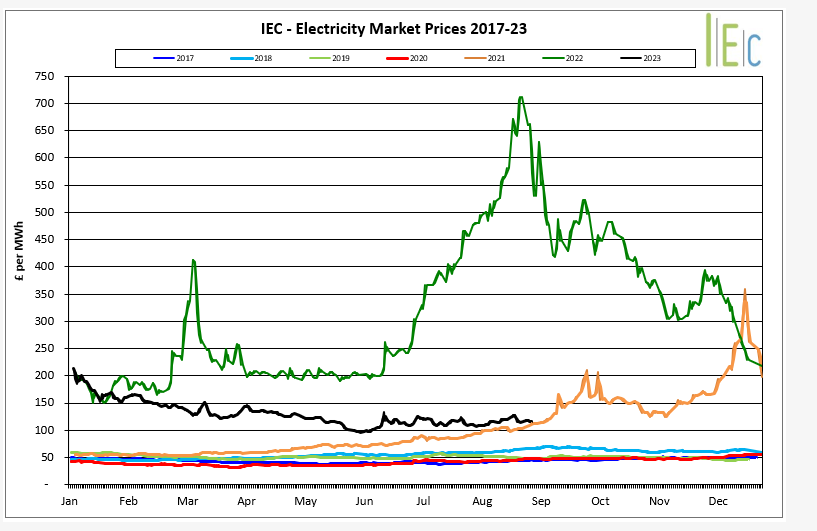

Electricity Market Prices 2017 – 2023

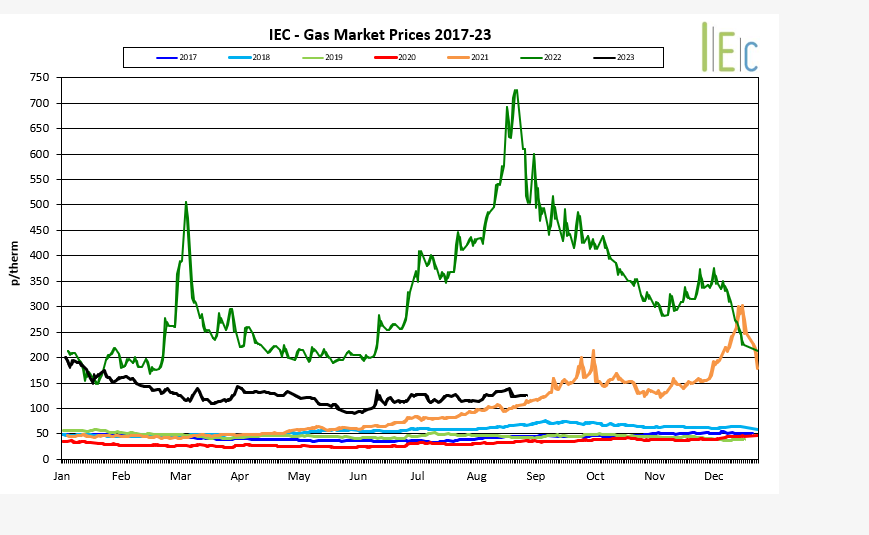

Gas Market Prices 2017 – 2023