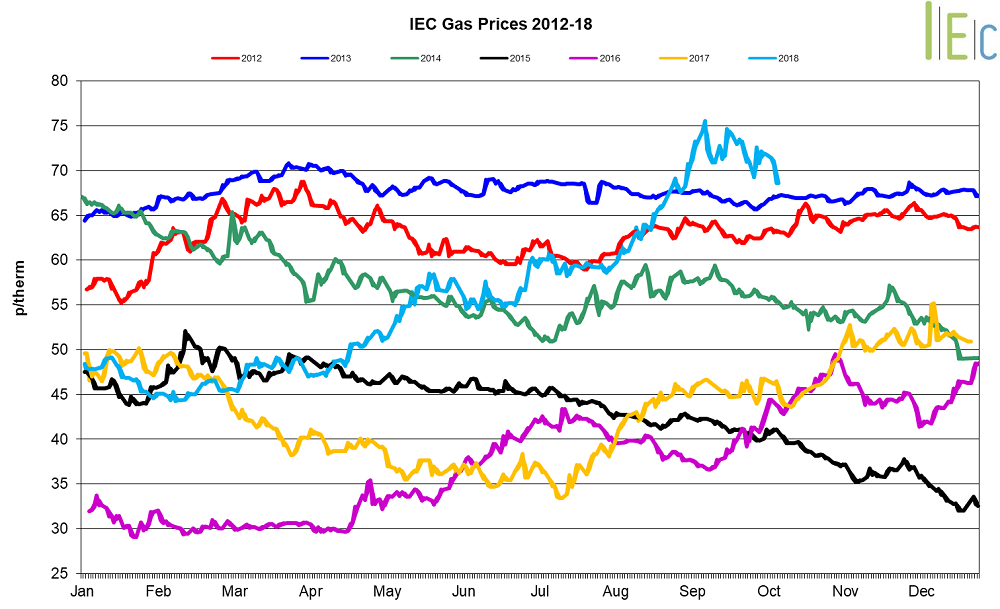

Gas market trends

What’s been happening?

- In September, day-ahead gas prices increased 18.3% to average 74.1p/th

- The month-ahead (October) gas contract went up 16.5% to average 73.5p/th, peaking at 78.3p/th on 24 September

- All seasonal gas contracts grew in September, up 11.4% on average

- Winter 18 and winter 19 gas averaged 78.6p/th and 70.0p/th, up 15.0% and 12.7% respectively. Winter 18 has grown 49.4% from January 2018 when it averaged 52.6p/th

- Summer 19 and summer 20 gas went up 14.6% and 10.2% to 62.6p/th and 54.2p/th respectively

- The annual October 18 gas contract grew 14.8% to 70.6p/th

Key market drivers

- Day-ahead gas prices grew early in the month amid below seasonal normal temperatures, and a series of unplanned outages at Kollsnes, Gullfaks and Åsgard gas facilities in Norway

- Average demand on the national system decreased month-on-month, falling from 169.1mcm in August to 159.4mcm in September. However, regional gas demand rose month-on-month, up from 57.7mcm in August to 77.7mcm in September

* £ per p/therm (Annual Forward Average)

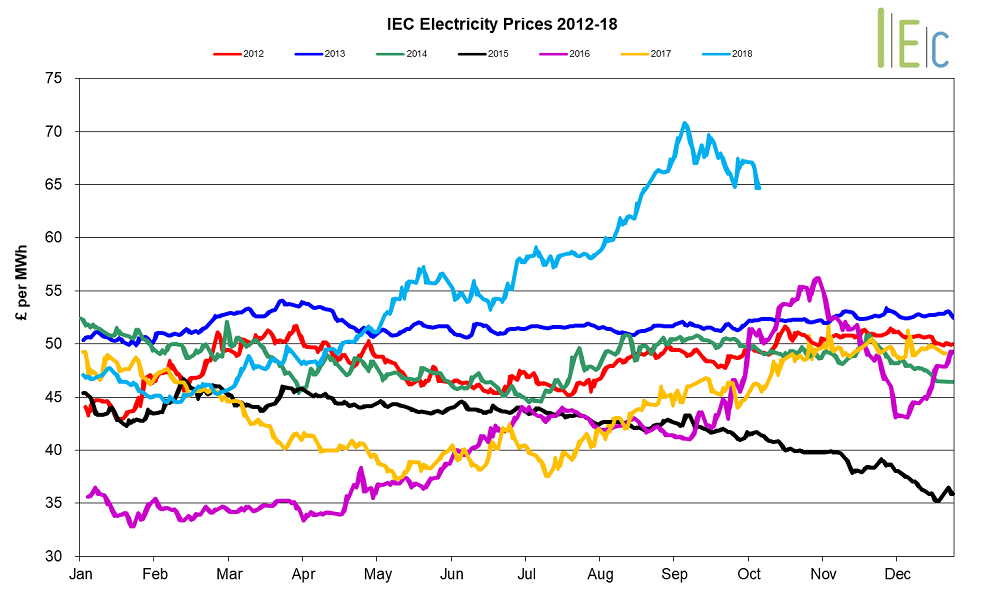

Electricity market trends

What’s been happening?

- Day-ahead power grew 9.5% throughout the month to average £67.7/MWh. Day-ahead power peaked at £72.6/MWh on 24 September, a five-month high

- The month-ahead (October) power contract gained 10.7% to average £69.6/MWh, peaking at £73.2/MWh on 24 September

- All seasonal power contracts rose, gaining 8.5% on average

- Winter 18 and summer 19 increased 10.8% and 11.6% to £73.1/MWh and £60.7/MWh respectively

- Winter 19 power rose 8.9% to average £65.4/MWh

- The annual October 18 power contract increased for the seventh consecutive month, up 11.2% to average £66.9/MWh

Key market drivers

- Day-ahead power prices followed gas prices higher

- Average demand increased month-on-month, rising from 0.65TWh to 0.67TWh. Average peak demand also rose month-on-month, up from 32.0GW in August to 34.7GW in September

- Support has also been found from a tighter market as planned maintenance restricts the French interconnector to 1.0GW capacity until 15 September

- 10-year high EU ETS carbon prices have also supported the power curve

* £ per MWh (Annual Forward Average)

European gas

- All tracked European gas contracts underwent growth throughout August, as all regions hovered around the 70.0p/th mark. The largest gains observed saw Belgian Zeebrugge prices rise by 3.6p/th to end the month at 75.2p/th

- Belgian Zeebrugge found support from a tight UK gas system early in the month as Total’s North Sea Strikes saw 13mcm/d offline

- All contracts peaked on 24 September, with Belgian Zeebrugge at 80.1p/th, and both Dutch TTF and German NCG at 78.0p/th. Contracts followed Brent crude oil and coal prices higher towards the end of September

- Gas for power demand dropped throughout the month as gas prices hit fresh highs and coal became a more economically attractive alternative despite 10-year high EU ETS carbon prices

European power

- Most European power prices saw bearish movement in September

- Dutch power prices experienced the greatest change, falling £22.7/MWh across the month to £49.9/MWh

- Soaring EU ETS carbon prices hit a 10-year high in September, and combined with fresh five-year high coal prices, support power prices throughout the month

- Low wind generation coupled with several nuclear reactor outages in France and Germany lifted power prices in September. French and German day-ahead power peaked at £69.0/MWh and £69.6/MWh respectively on 12 September

- Towards the end of the month renewable generation grew as wind output picked up, with German wind generation soaring to 40GW on 24 September, up from 13.5GW the previous day

- Prices ended the month down from the start of September as they followed commodities lower.

World oil

- Brent crude oil prices rose for the first time since May, up 7.5% to average $79.2/bl during September.

- Prices rose to a fresh four-year high above $82.0/bl on 25 September. The upcoming US sanctions against Iran continue to support prices as concerns over market tightness grows despite news that OPEC crude production rose to a year-to-date high in August after Libyan output offset a fall in Iranian production. OPEC’s Secretary-General, Mohammad Barkindo, has said that world oil consumption will reach 100mn bpd this year, much earlier than previously expected.

Coal

- API 2 coal prices were up 8.3% to average $96.1/t in September

- According to vessel tracking data, global coal shipments have grown by 3.8% between January and August this year, up to 835.5mn tonnes. Demand continues to be driven by Asian countries including China and India, with imports in Pakistan and Vietnam also up 45% and 65% respectively. Prices reached a fresh five-year high on 21 September, hitting $98.4/t.

EU ETS

- EU ETS carbon gained 15.2% to average €21.7/t, its ninth consecutive monthly rise. Prices hit a fresh 10-year high of €25.8/t on 10 September.

- Prices started the September at €20.6/t, but experienced its biggest with-in day decline since 2006 on 13 September as prices fell from fresh 10-year highs to below €19.0/t. This drop has been attributed to hedge funds and speculators exiting positions and traders chasing short-term profits. A British EUA auction failed on 19 September following a lack of successful bidders, the third cancelled auction in the UK this year.

- With 5.7mn EUAs available, 12 bidders placed bids for only 5.0mn allowances, resulting in a failed auction. The unsold EUAs will be evenly reallocated to auctions on 3, 17 and 31 October, and 14 November.