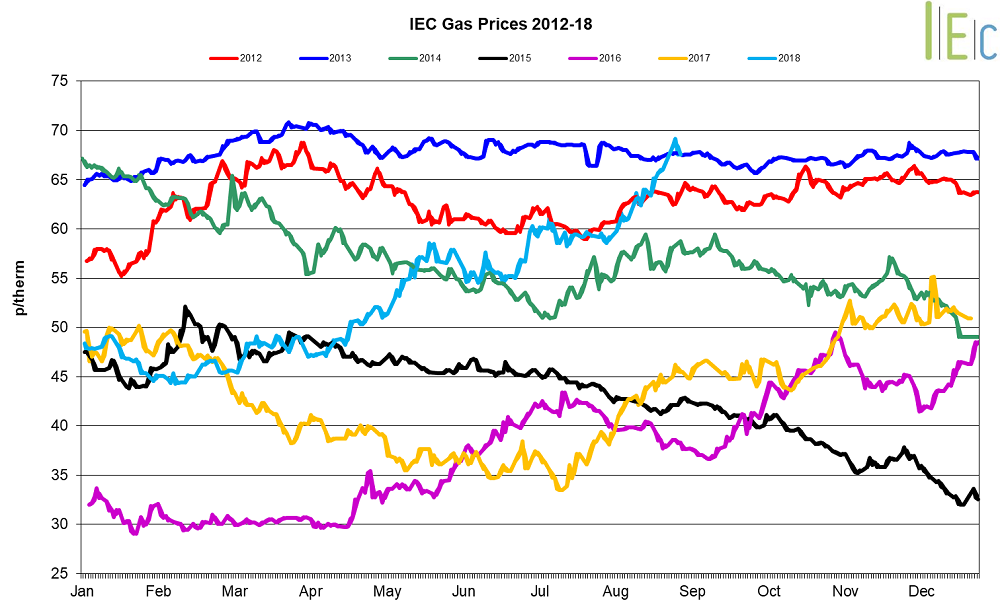

Gas market trends

What’s been happening?

- In August, day-ahead gas prices increased 6.8% to average 61.6p/th

- The month-ahead (September) gas contract went up 6.0% to average 62.0p/th, peaking at 68.6p/th on 29 August

- All seasonal gas contracts grew in August, up 5.1% on average

- Winter 18 and winter 19 gas averaged 67.5p/th and 61.5p/th, up 5.2% and 4.2% respectively. Winter 18 has grown 28.3% from January 2018 when it averaged 52.6p/th

- Summer 19 and summer 20 gas both went up 5.1% to average 54.0p/th and 48.9p/th respectively

- The annual October 18 gas contract grew 5.1% to 60.8p/th

Key market drivers

- Day-ahead gas prices have been driven higher by low levels of wind output, which increased gas demand for power generation, as well as low levels of LNG imports

- Prices were affected by ongoing strikes at three of Total’s North Sea oil and gas fields which, coupled with unplanned outages in Norway, saw the gas system undersupplied at times

- Average demand on the National system decreased month-on-month, falling from 185.4mcm in July to 169.3mcm in August. However, Regional gas demand rose month-on-month, up from 53.1mcm in July to 58.7mcm in August.

* £ per p/therm (Annual Forward Average)

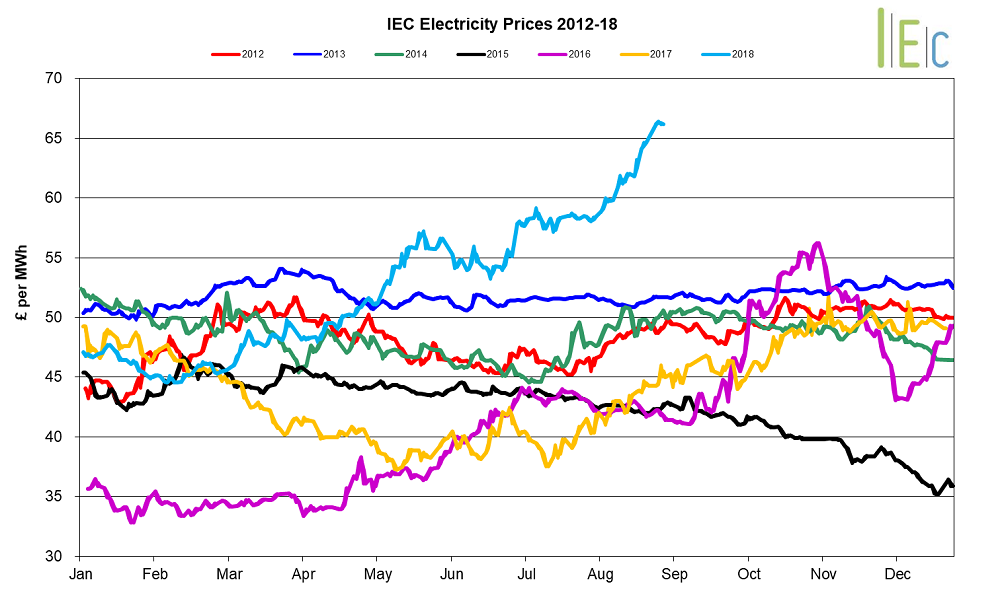

Electricity market trends

What’s been happening?

- Day-ahead power grew 5.8% throughout the month to average £60.9/MWh. Day-ahead power peaked at £68.9/MWh on 29 August, a five-month high

- The month-ahead (September) power contract gained 5.0% to average £61.6/MWh, peaking at £67.1/MWh on 29 August

- All seasonal power contracts rose, gaining 5.4% on average across August

- Winter 18 increased 5.3% to £65.2/MWh. Summer 19 and winter 19 power rose 5.4% and 4.4% to average £53.8/MWh and £59.6/MWh respectively

- Contracts for summer 20 and winter 20 delivery were up 6.0% and 5.9% to £49.4/MWh and £56.9/MWh

- The annual October 18 power contract increased for the sixth consecutive month, up 5.3% to average £59.5/MWh

Key market drivers

- Day-ahead power prices have continued to rise amid low renewables generation this summer, following gas prices higher

- Average demand decreased month-on-month, falling from 0.66TWh to 0.65TWh. However, average peak demand rose month-on-month, up from 31.8GW in July to 32.0GW in August

- Prices have reflected volatile commodity prices, with gas directly affecting power prices, particularly in periods of lower renewables generation

- Higher EU ETS carbon prices have also supported the power curve

* £ per MWh (Annual Forward Average)

European gas

- All tracked European gas contracts underwent growth throughout August, as all regions converged towards the 70.0p/th mark. The largest gains observed saw Dutch TTF prices rise by 12.2p/th to end the month at 69.7p/th

- Dutch TTF and German NCG gas prices rose amid lower supplies from Norway, as extended unplanned outages at Gullfaks and Asgard fields restricted supplies to both hubs

- Above seasonal average temperatures, lower wind output, coupled with high power prices aided in higher gas-to-power demand in periods throughout the month and supported gas prices across the tracked regions

- Looking ahead, projections of above average temperatures across northwest Europe could support gas storage injections throughout the region, as lower demand for heating would result in more gas being available for injection. As it stands Belgium, French, German and Dutch storage supplies have risen month-on-month, with the latter three ~70% full, while Belgium stores rose past 40% this month. Coupled with the temperature forecasts, storage injections are set to strengthen prior to November, as rising heating demand is delayed. A warm unveiling of Q4 could ultimately help sustain and build upon gas stores and increase available supplies for the coming winter

European power

- European power prices saw bullish movement in August

- French power prices experienced the greatest growth, rising £9.4/MWh across the month to £68.4/MWh

- French prices were influenced by an array of unplanned nuclear outages and delays to the restart of nuclear assets. Periods of low renewable output and bullish carbon prices further supported prices. Additional support stemmed from rising gas and commodity prices

- At the start of the month EDF said that high temperatures in the river Rhone would mean the shutdown of four nuclear reactors (4.5GW) which depend on the river’s waters for cooling. The reactors in question included two Saint-Alban units with an installed capacity of 2,700MW, and two 900MW reactors at Bugey 2 and 3. As a result the reduction in nuclear power capacity was met by an increase in fossil fuel-based generation, and acted to support gas, carbon and power prices

- German power prices rose by £6.2/MWh to £65.2/MWh. Prices were predominantly driven by long periods of below average wind output throughout the month, French nuclear outages and rising carbon and coal prices

- Dutch power prices rose £1.7/MWh to end the month at £66.7/MWh taking some direction from the German market. Despite rising carbon, power prices were pegged back by stable renewables output.

World oil

- Brent crude oil prices fell for the third consecutive month, dropping 2.6% to average $73.2/bl during August.

- Prices continued to respond with volatility to ongoing geopolitical tension amid the US-China trade war, and the upcoming US sanctions on Iran. Prices fell to below $70.6/bl in the middle of the month following the announcement of an unexpected build in US crude stockpiles. Prices recovered towards the end of August, peaking at $76.7/bl on 28 August.

Coal

- API 2 coal prices fell for the first time since March, down 1.5% to average $88.0/t.

- Coal dropped to $84.8/t on 2 August, its lowest since May. As with the other commodities, coal rose towards the end of the month, to $92.3/t on 29 August. Strong demand continues to be driven by Asian markets, with news that Thai imports in July climbed 57% year-on-year to 2.3mn tonnes.