Policy Update

In September the UK Government announced plans to support households, businesses and the public sector organisations with the rising cost of energy bills.

From 1st October, a new ‘Energy Price Guarantee’ will mean a typical UK household will now pay up to an average £2,500 a year on their energy bill for the next two years. This is automatic and applies to all households.

Business customers will receive support through the new Energy Bill Relief Scheme, where the government will provide a discount on wholesale gas and electricity prices for all non-domestic customers whose current gas and electricity prices have been significantly inflated in light of global energy prices.

It will apply to fixed contracts agreed on or after 1 April 2022, as well as to deemed, variable and flexible tariffs and contracts. It will apply to energy usage from 1 October 2022 to 31 March 2023, running for an initial 6 month period.

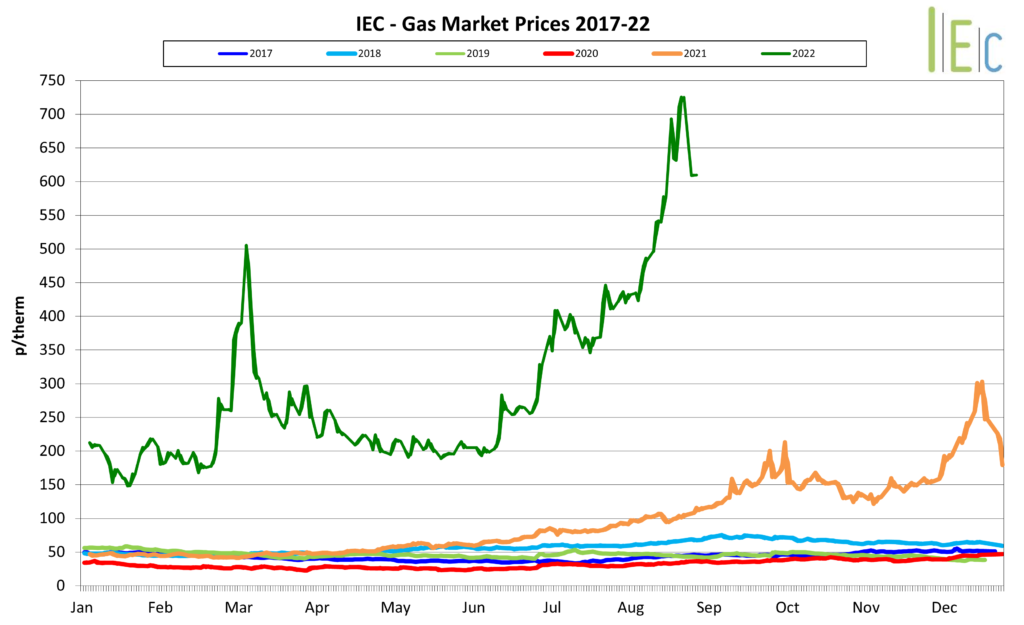

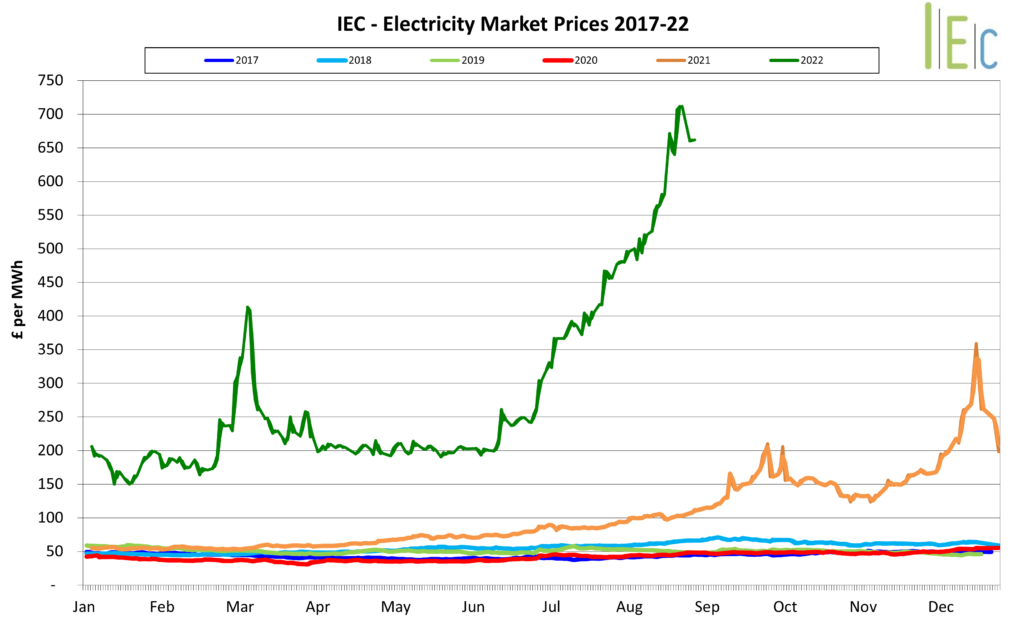

To administer support, the government has set a Supported Wholesale Price – expected to be £211 per MWh (21.1p/kWh) for electricity and £75 per MWh (7.5p/kWh) for gas, less than half the wholesale prices anticipated this winter.

Those on default, deemed or variable tariffs will receive a per-unit discount on energy costs, up to a maximum of the difference between the Supported Price and the average expected wholesale price over the period of the Scheme. The amount of this Maximum Discount is likely to be around £405/MWh for electricity and £115/MWh for gas, subject to wholesale market developments.

Please note in addition to the above wholesale prices, suppliers will also be required to add the relevant non-commodity charges to calculate the delivered cost of energy to customers.

Gas

Nord Stream 1 flows remained steady at 20% throughout the first 3 weeks of August as deliberations continued between Gazprom and Germany regarding the repaired turbine.

A statement from the Russian embassy in Germany said that the delivery of the turbine for Nord Stream 1 was not done in accordance with the current contract and Gazprom added they would not accept the turbine until confirmation is received that it would not be affected by sanctions.

Gazprom announced on 19th August that Nord Stream 1 would enter a period of unplanned maintenance for 3 days on the 30th August. In response to this markets surged, as concerns over winter gas storage supply increased price volatility.

In early September Gazprom announced that the main pipeline to Germany would remain closed indefinitely, delivering a shock to customers who had hoped it would reopen after the maintenance period. This declaration from the Kremlin came in response to an agreement among U.S. led rich countries which seeks to cap the prices paid for Russian oil exports. This consequently increased fears that parts of Europe could be forced to ration energy this winter.

The US LNG terminal at Freeport which experience a fire in June was originally expected to be back online in October however this has now been delayed until the end of November with full capacity not likely to be reached until March 2023.

European gas storage levels reached 80% by the end of August meeting their target and exceeding the 5 year average figure. The UK capacity storage level stood at 100% and significantly higher than the 5 year average level of 83%.

Electricity

Electricity markets remained bullish and driven by movements in the gas markets as prices saw large gains as a result of the unplanned Nord Stream 1 gas pipeline maintenance which occurred at the end of August. Department for Business, Energy and Industrial Strategy suggested cold weather combined with supply tightness could see the UK face blackouts for industrial and potentially domestic users for this winter which put further pressure on wholesale prices.

High temperatures and low wind generation during August required increased CCGT output for electrical generation to meet the demand.

On the continent, Germany began to show clear signs of demand reduction with industry and power gas demand below the 5-year minimum level. In France, EDF Energy has committed to restart all its nuclear reactors by this winter to help the country through the energy crisis and avoid restrictive measures.From October EDF has a schedule that should allow a new nuclear plant to be operational again every week.

Brent crude prices declined to below $100/bbl by the end of August as concerns over Chinese Covid lockdowns and interest rate increases are expected to see demand decline.