Gas market trends

- All seasonal gas contracts rose in April, increasing 4.6% on average. Winter 19 gas gained 5.1% to average 56.2p/th. Summer 20 gas was 4.9% higher, averaging 46.5p/th during the month, a 17.3% increase from the same time last year. The annual October 19 gas contract rose 5.0% to average 51.3p/th, also significantly higher than April last year.

- Day-ahead gas fell for the seventh consecutive month, down 10.3% to average 35.5p/th. The month ahead gas contract reduced by 6.6% to average 36.2p/th. Prices were affected by the arrival of 20 LNG tankers and higher-than-usual temperatures which decreased demand.

* £ per p/therm (Annual Forward Average)

* £ per p/therm (Annual Forward Average)

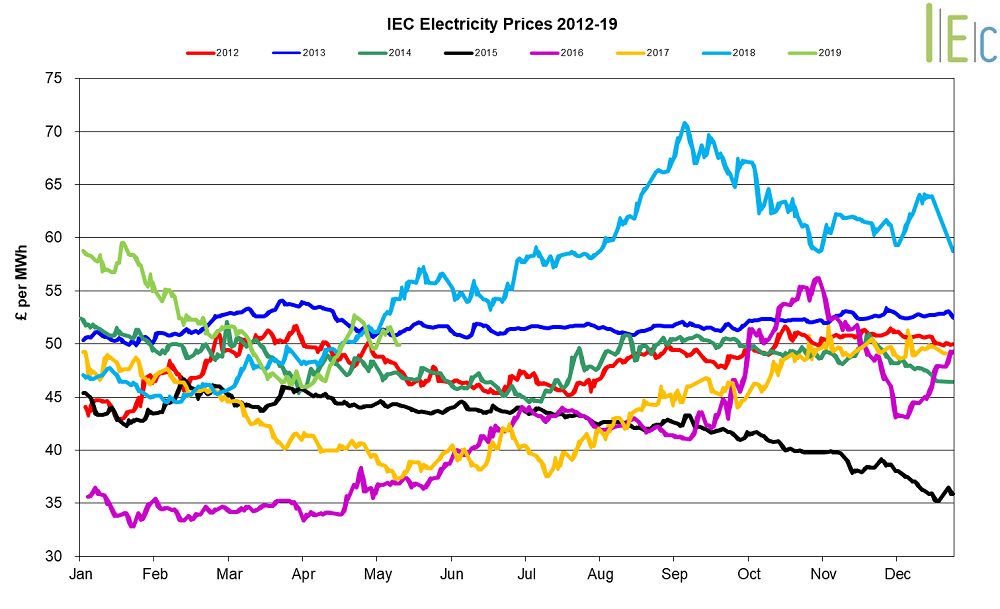

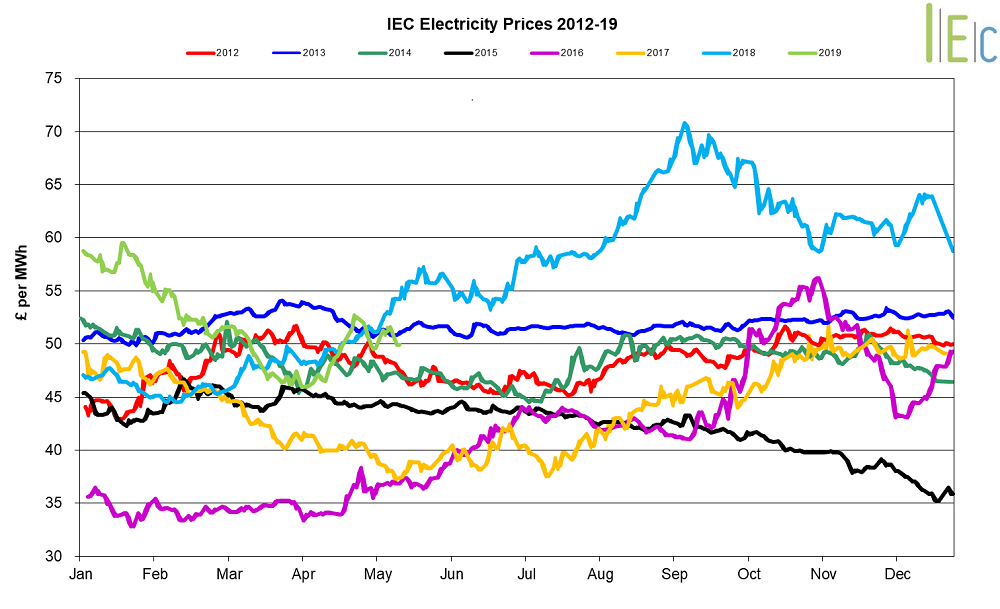

Power market trends

- All seasonal baseload power contracts rose in April, up 6.0% on average. Winter 19 power increased 5.9% from March to average £58.8/MWh. The annual October 19 power contract gained 6.3% to average £54.4/MWh, up 19.4% from April 2018 when the contract was at £45.5/MWh.

- Day-ahead power fell for the fourth consecutive month to average £43.7/MWh. The contract dropped to £38.5/MWh on 23 April, a 20-month low. Month-ahead (May) power was slightly lower, down 1.7% to average £43.8/MWh. Day-ahead power prices continued to follow their gas counterparts lower.

* £ per MWh (Annual Forward Average)

* £ per MWh (Annual Forward Average)

World Oil

- Brent crude oil prices continued to recover during April. Prices rose 6.8% to average $71.5/bl, peaking at $75.5/bl on 25 April. The rise in Brent crude oil prices has been largely due to ongoing OPEC+ production cuts as well as US sanctions against Iran and Venezuela.

Coal

- API 2 coal prices dropped for a fourth consecutive month, down 3.7% to average $72.9/t in April. Above seasonal temperatures and cheaper gas prices across Europe continues to put pressure on coal prices.

Carbon EU ETS

- EU ETS carbon rose for the second consecutive month, lifting 16.4% to average €25.6/t. Carbon prices rose to €27.9/t on 12 April, a near 11-year high. Prices found support from the approaching compliance deadline on 30 April, which is the last occasion for companies to hand in EUAs to account for emissions in 2018.